Automotive, Tires and ContiTech: the three strong pillars of the Continental Group.

Organizational structure

The Continental Group is divided into four group sectors: Automotive, Tires, ContiTech and Contract Manufacturing. As of January 1, 2023, these comprise a total of 18 business areas.

A group sector or business area with overall responsibility for a business, including its results, is classified according to product requirements, market trends, customer groups and distribution channels.

Business responsibility

Overall responsibility for managing the company is borne by the Executive Board of Continental Aktiengesellschaft (AG). The Automotive, Tires and ContiTech group sectors are each represented on the Executive Board.

The group functions of Continental AG are represented by the chairman of the Executive Board, the chief financial officer and the Executive Board member responsible for Human Relations, and assume the functions required to manage the Continental Group across the group sectors. They include, in particular, Finance, Controlling, Compliance, Law, IT, Human Relations, Sustainability, and Quality and Environment. The Group Purchasing group function is represented by the Executive Board member responsible for the Tires group sector.

Customer structure

With a 61% share of consolidated sales, the automotive industry – with the exception of the replacement business – is our most important customer group. This industry is particularly important for the growth of the Automotive group sector. In the Tires group sector, sales to dealers and end users represent the largest share of the tire-replacement business. In the ContiTech group sector, the customer base is made up of the automotive industry and other key industries such as railway engineering, machine and plant construction, mining and the replacement business. In the Contract Manufacturing group sector, Vitesco Technologies constitutes the sole customer.

Companies and locations

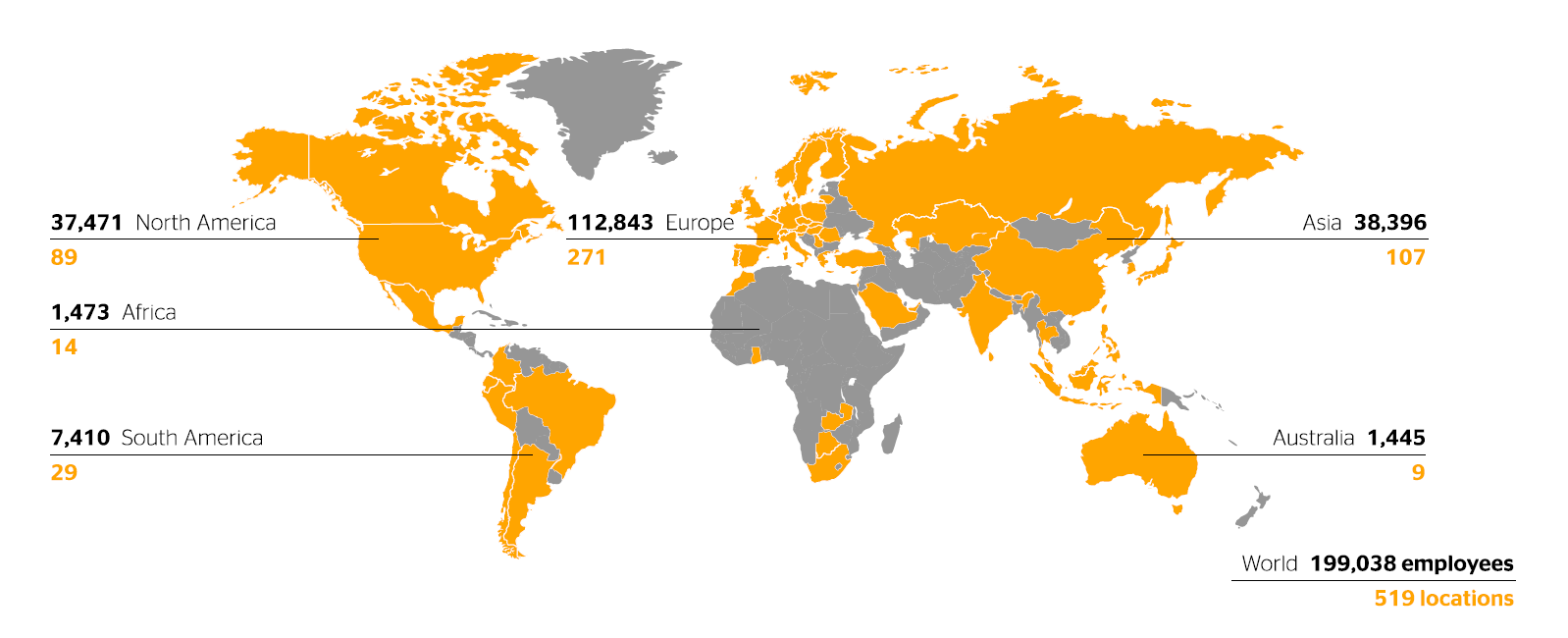

Continental AG is the parent company of the Continental Group. In addition to Continental AG, the Continental Group comprises 477 companies, including non-controlled companies. The Continental team is made up of 199,038 employees at 519 locations for production, research and development, and administration in 57 countries and markets. Added to this are distribution locations, with 917 company-owned tire outlets and a total of around 5,228 franchises and operations with a Continental brand presence.

The Automotive group sector offers technologies for passive-safety, brake, chassis, motion and motion-control systems. Its portfolio also includes innovative solutions for assisted and automated driving, display and operating technologies, audio and camera solutions for the vehicle interior as well as intelligent information and communication technology associated with the mobility services of fleet operators and commercial vehicle manufacturers. Comprehensive activities relating to connectivity technologies, vehicle electronics and high-performance computers round off the range of products and services. The group sector is divided into five business areas:

- Architecture and Networking

- Autonomous Mobility

- Safety and Motion

- Smart Mobility

- User Experience

As of January 1, 2023, the Automotive group sector, including a development unit called Software and Central Technologies (SCT), is divided into six business areas.

With its premium portfolio in the car, truck, bus, two-wheel and specialty tire segment, the Tires group sector stands for innovative solutions in tire technology. Intelligent products and services related to tires and the promotion of sustainability complete the portfolio. For specialist dealers and fleet management, Tires offers digital tire monitoring and tire management systems, in addition to other services, with the aim of keeping fleets mobile and increasing their efficiency. With its tires, Continental contributes to safe, efficient and environmentally friendly mobility. In the reporting year, 22% of sales in Tires related to business with vehicle manufacturers, and 78% related to the tire-replacement business. The group sector is divided into five business areas:

- Original Equipment

- Replacement APAC

- Replacement EMEA

- Replacement The Americas

- Specialty Tires

The ContiTech group sector develops and manufactures, for example, cross-material, environmentally friendly and intelligent products and systems for the automotive industry, railway engineering, mining, agriculture and other key industries. The group sector draws on its long-standing knowledge of the industry and materials to open up new business opportunities by combining various materials with electronic components and individual services. In the reporting year, 48% of sales in ContiTech related to business with automotive manufacturers, and 52% to business with other industries and in the automotive replacement market. The group sector is divided into six business areas:

- Advanced Dynamics Solutions

- Conveying Solutions

- Industrial Fluid Solutions

- Mobile Fluid Systems

- Power Transmission Group

- Surface Solutions

The contract manufacturing of products by Continental companies for Vitesco Technologies is consolidated in the Contract Manufacturing group sector. This contract manufacturing is not intended to be a permanent situation; rather, the operational separation of production will be promoted in the coming years, and the volume of contract manufacturing reduced. Contract Manufacturing includes one business area:

- Contract Manufacturing

Globally interconnected value creation

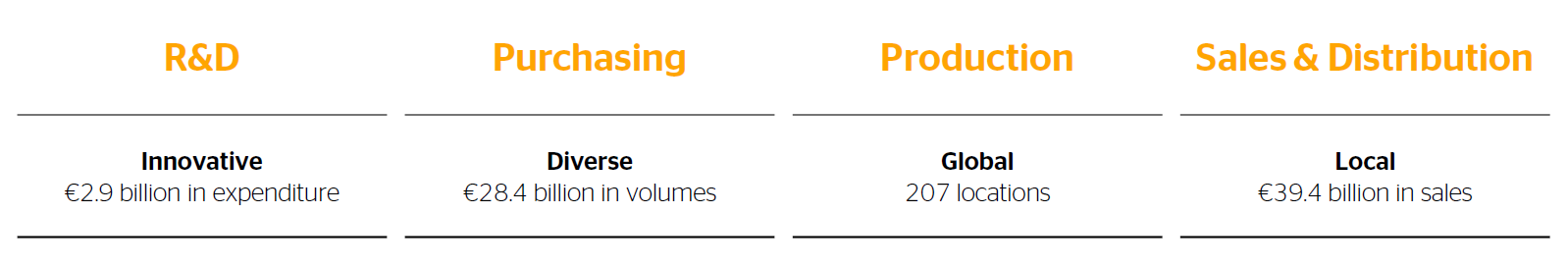

Research and development (R&D) took place at 94 locations in the reporting year, predominantly in close proximity to our customers to ensure that we can respond flexibly to their various requirements and to regional market conditions. This applies particularly to projects of the Automotive and ContiTech group sectors. In the Tires group sector, R&D is largely centrally organized, since product requirements for tires are much the same across the world. They are adapted according to the specific requirements of each market. Continental generally invests around 7% to 8% of sales in R&D each year. For more information, see the Research and Development section.

Continental processes a wide range of raw materials and semi-finished products. The purchasing volume in the reporting year was €28.4 billion in total, €19.3 billion of which was for production materials. Electronics and electromechanical components together make up around 35% of the Continental Group’s purchasing volume for production materials, which are primarily used in the Automotive and Contract Manufacturing group sectors, while mechanical components account for around 19%. Natural rubber and oil-based chemicals as well as synthetic rubber and carbon black are key raw materials for the Tires and ContiTech group sectors. The total purchasing volume for these materials amounts to around 26% of the total volume for production materials. For more information, see the Development of Raw Materials Markets section in the economic report.

Production and sales in the Automotive and ContiTech group sectors are organized across regions. For the Tires group sector, economies of scale play a key role when it comes to tire manufacturing. Low production costs coupled with large volumes and proximity to our customers or high rates of regional growth constitute key success factors. For this reason, manufacturing takes place at major locations in the dominant automotive markets, namely Europe, the USA and China. Tires are sold worldwide via our dealer network with tire outlets and franchises, as well as through tire trading in general.