Corporate structure focused on flexibility and sustainable value creation.

Market- and customer-oriented corporate structure

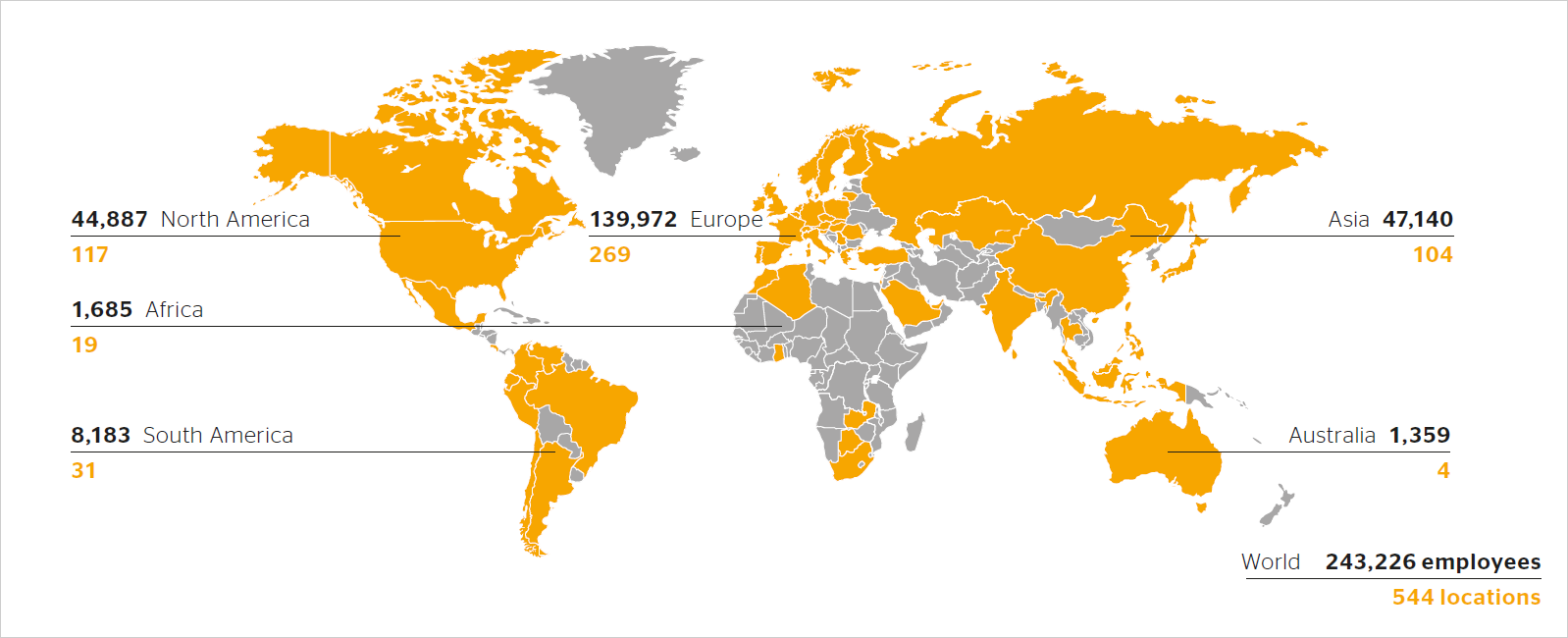

In 1871, Continental Aktiengesellschaft (AG) was founded in Hanover as Continental-Caoutchouc- und Gutta-Percha Compagnie. Today, Continental AG, still headquartered in Hanover, Germany, is the parent company of the Continental Corporation. The Continental Corporation comprises 572 companies, including non-controlled companies, in addition to the parent company Continental AG. The Continental team is made up of 243,226 employees at a total of 544 locations in 60 countries and markets. The postal addresses of companies under our control are defined as locations.

Overall responsibility for management is borne by the Executive Board of Continental AG. In the reporting year, each division was represented by one Executive Board member until September 30, 2018. Since October 1, 2018, the Powertrain division has been under new management as a result of its transformation into an independent group of legal entities from 2019. With the exception of Corporate Purchasing, the central functions of Continental AG are represented by the chairman of the Executive Board, the chief financial officer and the Executive Board member responsible for Human Relations. They take on the functions required on a crossdivisional basis to manage the corporation. These include, in particular, finance, controlling, compliance, law, IT, sustainability, quality and environment.

The effective and efficient cooperation of divisions, business units and central functions is governed by our “Balance of Cooperation.” It defines the framework of our activities across organizational, hierarchical and geographic boundaries and promotes our corporate culture on the basis of our corporate values: Trust, For One Another, Freedom To Act and Passion To Win.

With a 72% share of our consolidated sales, the automotive industry (original equipment) is our largest customer group. The importance of this industry is accordingly high for growth in the Automotive Group. In the Rubber Group, the tire business with end customers is predominant. At ContiTech, other key industries in addition to the automotive industry play a major role as well, such as railway engineering, machine and plant construction, mining and the replacement sector. We deliver high-quality, innovative and established products, systems and services. Focusing on the market and on customers is a key success factor. The global corporate structure is thus based upon a balance of decentralized structures and central functions.

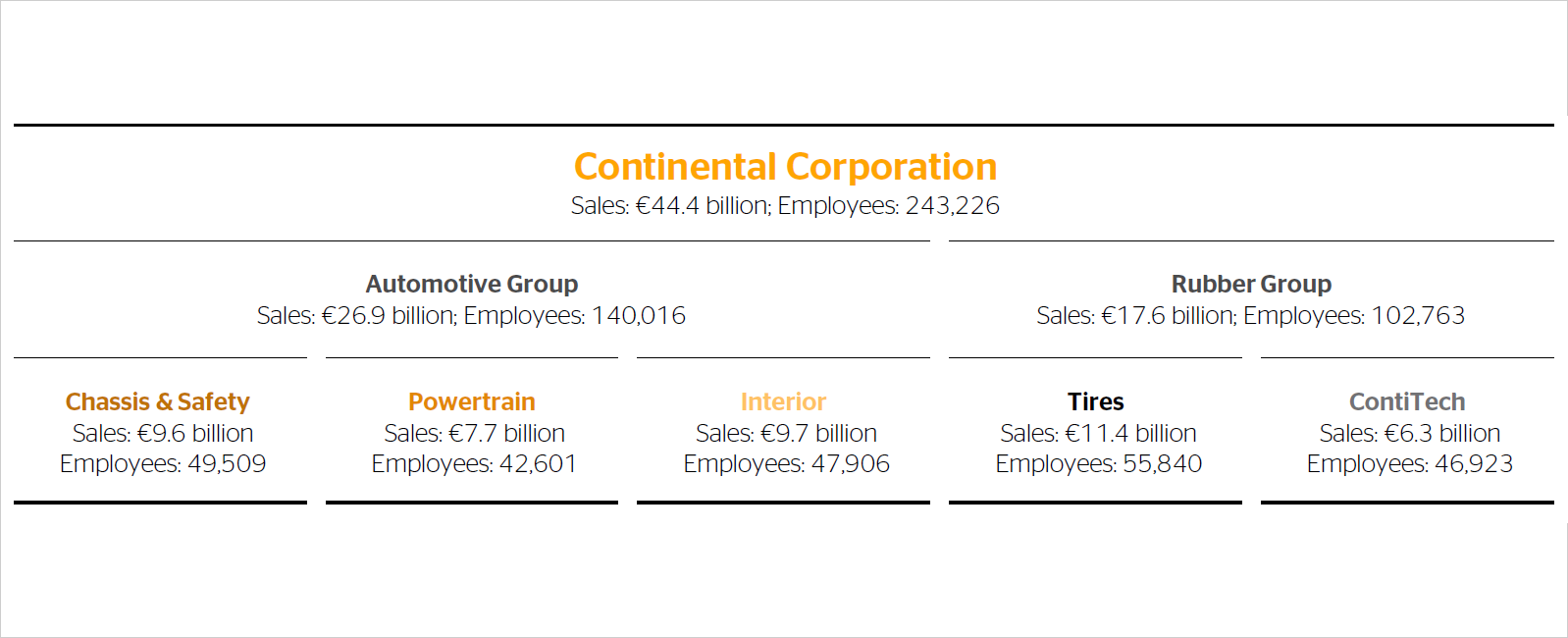

In the reporting year, the corporation consisted of the Automotive Group and the Rubber Group, which comprised five divisions with 26 business units. A division or business unit is classified according to products, product groups and services or according to regions. Differences result primarily from technological product requirements, innovation and product cycles; the raw materials base; and production technology. The divisions and business units have overall responsibility for their business, including their results.

Automotive Group:

The Chassis & Safety division develops, produces and markets intelligent systems to improve driving safety and vehicle dynamics. Integral active and passive safety technologies and products that support vehicle dynamics provide greater safety, comfort and convenience. The goal here is to implement “Vision Zero,” the vision of accident-free driving. The Chassis & Safety division is divided into four business units:

- Advanced Driver Assistance Systems

- Hydraulic Brake Systems

- Passive Safety & Sensorics

- Vehicle Dynamics

The Powertrain division focuses on efficient and clean vehicle drive systems. Here, the division works to improve the performance of injection systems, turbochargers, transmission control units, sensors, actuator systems and exhaust-gas aftertreatment. At the same time, it paves the way for the electrification of vehicles with efficient systems technology and economical vehicle integration. In the reporting year, the division was divided into five business units:

- Engine Systems

- Fuel & Exhaust Management

- Hybrid Electric Vehicle

- Sensors & Actuators

- Transmission

At the beginning of 2019, the Powertrain division was transformed into an independent group of legal entities. Since then, it has comprised three business units:

- Engine & Drivetrain Systems

- Powertrain Components

- Hybrid & Electric Vehicles

For more information, see the Corporate Strategy and the Research and Development sections.

The Interior division specializes in information management. It develops and produces network, information and communication solutions and services for cars and commercial vehicles. This enables and optimizes the control of the complex flow of information between the driver, passengers and the vehicle as well as mobile devices, other vehicles and the outside world. The focus is on systems integration. In addition, the Interior division is involved in crosssector collaborations with leading companies. Since December 1, 2018, the Intelligent Transportation Systems business unit has been integrated as a segment into the Commercial Vehicles & Aftermarket business unit. The division is now divided into four business units:

- Body & Security

- Commercial Vehicles & Aftermarket

- Infotainment & Connectivity

- Instrumentation & Driver HMI

Rubber Group:

The Tire division is known for maximizing safety through short braking distances and excellent grip as well as reducing fuel consumption by minimizing rolling resistance. Tires are the vehicle’s only link with the road. They transmit all forces onto the road. It is the tire technology that determines whether a vehicle is able to stop in time and stay in the correct lane during cornering maneuvers. 28% of sales in the Tire division relates to business with vehicle manufacturers, and 72% relates to the replacement business. The division is divided into six business units:

- Passenger and Light Truck Tire Original Equipment

- Passenger and Light Truck Tire Replacement Business, EMEA (Europe, the Middle East and Africa)

- Passenger and Light Truck Tire Replacement Business, The Americas (North, Central and South America)

- Passenger and Light Truck Tire Replacement Business, APAC (Asia and Pacific region)

- Commercial Vehicle Tires

- Two-Wheel Tires

The ContiTech division develops, manufactures and markets products, systems and intelligent components made of rubber, plastic, metal and fabric. They are used in machine and plant engineering, mining, agriculture, the automotive industry and other important sectors of the future. 51% of sales in the ContiTech division relates to business with vehicle manufacturers, and 49% relates to business with other industries and in the replacement market. The division is divided into seven business units:

- Air Spring Systems

- Benecke-Hornschuch Surface Group

- Conveyor Belt Group

- Industrial Fluid Solutions

- Mobile Fluid Systems

- Power Transmission Group

- Vibration Control.

Interconnected value creation

Research and development (R&D) takes place at 82 locations, predominantly in close proximity to our customers to ensure that we can respond flexibly to their various requirements and to regional market conditions. This applies particularly to projects of the Automotive Group and the ContiTech division. The product requirements governing tires are largely similar all around the world. They are adapted according to the specific requirements of each market. In this respect, R&D has a largely centralized structure in the Tire division. Continental invests about 7% of sales in R&D each year. For more information, see the Research and Development section.

Continental processes a wide range of raw materials and semifinished products. The purchasing volume in the reporting year was €29.9 billion in total, €20.3 billion of which was for production materials. The Automotive Group uses primarily steel, aluminum, precious metals, copper and plastics. Key areas when it comes to purchasing materials and semifinished products include electronics and electromechanical components, which together make up about 44% of the corporation’s purchasing volume of production materials. Furthermore, mechanical components account for nearly a quarter of production materials. Natural rubber and oil-based chemicals such as synthetic rubber and carbon black are key raw materials for the Rubber Group. The total purchasing volume for these materials amounts to around a sixth of the total volume for production material. For more information, see the Development of Raw Materials Markets section in the Economic Report.

Production and sales in the divisions of the Automotive Group and in the ContiTech division are organized across regions. Our tire production activities, in which economies of scale play a key role, are represented with major locations in the three dominant automotive markets in terms of production and vehicle numbers, namely Europe, the U.S.A. and China. Low production costs coupled with large volumes or high rates of regional growth constitute key success factors. Sales activities in the Tire division are performed worldwide via our dealer network with tire outlets and franchises as well as through tire trading in general.