Realigned strategy to address the transformation in the mobility industry.

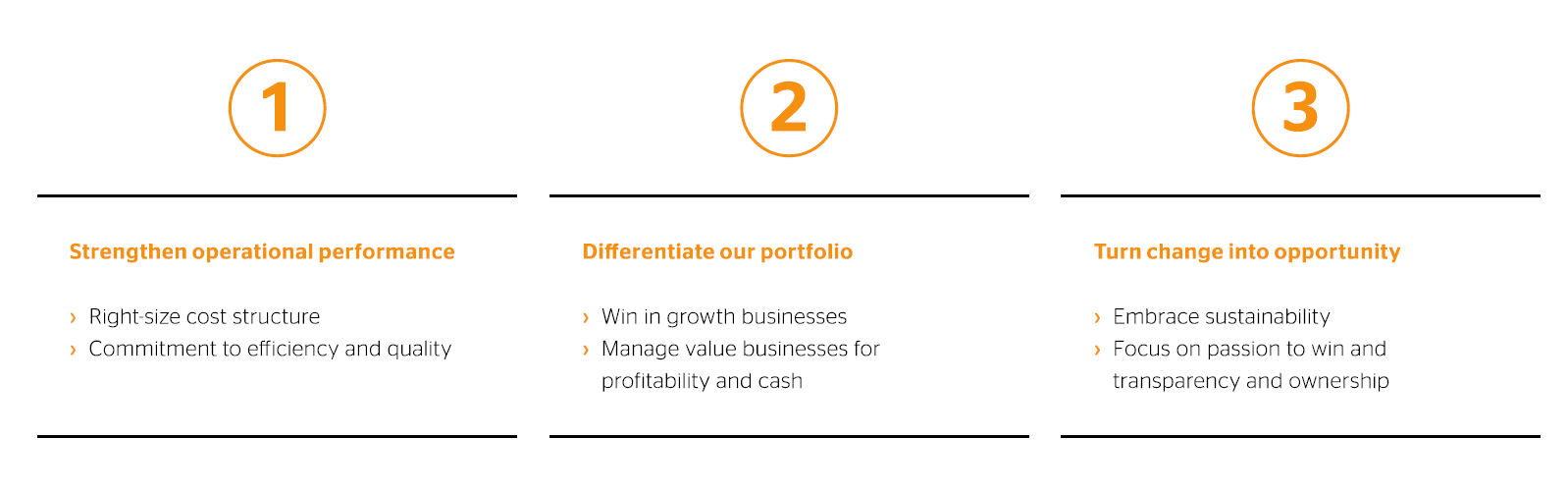

The transformation in the mobility industry opens up many opportunities. To capitalize on these opportunities, Continental adopted a realigned strategy in the year under review. This is based on three cornerstones:

- Strengthening operational performance

- Differentiating the portfolio

- Turning change into opportunity

1. Strengthening operational performance

By strengthening our operational performance, we can ensure our future viability and competitiveness. We are aligning our cost structure to global market conditions. Measures for this purpose were introduced in September 2019 and are part of our Transformation 2019–2029 structural program.

In addition to adjusting our cost structure, we also want to continuously improve our productivity, for example by increasing the level of automation and digitalization in our production environment. In our plants, our colleagues are already working together with more than 2,000 collaborative robots, including autonomous, driverless transportation systems.

2. Differentiating the portfolio

We will differentiate our product portfolio in a more targeted way in the future. We are concentrating on two key areas: “growth” and “value.” By focusing on “growth” we are aiming, above all, to establish a strong position in innovative fields featuring highly dynamic growth, and with “value” we are addressing saturated markets with stable but low growth.

We see above-average growth in connected, assisted and autonomous driving, as well as in new vehicle architectures. In the Tires and ContiTech business areas, our opportunities lie in high-growth regions and digital solutions and services, such as those for fleet and industrial customers.

Our extensive know-how in the area of software gives us a major competitive advantage here. It is software that will make the difference in the future. Crucial to this are, for example, high-performance computers that combine vehicle functions from the areas of safety, assistance, connectivity and entertainment. Continental is the first automotive supplier ever to supply such a central computer for the Volkswagen ID. series. Connectivity, safety and convenience are key to the future of mobility – regardless of how a vehicle is powered.

These fields include products and systems for assisted and autonomous driving, services for automotive manufacturers, end and fleet customers as well as architecture, connectivity and software solutions.

When it comes to “value,” our focus is on profitable product areas where we have solid competitive positions in markets with a high degree of maturity. These include, for example, safety solutions, display and control systems, surface materials and the European tire business. Our growth will be only slightly higher than the market here. The emphasis will be on sustaining profitability and generating sufficient funds, which we will use to ensure the competitive expansion of growth areas geared to market and technology leadership that are unable to fully finance their ambitious growth themselves.

The portfolio strategy also includes possible acquisitions, divestments and partnerships. We will regularly review business units focusing on “value” to determine whether they are able to create the best possible value for Continental. We will also assess how profitability can be increased. Divestitures may also be an option. However, this would be pursued only after careful consideration of potential dissynergies. Part of this systematic approach is the planned spin-off of Vitesco Technologies in 2021. Our internal processes have been reorganized for this purpose and the necessary organizational requirements are in place.

3. Turning change into opportunity

The third cornerstone of our strategy involves turning change into opportunity. We have already laid the foundation for this through our company culture, which is based on our four values of Trust, For One Another, Freedom To Act and Passion To Win. The task now is to strengthen this Passion To Win further in order to turn market opportunities into value even more quickly. We will make clear and transparent decisions to ensure that our actions are appropriate for our respective focus areas. Our aim is to be among the winners of the transformation in our industries and to create value for all stakeholders.

At the end of 2020, we thus laid a solid foundation for sustainability like practically no other company in the supplier industry to date. From 2022, we will make our global business with zerotailpipe- emission vehicles completely carbon-neutral. By 2050 at the latest, we want to achieve 100% carbon neutrality, 100% emission-free mobility and industry, a 100% circular economy and 100% responsible value chains. In doing so, we will decisively shape the future of sustainable mobility.

For the Continental Group and the individual group sectors (excluding Powertrain Technologies), this means the following: for the Continental Group as a whole, we are aiming for average annual organic growth of around 5% to 8% and an adjusted EBIT margin of between around 8% and 11% in the medium term. Its return on capital employed is expected to amount to around 15% to 20%, and its cash conversion ratio to more than 70%.

The Automotive Technologies group sector will focus on the growing global demand for even safer, more connected and more convenient mobility. We are supplying the technological basis for this, which primarily comprises integrated vehicle architecture and increasingly comprehensive computer programs for controlling mobility systems. These include, for example, our high-performance computers as well as products and systems for assisted and automated driving. We are also in leading market positions in the area of display and control systems as well as safety applications such as braking and restraint systems.

Overall, we expect the Automotive Technologies group sector – in other words, the Autonomous Mobility and Safety as well as Vehicle Networking and Information business areas – to achieve average annual organic growth of around 7% to 11% in the medium term. This assumes that the average annual market growth for passenger cars and light commercial vehicles will be between around 5% and 7%, as forecast. In the medium term, we will therefore exceed this by around 2 to 4 percentage points. The adjusted EBIT margin is expected to be around 6% to 8%, and the return on capital employed to exceed 15%.

In the Rubber Technologies group sector, the Tires business area will focus on further consolidating its position among the world’s top tire manufacturers. We want to increase our market share in the growth markets of Asia and North America in particular. In the passenger-car tire segment, the global business with tires for electric mobility and ultra-high performance tires is to be systematically expanded further. We also see further growth for truck and bus tires as well as in the area of specialty tires.

We are pursuing ambitious targets in the area of sustainability. We want to become the most progressive manufacturer in the tire industry by 2030. The focus here will be on climate protection, low-emission mobility, a circular economy and sustainable supply chains. For example, our tires are to be made from 100% sustainable materials by 2050.

The tire market is expected to grow by around 3% to 4% in the medium term, based on the production of passenger cars and light commercial vehicles, the tire replacement market and the production of truck tires. On this basis, we expect to achieve annual growth of around 4% to 5%. In our tire segment, we are aiming in the medium term for an adjusted EBIT margin of around 12% to 16% and a return on capital employed (ROCE) of more than 20%.

The ContiTech business area will pursue the path it has been forging since 2017 in the direction of “smart and sustainable solutions beyond rubber.” With the growth-based part of the product portfolio, we want to grow at a rate of around 3 percentage points faster than the market. The potential here results primarily from the increasing demand for digital and intelligent solutions. In this regard, ContiTech can draw on its long-standing and detailed knowledge of the industry and materials. We will also combine various materials with electronic components and individual services. The value-based portfolio includes applications for passenger cars and rail transport as well as the printing and mining industries. For ContiTech overall, we anticipate that medium-term growth will be 1 percentage point higher than the forecast market growth of around 2% to 3% and the EBIT margin will be around 9% to 11%. Its return on capital employed is expected to exceed 20%.