In the year under review, the sanctions imposed against Russia initially led to a shortage of many raw materials, which in turn caused sharp price rises. Expanded offerings from other suppliers and a decline in demand as a result of weaker economic growth in many economies caused prices for many raw materials to fall again as the year progressed – in some cases to below their level at the beginning of the year.

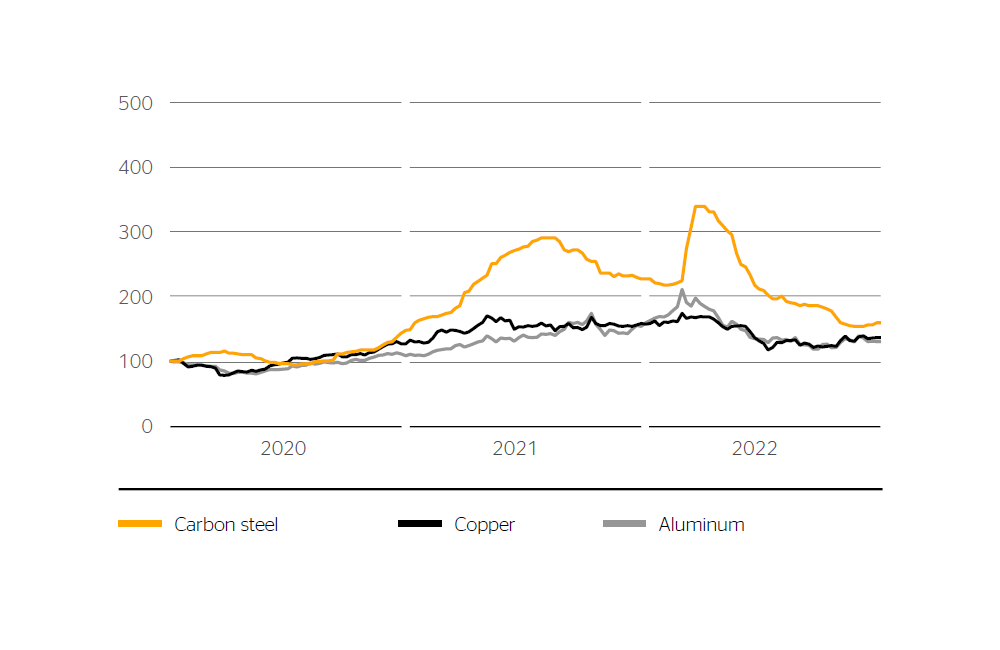

Carbon steel and stainless steel are input materials for many of the mechanical components such as die-cast parts integrated by Continental into its products. Steel wire is used in particular in tire production as steel cord but also in conveyor belts and timing belts to increase tensile strength. Aluminum is used in particular for die-cast parts and stamped and bent components, while copper is used in particular in electric motors, mechatronic components and printed circuit boards. Prices for carbon steel in euros, which had increased sharply in the previous year, fell by approximately 6% on average in 2022. The price of copper in US dollars, which had also seen a sharp increase in the previous year, fell by 5% on average. Conversely, the average price of aluminum in US dollars was up 9% in 2022.

Precious metals such as silver and gold are used by Continental and by our suppliers to coat components. In 2022, the average US-dollar price of gold was on par with the previous year. By contrast, the price of silver in US dollars fell by 13% on average.

For natural rubber, weakening tire demand led to a decline in prices from the summer of 2022 onward. The price of natural rubber TSR 20 in US dollars was down 8% year-on-year in 2022, for example.

Crude oil is the most important basic building block for synthetic-rubber input materials such as butadiene and styrene as well as for carbon black, various other chemicals, and plastics. The price of crude oil rose sharply in the first few months of 2022 due to the war in Ukraine. This trend reversed, however, in the summer. By the end of the year, the price had fallen back to the level it was at the beginning of 2022. The annual average price of Brent crude oil in US dollars increased by 42% year-on-year.

The rise in the price of crude oil also led to price increases for various input materials for synthetic rubber in 2022, although these price increases were dampened by the weakening demand for tires. The average prices in US dollars for butadiene and styrene, for example, increased by 6% and 4%, respectively.

Plastic resins, as technical thermoplastics, are required by Continental and our suppliers in particular for the manufacture of housing parts in the Automotive group sector and for various other plastic parts in the ContiTech group sector. The average price of resins in US dollars was up 23% in 2022.

TSR 20, crude oil and butadiene

Indexed to January 1, 2020

Sources:

TSR 20: rolling one-month contracts from the Singapore Exchange (US $ cents per kg).

Crude oil: European Brent spot price from Bloomberg (US $ per barrel).

Butadiene: South Korea spot price (FOB) from PolymerUpdate.com (US $ per metric ton).

Continental uses natural and synthetic rubber in large quantities for the manufacture of tires and industrial rubber products. It also uses relatively large quantities of carbon black as a filler material and of steel cord and nylon cord as structural materials. Due to the high volumes and direct purchasing of raw materials, their price development has a significant influence on the earnings of the Tires and ContiTech group sectors.

Overall, the described price developments for raw materials together with a significantly weaker euro led to significant cost burdens in all group sectors of the Continental Group in 2022.