In the first half of the year under review, the temporary industrial plant closures in many countries as a result of the COVID-19 pandemic led to a decline in demand for raw materials. This initially resulted in falling raw material prices. Due to the global spread of the pandemic, many raw material producers were also forced to temporarily suspend their production either partially or completely. This temporary supply shortage, just as demand in industrialized nations was recovering, led to a sharp rise in raw material prices in the second half of 2020.

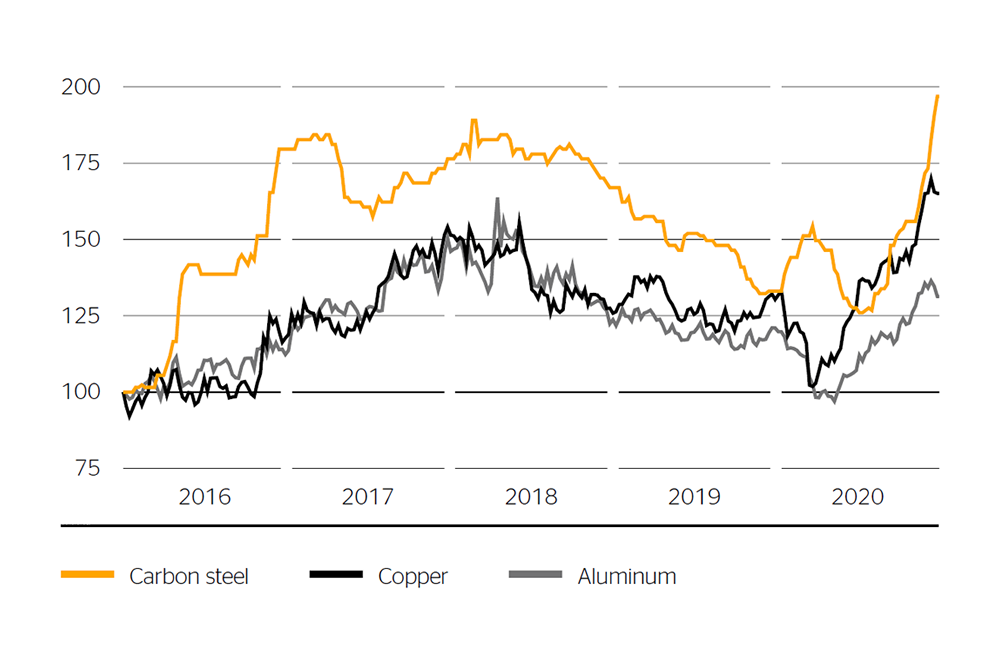

Carbon steel and stainless steel are input materials for many of the mechanical components such as stamped, turned, drawn and diecast parts integrated by Continental into its products. Steel wire is used in particular in tire production as steel cord but also, for example, in conveyor belts and timing belts to increase tensile strength. Aluminum is used in particular for die-cast parts and stamped and bent components, while copper is used in particular in electric motors and mechatronic components. On a euro basis, prices for carbon steel fell by 2% on average in 2020. The annual average price of copper increased by around 3% on a US dollar basis in 2020, while that of aluminum fell by around 5% on a US dollar basis.

Precious metals such as gold, silver, platinum and palladium are used by Continental and by our suppliers to coat components. Prices for precious metals rose again in 2020. On average for the year, on a US dollar basis, the prices of gold and silver increased by 27% each and the price of palladium by as much as 43%. The price of platinum remained relatively stable, with an increase of 2%.

Continental uses various types of natural rubber and synthetic rubber for the production of tires and industrial rubber products. It also uses relatively large quantities of carbon black as a filler material and of steel cord and nylon cord as structural materials. Due to the large quantities and direct purchasing of raw materials, their price development has a significant influence on the earnings of the Rubber Technologies group sector, particularly the Tires business area.

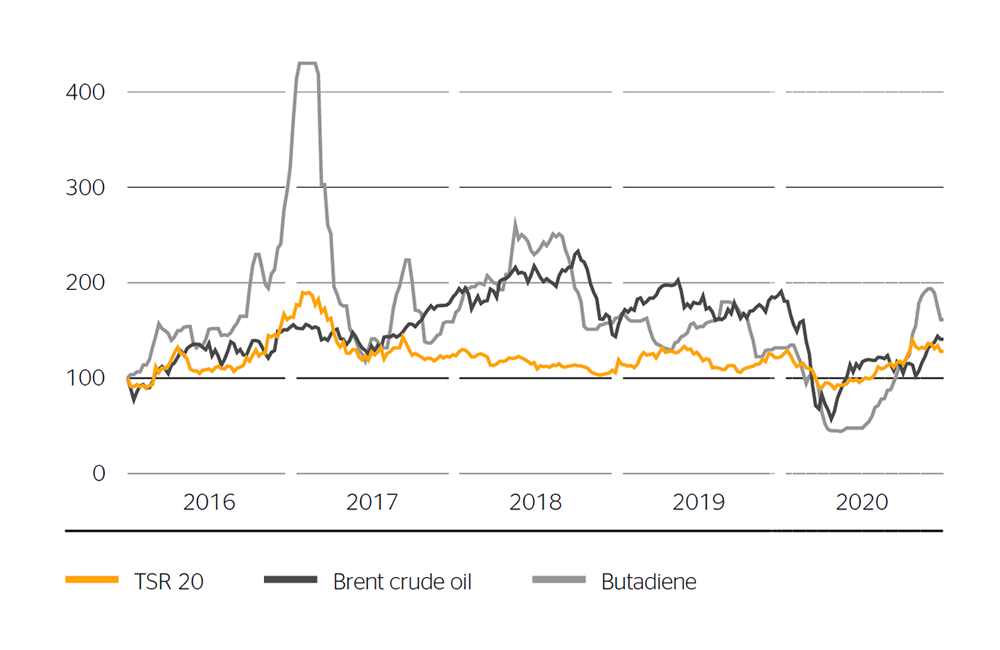

The price of crude oil – the most important basic building block for synthetic-rubber input materials such as butadiene and styrene as well as for carbon black and various other chemicals – fell sharply in the first few months of 2020 due to the decline in demand as a result of the pandemic. From May 2020, the listings recovered again, thanks to falling production levels as well as higher demand. The average price of Brent crude oil for the year decreased by around 34% year-on-year on a US dollar basis. As a result, the prices of various input materials for synthetic rubber fell year-on-year in the year under review. Butadiene and styrene, for example, decreased by 33% and 26% year-on-year on a US dollar basis.

TSR 20, crude oil and butadiene

indexed to January 1, 2016

Sources:

TSR 20: rolling one-month contracts from the Singapore Exchange (US $ cents per kg).

Crude oil: European Brent spot price from Bloomberg (US $ per barrel).

Butadiene: South Korea spot price (FOB) from PolymerUpdate.com (US $ per metric ton).

Prices for natural rubber initially fell in the first few months of 2020, before recovering again as the year progressed. The primary reason for this was the rise in demand for tires in Asia, particularly in China. But in Europe and North America too, demand normalized in the second half of the year. The average price of natural rubber TSR 20 for the year was down 6% year-on-year on a US dollar basis. The average price of ribbed smoked sheets (RSS) for the year rose by 6% on a US dollar basis.

The stronger euro led to a decline in the average price of raw material imports to Europe by around 2% in the reporting year. Overall, the described price developments for raw materials led to cost savings in 2020, in particular in the Rubber Technologies group sector. However, there is generally a gap of several months between purchasing raw materials, their delivery and their use in production, depending on the product and contractual arrangement. As a result, the rise in spot prices in the second half of 2020 is expected to lead to increased costs for raw materials in 2021.