5.2% increase in Continental share price.

Stock markets dominated by the COVID-19 pandemic

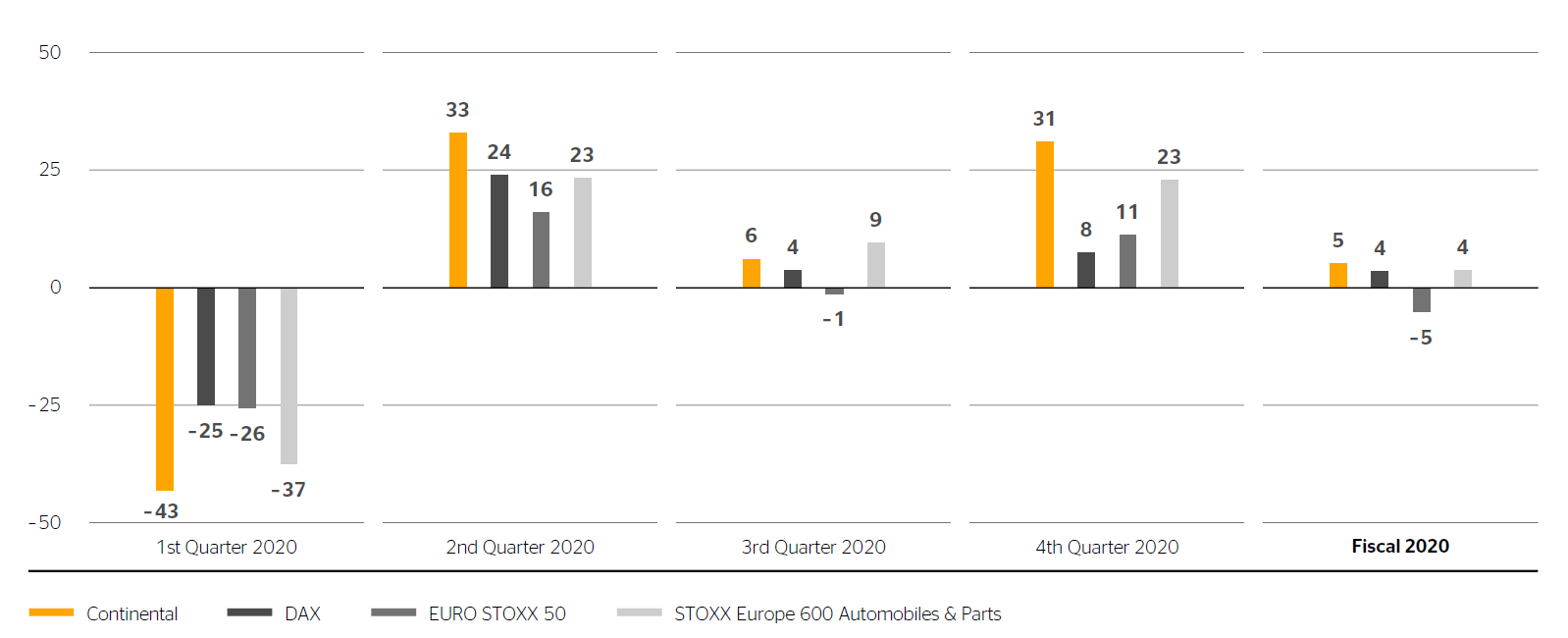

In the first quarter of 2020, the spread of the coronavirus, the subsequent extensive economic shutdowns in many countries as well as numerous company profit warnings and forecast retractions triggered a sharp decline in global stock market prices from the end of February to mid-March. The DAX closed the first quarter of 2020 at 9,935.84 points. This represented a decline of 25.0% compared to the end of 2019, when it was quoted at 13,249.01 points. The EURO STOXX 50 fell by 25.6% in the first quarter to 2,786.90 points.

The second quarter of 2020 was initially characterized by a rapid recovery of the stock markets, driven mainly by relief programs put in place by central banks, the stimulus packages introduced by many countries and the gradual resumption of production in industry. Resurging infection rates in some countries led to another decline in prices in June. The DAX grew by 23.9% in the second quarter compared to the end of the previous quarter, closing June 2020 at 12,310.93 points. The EURO STOXX 50 closed the second quarter at 3,234.07 points, an increase of 16.0%.

In the third quarter of 2020, there was a largely sideways trend on the stock markets. Although reports on the ongoing economic recovery in countries such as Germany, China and the USA had a positive effect, the increase in coronavirus infections in many countries made investors reluctant to buy. The DAX rose by 3.7% in the third quarter and ended September at 12,760.73 points. The EURO STOXX 50 fell by 1.3% in the third quarter and ended September at 3,193.61 points.

In October 2020, the continued rise in COVID-19 infection rates and government measures to contain the pandemic again weighed on the stock markets. As the fourth quarter progressed, the election for the next US president and the prospect of further government assistance to stabilize the US economy led to gains on the US stock markets and other stock exchanges worldwide. Several pharmaceutical companies published positive results of clinical studies on vaccines, and this as well as their approval in various countries also had a positive effect on sentiment. In addition, the European stock markets benefited from hopes of successful negotiations between the European Union (EU) and the United Kingdom (UK) on their future collaboration. On December 24, 2020, the EU and the UK finally reached a partnership agreement, which took effect provisionally on January 1, 2021. The DAX increased by 7.5% in the fourth quarter of 2020 and ended the year at 13,718.78 points. Compared to the start of 2020, it had risen by 3.5%. The EURO STOXX 50 rose by 11.2% in the fourth quarter and ended 2020 at 3,552.64 points, thus falling short of the previous year by 5.1%.

Automotive stocks severely affected by the COVID-19 pandemic

In March 2020, plant closures by vehicle manufacturers and suppliers as well as further anticipated negative effects of COVID-19 measures on vehicle demand and production caused a sudden drop in the prices of European automotive stocks. In the first quarter of 2020, the STOXX Europe 600 Automobiles & Parts fell to 317.82 points, a decline of 37.5% compared to the end of 2019.

The index recovered in the second quarter of 2020, rising by 23.2% to 391.65 points as a result of the renewed increase in sales and production volumes.

In the third quarter of 2020, the STOXX Europe 600 Automobiles & Parts rose by 9.5% to 428.84 points thanks to the further normalization of production volumes.

In the fourth quarter of 2020, automotive stocks benefited from the general recovery as well as production and sales figures that were once again better than expected. The STOXX Europe 600 Automobiles & Parts rose by 23.0% over the quarter and ended 2020 at 527.26 points, gaining 3.7% in the reporting year.

Slump in Continental share price in the first quarter and recovery over the rest of the year

Continental shares largely followed the trend in the European automotive sector in the first quarter of 2020, although they were somewhat more volatile. They closed March 2020 at €65.61, having fallen 43.1% compared to the 2019 year-end price of €115.26.

In the second and third quarters of 2020, Continental shares continued to move broadly in line with the development of the European automotive sector. They increased by 32.8% in the second quarter and ended June 2020 at €87.16. In the third quarter, Continental shares increased by 6.1% to €92.48.

In the fourth quarter of 2020, Continental shares benefited from the announcement of better-than-expected third-quarter results and new mid-term targets as part of the virtual Capital Market Days. This led analysts to adjust their price targets and recommendations. Continental shares rose by 31.1% in the fourth quarter and ended the year under review at €121.25, increasing by 5.2% compared to the closing price for the previous year.

In terms of its share-price performance, Continental was in the middle of the annual ranking of the 30 DAX shares in 2020, taking 13th place (PY: 28th place).

Allowing for a reinvestment of the dividend distribution of €3.00 on the payout date, Continental shares generated a total return of 8.8% in 2020.

They therefore outperformed the benchmark indices in the reporting year. Including reinvested dividends, the STOXX Europe 600 Automobiles & Parts achieved a total return of 6.3% in 2020, while the EURO STOXX 50 including reinvested dividends generated a negative return of 2.6%. As already mentioned, the return on the DAX was 3.5% in 2020.

Volatile price performance of Continental’s bonds

Uncertainty about the projected duration of government measures to contain the COVID-19 pandemic and possible negative effects on companies’ solvency led to a significant rise in interest rates for European corporate bonds in the first quarter of 2020. As a result, the prices of listed bonds declined.

Interest rates subsequently fell as the year progressed, with the prices of corporate bonds rising significantly compared to the end of the first quarter of 2020 as a result.

The price of the 0.0% euro bond from Continental maturing on September 12, 2023, decreased by 616.7 basis points to 93.141% in the first quarter of 2020. By the end of December 2020, it had risen by 695.7 basis points to 100.098%. The price of the 0.375% euro bond maturing on June 27, 2025, decreased by 917.9 basis points to 90.601% in the first quarter. It then rose by 1,025.1 basis points to 100.852% by the end of December 2020.

| Continental’s key bonds outstanding as at December 31, 2020 | ||||||

|---|---|---|---|---|---|---|

| WKN/ISIN | Coupon | Maturity | Volume in € millions | Issue price | Price as at Dec. 31, 2020 | Price as at Dec. 31, 2019 |

| A2YPE5/XS2051667181 | September 12, 2023 | 500.0 | ||||

| A28XTQ/XS2178585423 | November 27, 2023 | 750.0 | ||||

| A28YEC/XS2193657561 | September 25, 2024 | 625.0 | - | |||

| A2YPAE/XS2056430874 | June 27, 2025 | 600.0 | ||||

| A28XTR/XS2178586157 | August 27, 2026 | 750.0 | ||||

Repayment of two euro bonds

The price of the 0.0% euro bond from Continental that matured on February 5, 2020, hovered around the 100% mark in January and February 2020. The nominal value of €600.0 million was repaid on the maturity date. The price of the 3.125% euro bond that matured on September 9, 2020, successively fell toward the 100% mark due to the reduction in its remaining term to maturity. The nominal value of €750.0 million was repaid on the maturity date.

Successful placement of new euro bonds

In May and June 2020, Continental AG and Conti-Gummi Finance B.V. successfully placed a total of three euro bonds with investors in Germany and abroad under the Debt Issuance Programme (DIP).

Two euro bonds were offered on May 18, 2020 – one with an interest coupon of 2.125% for a term of three and a half years and the other with an interest coupon of 2.5% for a term of six years and three months. The nominal volume of each bond was set at €750.0 million. The respective issue prices amounted to 99.559% and 98.791%. Both bonds were issued on the regulated market of the Luxembourg Stock Exchange on May 27, 2020.

The third euro bond was offered on June 17, 2020, with an interest coupon of 1.125%. With a nominal volume of €625.0 million, the issue price amounted to 99.589%. The bond has a term of four years and three months. It was issued on the regulated market of the Luxembourg Stock Exchange on June 25, 2020.

The falling interest-rate level led to significant gains in the prices of the new euro bonds over the remainder of the year under review.

Special effects resulted in negative earnings per share

Net income attributable to the shareholders of the parent totaled -€0.96 billion (PY: -€1.23 billion) in the reporting year. The primary reasons for this were the weaker operating performance due to the COVID-19 pandemic and the negative impact of special effects totaling €1.87 billion, which mainly comprised impairment and restructuring expenses in the third and fourth quarters of 2020. Earnings per share fell as a result to -€4.81 (PY: -€6.13).

Suspension of dividend for fiscal 2020

The Executive Board and the Supervisory Board have resolved to propose to the Annual Shareholders’ Meeting, which will be held virtually on April 29, 2021, that the dividend for the past fiscal year be suspended and the retained earnings for fiscal 2020 be carried forward in full to new account.

A dividend of €3.00 per share was paid for fiscal 2019, amounting to a total payout of €600.0 million. The dividend yield was 2.4%.

Free float unchanged at 54.0%

As in the previous year, free float as defined by Deutsche Börse AG amounted to 54.0% as at the end of 2020. The most recent change took place on September 17, 2013, when our major shareholder, the IHO Group, Herzogenaurach, Germany, announced the sale of 7.8 million Continental shares, reducing the shareholding in Continental AG from 49.9% to 46.0%.

As at the end of 2020, the market capitalization of Continental AG amounted to €24.3 billion (PY: €23.1 billion). Market capitalization on the basis of free float averaged €12.6 billion over the last 20 trading days of the reporting year (PY: €12.7 billion). The trading volume, which is also relevant for the index selection by Deutsche Börse AG, amounted to €18.0 billion from January to December 2020 (PY: €21.1 billion). Among the 30 DAX shares, Continental shares as at the end of 2020 were ranked 26th (PY: 25th) in terms of free-float market capitalization and 22nd (PY: 17th) in terms of stock exchange turnover.

Share of free float in the USA rises further

As at the end of the year, we once again determined the distribution of free float of Continental shares by way of shareholder identification (SID). We were able to assign 97.9 million of the 108.0 million shares held in the form of shares or alternatively as American depositary receipts (ADRs) in the USA to more than 700 institutional investors across 48 countries. The identification ratio was 90.7% (PY: 85.5%).

According to the SID, the identified level of Continental shares held in Europe was slightly higher than the previous year at 52.5% (PY: 51.1%). The identified level of shares held by institutional investors from the UK and Ireland increased to 29.7% (PY: 25.3%). The identified holdings of German institutional investors rose to 9.3% in the year under review (PY: 6.6%). Scandinavian investors held 4.1% (PY: 4.4%) of Continental shares at the end of 2020. At 3.4%, the shareholdings of French institutional investors also showed little change (PY: 3.1%). Shareholdings of institutional investors in other European countries amounted to 6.0% (PY: 5.7%).

| Continental share data | |

|---|---|

| Type of share | No-par-value share |

| German stock exchanges (regulated market) | Frankfurt (Prime Standard), Hamburg, Hanover, Stuttgart |

| German securities code number (WKN) | 543900 |

| ISIN | DE0005439004 |

| Reuters ticker symbol | CONG |

| Bloomberg ticker symbol | CON |

| Index memberships (selection) | DAX Prime All Share Prime Automobile NISAX |

| Outstanding shares as December 31, 2020 | 200,005,983 |

| Free float as at December 31, 2020 | |

| Continental’s American depositary receipt (ADR) data | |

|---|---|

| Ratio | 1 share : 10 ADRs |

| SEDOL number | 2219677 |

| ISIN | US2107712000 |

| Reuters ticker symbol | CTTAY.PK |

| Bloomberg ticker symbol | CTTAY |

| ADR Level | Level 1 |

| Trading | OTC |

| Sponsor | Deutsche Bank Trust Company Americas |

| ADRs issued as at December 31, 2020 | 28,818,830 (with 2,881,883 Continental shares deposited) |

As at the end of December 2020, institutional investors in the USA and Canada held a total of 34.5% (PY: 29.3%) of the free float in the form of shares or ADRs.

The identified shareholdings of institutional investors in Asia, Australia and Africa was stable at 3.6% at the end of 2020.

Share capital unchanged

As at the end of fiscal 2020, the share capital of Continental AG still amounted to €512,015,316.48. It is divided into 200,005,983 no-par-value shares with a notional value of €2.56 per share. Each share has the same dividend entitlement.

In line with Article 20 of Continental AG’s Articles of Incorporation, each share grants one vote at the Shareholders’ Meeting. The current Articles of Incorporation are available on our website at www.continental.com under Company/Corporate Governance.

Continental share listings

Continental’s shares continue to be officially listed on the German stock exchanges in Frankfurt, Hamburg, Hanover and Stuttgart on the regulated market. They are also traded on other unofficial stock exchanges in Germany and in other countries around the world.

Continental ADR listings

In addition to being listed on European stock exchanges, Continental shares are traded in the USA as part of a sponsored ADR program on the over-the-counter (OTC) market. They are not admitted to the US stock market. Since the split of the outstanding ADRs at the end of October 2018, ten ADRs (rather than the previous five) are equivalent to one Continental share.

Continental Investor Relations online

For more information about Continental shares, bonds and credit ratings, please visit www.continental-ir.com.

| Key figures of the Continental share1 | ||

|---|---|---|

| € (unless otherwise specified) | 2020 | 2019 |

| Basic earnings per share | -4.81 | -6.13 |

| Diluted earnings per share | -4.81 | -6.13 |

| Dividend per share | —2 | 3.00 |

| Dividend payout ratio (%) | n. a. | n. a. |

| Dividend yield3 (%) | 0.02 | 2.4 |

| Annual average price-earnings ratio (P/E ratio)4 | n. a. | n. a. |

| Share price at year end | 121.25 | 115.26 |

| Annual average share price | 93.36 | 127.58 |

| Share price at year high | 126.50 | 157.40 |

| Share price at year low | 51.45 | 103.62 |

| Number of outstanding shares, average (in millions) | 200.0 | 200.0 |

| Number of outstanding shares as at December 31 (in millions) | 200.0 | 200.0 |

1 All market prices are quotations of the Continental share in the Xetra system of Deutsche Börse AG.

2 Subject to the approval of the Annual Shareholders’ Meeting on April 29, 2021.

3 Dividend per share at the annual average share price.

4 Net income per share attributable to the shareholders of the parent at the annual average share price.