The goal is the sustained increase in the corporation’s value.

Value management

Key financial performance indicators for Continental relate to the development of sales, capital employed and adjusted EBIT margin, as well as the amount of capital expenditure and free cash flow. To allow us to use the financial performance indicators for management purposes as well, and to map the interdependencies between these indicators, we summarize them as key figures as part of a value-driver system. Our corporate objectives center on the sustainable enhancement of the value of each individual business unit. This goal is achieved by generating a positive return on the capital employed in each respective business unit. At the same time, this return must always exceed the equity and debt financing costs of acquiring the operating capital. It is also crucial that the absolute contribution to value (Continental Value Contribution, CVC) increases year for year. This can be achieved by increasing the return on capital employed (with the costs of capital remaining constant), lowering the costs of capital (while maintaining the return on capital employed), or decreasing capital employed over time. The performance indicators used are EBIT, capital employed, and the weighted average cost of capital (WACC), which is calculated from the proportional weight of equity and debt costs.

EBIT is calculated from the ongoing sales process. The figure is the net total of sales, other income and expenses plus income from equity-accounted investees and from investments but before financial result and income tax expense. Consolidated EBIT amounted to €4.0 billion in 2018.

Capital employed is the funds used by the company to generate its sales. At Continental, this figure is calculated as the average of operating assets as at the end of the quarterly reporting periods. In 2018, average operating assets amounted to €23.6 billion.

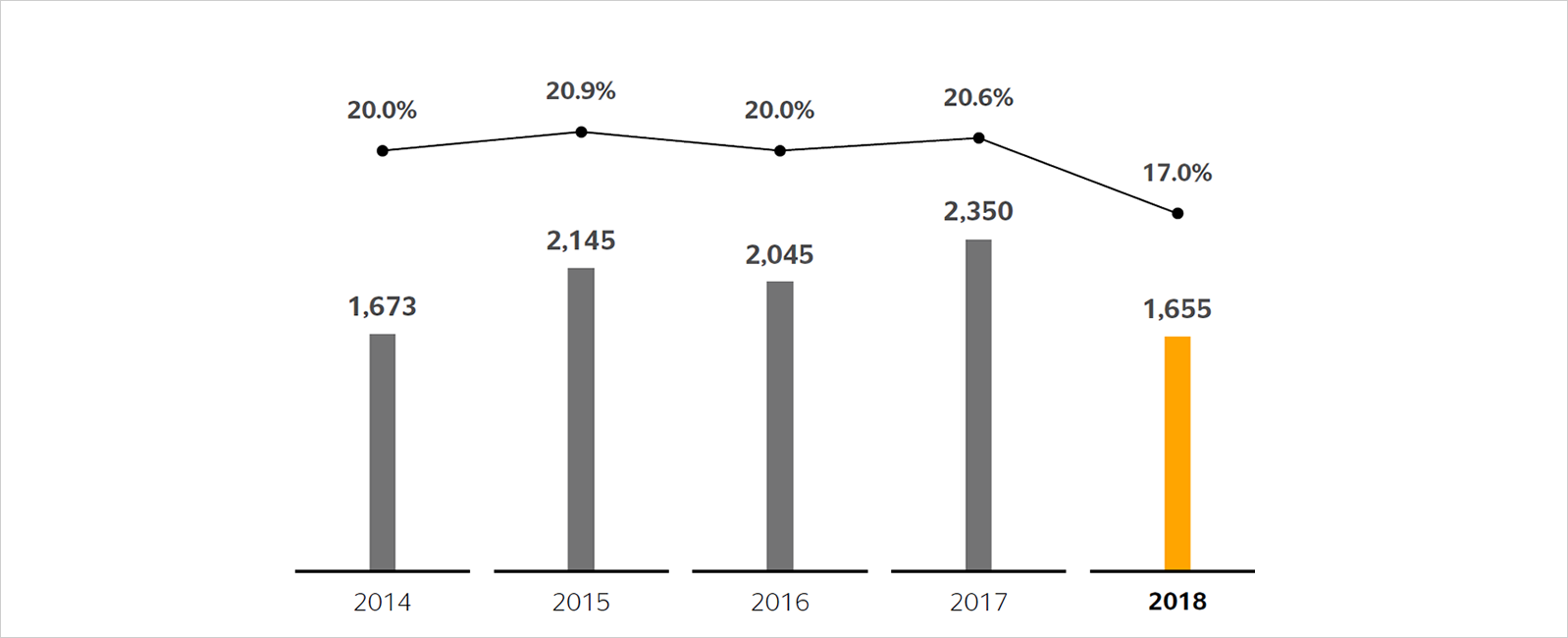

The return on capital employed (ROCE) represents the ratio of these two calculated values. Comparing a figure from the statement of income (EBIT) with one from the statement of financial position (capital employed) produces an integral analysis. We deal with the problem of the different periods of analysis by calculating the capital employed as an average figure over the ends of quarterly reporting periods. ROCE amounted to 17.0% in 2018 and was thus below 20% for the first time since 2013, but still significantly exceeded the weighted average cost of capital.

The weighted average cost of capital (WACC) is calculated to determine the cost of financing the capital employed. Equity costs are based on the return from a risk-free alternative investment plus a market risk premium, taking into account Continental’s specific risk. Borrowing costs are calculated based on Continental’s weighted debt-capital cost rate. Based on the long-term average, the weighted average cost of capital for our company is about 10%.

Value is added only if ROCE exceeds the weighted average cost of capital (WACC). We call this value added, produced by subtracting WACC from ROCE multiplied by average operating assets, the Continental Value Contribution (CVC). In 2018, the CVC amounted to €1,654.8 million.

According to our definition, the value of the company increases when the CVC demonstrates positive growth in value.

Financing strategy

Our financing strategy aims to support value-adding growth of the Continental Corporation while at the same time complying with an equity and liabilities structure adequate for the risks and rewards of our business.

The corporate function Finance & Treasury provides the necessary financial framework to finance corporate growth and secure the long-term existence of the company. The company’s annual investment requirements will be 7% to 8% of sales in the coming years. The reasons for this are the continuing increase in incoming orders in the Automotive Group and the successful implementation of Vision 2025 in our Tire division, which will mean the expansion of tire production capacity, particularly in North America and Asia.

Our goal is to finance ongoing investment requirements from the operating cash flow. Other investment projects, for example acquisitions, should be financed from a balanced mix of equity and debt depending on the ratio of net indebtedness to equity (gearing ratio) and the liquidity situation to achieve constant improvement in the respective capital market environment. In general, the gearing ratio should remain below 20% in the coming years and not exceed 60% in general. If justified by extraordinary financing grounds or specific market circumstances, we can rise above this maximum level under certain conditions. The equity ratio should exceed 35%. In the reporting year, it was 45.3% and the gearing ratio 9.1%.

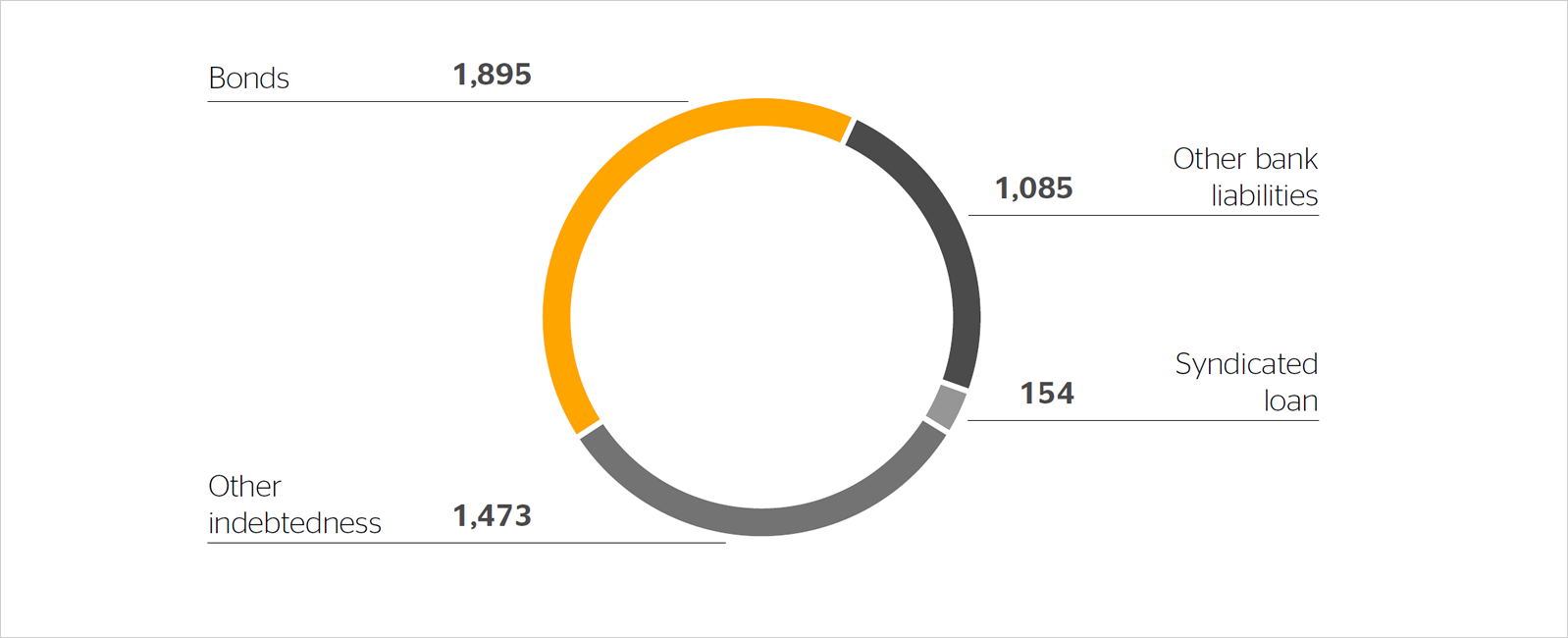

Our gross indebtedness should be a balanced mix of liabilities to banks and other sources of financing on the capital market. For short-term financing in particular, we use a wide range of financing instruments. As at the end of 2018, this mix consisted of bonds (41%), syndicated loan (3%), other bank liabilities (24%) and other indebtedness (32%) based on the gross indebtedness of €4,606.9 million. The committed volume of the syndicated loan, which consists of the revolving tranche, remained unchanged at €3.0 billion. The tranche will run until April 2021. The financing mix will not change significantly. Starting in 2019, however, all liabilities from leases will be recognized under gross indebtedness due to the application of IFRS 16, Leases, starting from January 1, 2019. This will accordingly lead to an increase in gross indebtedness.

The corporation strives to have at its disposal unrestricted liquidity of about €1.5 billion. This is supplemented by committed, unutilized credit lines from banks in order to cover liquidity requirements at all times. These requirements fluctuate during a calendar year owing in particular to the seasonal nature of some business areas. In addition, the amount of liquidity required is also influenced by corporate growth. Unrestricted cash and cash equivalents amounted to €2,587.7 million as at December 31, 2018. There were also committed and unutilized credit lines of €3,504.1 million.

Gross indebtedness amounted to €4,606.9 million as at December 31, 2018. Key financing instruments are the syndicated loan with a revolving credit line of €3.0 billion that has been granted until April 2021 and bonds issued on the capital market.

The carrying amount drawn under the revolving line of credit was €154.3 million as at December 31, 2018. Around 40% of gross indebtedness is financed on the capital market in the form of bonds maturing between February 2019 and September 2020. The interest coupons vary between 0.0% and 3.125%. The repayment amounts are €500.0 million in 2019, and €600.0 million and €750.0 million in 2020. In addition to the forms of financing already mentioned, there were also bilateral credit lines with various banks in the amount of €1,799.5 million as at December 31, 2018. Continental’s corporate financing instruments currently also include saleof- receivables programs and commercial paper programs. In the second half of 2018, the existing commercial paper programs were supplemented with an additional U.S. $500.0 million commercial paper program in the U.S.A.

Maturity profile

Continental always strives for a balanced maturity profile of its liabilities in order to be able to repay the amounts due each year from free cash flow as far as possible. Other than short-term maturities, which are usually rolled on to the next year, the repayment of the €500.0 million bond maturing in February 2019 and of the €600.0 million and €750.0 million bonds maturing in February and September 2020 is also on the agenda for 2019 and 2020.

In the reporting period, Continental AG was rated by the three rating agencies Standard & Poor’s, Fitch and Moody’s, each of which maintained their credit ratings for Continental AG during 2018.

| Credit rating for Continental AG | ||||

|---|---|---|---|---|

| December 31, 2018 | December 31, 2017 | |||

| Standard & Poor’s1 | ||||

| Long term | BBB+ | BBB+ | ||

| Short term | A-2 | A-2 | ||

| Outlook | stable | stable | ||

| Fitch2 | ||||

| Long term | BBB+ | BBB+ | ||

| Short term | F2 | F2 | ||

| Outlook | stable | stable | ||

| Moody’s3 | ||||

| Long term | Baa1 | Baa1 | ||

| Short term | no rating | no rating | ||

| Outlook | stable | stable | ||

1 Contracted rating since May 19, 2000.

2 Contracted rating since November 7, 2013.

3 Non-contracted rating since February 1, 2014.