This Remuneration Report is a part of the Management Report.

Basic elements of the Executive Board remuneration system

In accordance with the German Stock Corporation Act (Aktiengesetz – AktG), the plenary session of the Supervisory Board is responsible for determining the remuneration for the Executive Board. In September 2013, the Supervisory Board redefined the structure and key elements of the Executive Board remuneration system. The Annual Shareholders’ Meeting on April 25, 2014, approved this system of remuneration for the Executive Board members in accordance with Section 120 (4) AktG.

The Supervisory Board reviews the Executive Board’s remuneration regularly. In 2016, it once again commissioned an independent consultant to review the system, structure and amount of remuneration for the Executive Board. The conclusion was that the remuneration system and structure, as described in detail hereinafter, satisfy the legal requirements and comply with the recommendations of the German Corporate Governance Code. The consultant assessed the amount of remuneration as appropriate overall. In order to raise the direct remuneration, i.e. the fixed and variable remuneration, to the middle of a remuneration range for comparable companies, the consultant, however, proposed that individual elements be increased. After performing its own detailed review and discussions, the Supervisory Board resolved on the adjustments described hereinafter, which took effect as at January 1, 2017. In determining the remuneration of the Executive Board, the Supervisory Board also took account of the remuneration structure that applies in the rest of the corporation and the ratio of the Executive Board remuneration to the remuneration of senior executives and the workforce in Germany as a whole, including its development over time. The Annual Shareholders’ Meeting on April 28, 2017, approved the remuneration system in accordance with Section 120 (4) AktG. It was applied in 2017 to all Executive Board members in office in this fiscal year. Remuneration for Executive Board members consists of the following:

- Fixed remuneration

- Variable remuneration elements

- Additional benefits

- Retirement benefits

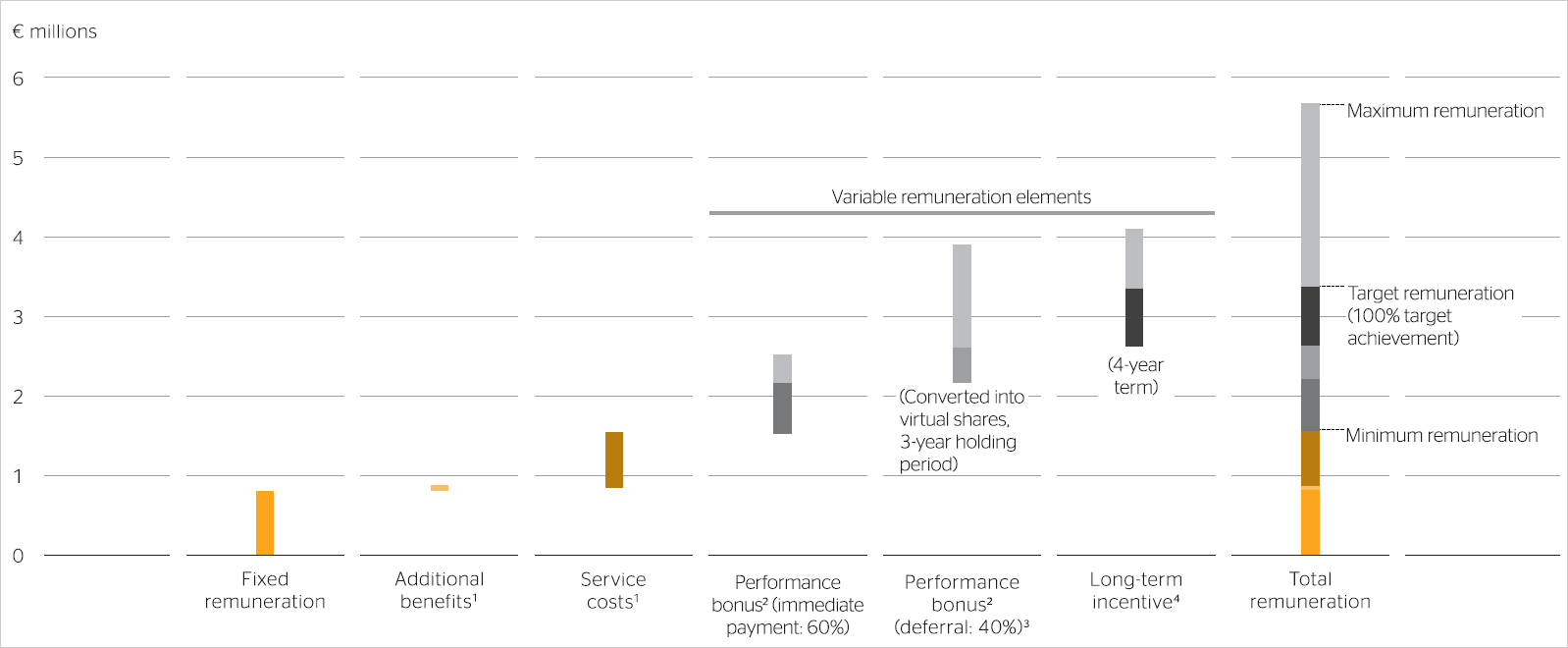

The chart below shows an example of the composition of the remuneration for an Executive Board member with responsibility for a division, based on 100% target achievement.

2017 remuneration of an Executive Board member responsible for a division (example)

1 Average for 2017.

2 Based on a target bonus (here: €1.167 million), for 100% achievement of defined CVC and ROCE targets, maximum of 150% of the target bonus (including achieving any additional strategic targets as well as any correction of the target achievement of +/- 20% by the Supervisory Board), divided into an immediate payment (60%) and deferral (40%).

3 The possible increase in the value of the deferral is capped at 250% of the initial value. The maximum amount shown relates to the maximum payment in the performance bonus at 150% target achievement.

4 Based on achieving average CVC versus planned CVC (max. 200%), multiplied by the degree of achieving the total shareholder return, maximum payment of 200%.

1. Fixed remuneration

Each Executive Board member receives fixed annual remuneration paid in 12 monthly installments. The fixed remuneration of the chairman of the Executive Board was raised as at January 1, 2017, to bring it in line with market development. The fixed remuneration of the other Executive Board members as determined in 2013 remained unchanged. The fixed remuneration, with 100% target achievement, makes up around one-third of the direct remuneration.

2. Variable remuneration elements

The Executive Board members also receive variable remuneration in the form of a performance bonus and a share-based long-term incentive (LTI). A key criterion for measuring variable remuneration is the Continental Value Contribution (CVC), which is a central corporate management instrument (please refer to the Corporate Management section in the Management Report, page 46). The variable remuneration elements, with 100% target achievement, make up around two-third of the direct remuneration. The structure of the variable remuneration is geared toward sustainable development of the company as defined in the German Stock Corporation Act and the German Corporate Governance Code, with a futureoriented assessment basis that generally covers several years. The share of long-term components amounts to 60% or more of variable remuneration on the basis of the target values.

a) Performance bonus

The performance bonus is based on a target amount that the Supervisory Board determines for each Executive Board member for 100% target achievement. Target criteria are the year-on-year change in the CVC and the return on capital employed (ROCE). For Executive Board members who are responsible for a particular division, these criteria relate to the relevant division; for other Executive Board members, they relate to the corporation. The CVC target is 100% achieved if the CVC is unchanged compared to the previous year. If the CVC has fallen or risen by a defined percentage, this element is reduced to zero or reaches a maximum of 150%. In the case of negative CVC in the previous year, target achievement is based on the degree of improvement. The criteria for the ROCE target are guided by planning targets. This component can also be omitted if a certain minimum value is not achieved. Because of the link with planning, more specific disclosures regarding the target values would not be in the company’s interests.

The CVC target is weighted at 60% and the ROCE target at 40% in the calculation of the performance bonus. In addition to the CVC and ROCE targets, the Supervisory Board can determine a strategic target at the beginning of each fiscal year, which is weighted at 20% – reducing the weighting of the other two targets accordingly. The Supervisory Board did not set an additional target for 2017. In order to take into account extraordinary factors that have influenced the degree to which targets are achieved, the Supervisory Board has the right – as it sees fit – to retroactively adjust the established attainment of goals on which the calculation of the performance bonus is based by up to 20% upward or downward. The Supervisory Board considers this adjustment option necessary to account in particular for positive and negative effects on target achievement over which a member of the Executive Board has no influence. It has not yet made use of the discretionary power. In any event, the performance bonus is capped at 150% of the target bonus. This applies irrespective of whether an additional strategic target is resolved.

The performance bonus achieved in a fiscal year is divided into a lump sum, which is paid out as an annual bonus (immediate payment), and a deferred payment (deferral). Under the agreements applicable until December 31, 2013, the immediate payment amounted to 40% of the performance bonus while the deferral amounted to 60%. Since 2014, the immediate payment has amounted to 60% and the deferral 40%. The deferral is converted into virtual shares of Continental AG. Following a holding period of three years after the end of the fiscal year for which variable remuneration is awarded, the value of these virtual shares is paid out together with the value of the dividends that were distributed for the fiscal years of the holding period. The conversion of the deferral into virtual shares and payment of their value after the holding period are based on the average share price for the three-month period immediately preceding the Annual Shareholders’ Meeting in the year of conversion or payment. However, the amount of a deferral relating to a fiscal year up to and including 2013 that is paid after the holding period may not fall below 50% of the value at the time of conversion or exceed three times the same value. In addition, the Supervisory Board may retroactively revise the amount paid out for such deferrals by up to 20% upward or downward to balance out extraordinary developments. For deferrals acquired in 2014 or subsequent years, there is no guarantee that at least 50% of the initial value of the deferral will be paid out at the end of the holding period, and it is no longer possible for the Supervisory Board to change the amount to be paid out retroactively. Furthermore, the possible increase in the value of the deferral is capped at 250% of the initial value.

In addition to the performance bonus, a special bonus can be agreed upon for special projects in individual cases or a recognition bonus can be granted. However, a recognition or special bonus of this kind and the performance bonus together must not exceed 150% of the target bonus, and it is also included in the division into immediate payment and deferral. No special or recognition bonus has been granted since 2013.

The amount of the performance bonus to be paid out for fiscal 2017 in the event of 100% target achievement is shown – divided into immediate payment and deferral – in the “remuneration granted” column in the below remuneration tables for the Executive Board members for 2017.

b) Long-term incentive (LTI)

The LTI plan is resolved by the Supervisory Board on an annual basis with a term of four years in each case. It determines the target bonus to be paid for 100% target achievement for each Executive Board member, taking into account the corporation’s earnings and the member’s individual performance.

The first criterion for target achievement is the average CVC that the corporation actually generates in the four fiscal years during the term, starting with the fiscal year in which the tranche is issued. This value is compared to the average CVC, which is set in the strategic plan for the respective period. The degree to which this target is achieved can vary between 0% and a maximum of 200%.

The other target criterion is the total shareholder return (TSR) on Continental shares during the term of the tranche. To determine the TSR, the average price of the Continental share in the months from October to December is set in relation to the beginning and the end of the respective LTI tranche. In addition, all dividends paid during the term of the LTI tranche are taken into account for the TSR (please refer to the Notes to the Consolidated Financial Statements, starting on page 179). The degree to which this target is achieved is multiplied by the degree to which the CVC target is achieved to determine the degree of target achievement on which the LTI that will actually be paid after the end of the term is based. The maximum amount to be paid out is capped at 200% of the target bonus.

In 2013, in anticipation of the plan to be implemented from 2014, the Supervisory Board already granted an LTI to the Executive Board members in office, with the exception of Frank Jourdan. Its conditions correspond to those that applied to the 2013 LTI plan for the senior executives. In addition to a CVC target, this plan did not have a share-based target but did have a target relating to free cash flow in the last year of the term. The 2013 LTI plan is described in detail in the Notes to the Consolidated Financial Statements in the section on employee benefits (Note 24). Frank Jourdan and Hans-Jürgen Duensing remain entitled to LTI that were granted to them as senior executives between 2010 and 2013 or 2011 and 2014 respectively.

Starting from January 1, 2017, the target amounts for the performance bonus and the LTI were increased to raise the total remuneration of the Executive Board members to the middle of a remuneration range of comparable companies in each case.

The amount of the LTI to be paid out for fiscal 2017 in the event of 100% target achievement is shown in the “remuneration granted” column in the remuneration tables below for the Executive Board members for 2017.

3. Additional benefits

Executive Board members also receive additional benefits, primarily the reimbursement of expenses, including any relocation expenses and payments – generally for a limited time – for a job-related second household, the provision of a company car, and premiums for group accident and directors’ and officers’ (D&O) liability insurance. The D&O insurance policy provides for an appropriate deductible in line with the requirements of Section 93 (2) Sentence 3 AktG. For longer periods working abroad, benefits are granted in line with the foreign assignment guidelines for senior executives. As a rule, members of the Executive Board must pay taxes on these additional benefits.

Continued remuneration payments have also been agreed for a certain period in the event of employment disability through no fault of the Executive Board member concerned.

4. Retirement benefits

All members of the Executive Board have been granted post-employment benefits that are paid starting at the age of 63 (but not before they leave the service of the company) or in the event of disability.

From January 1, 2014, the company pension for the members of the Executive Board was changed from a purely defined benefit to a defined contribution commitment. A capital component is credited to the Executive Board member’s pension account each year. To determine this, an amount equivalent to 20% of the sum of the fixed remuneration and the target value of the performance bonus is multiplied by an age factor representing an appropriate return. The future benefit rights accrued until December 31, 2013, have been converted into a starting component in the capital account. When the insured event occurs, the benefits are paid out as a lump sum, in installments or – as is normally the case due to the expected amount of the benefits – as a pension. Overall, the level of the benefits has fallen to around 80% of the previous commitments due to the conversion. Post-employment benefits are adjusted after commencement of such benefit payments in accordance with Section 16 of the German Company Pensions Law (Betriebsrentengesetz – BetrAVG).

In the employment contracts, it has been agreed that, in the event of premature termination of Executive Board work, payments to the Executive Board member that are to be agreed, including the additional benefits, shall not exceed the value of two annual salaries or the value of remuneration for the remaining term of the employment contract for the Executive Board member. There are no compensation agreements with the members of the Executive Board for the event of a takeover bid or a change of control at the company. Heinz-Gerhard Wente, who retired on April 30, 2015, received compensation for non-competition in an amount of €96 thousand in 2017 – taking into account his pension entitlements – for a post-contractual non-compete covenant, which was still in place in that year. Dr. Ralf Cramer, who stepped down from the Executive Board on August 11, 2017, received compensation for non-competition in an amount of €457 thousand.

Individual remuneration

In the tables below, the benefits, inflows and service costs granted to the members of the Executive Board are shown separately in accordance with the recommendations of Section 4.2.5 para. 3 of the German Corporate Governance Code.

| Dr. E. Degenhart (Board chairman; Board member since August 12, 2009) | |||||||

|---|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | ||||||

| € thousands | 2016 | 2017 | 2017 (min.) | 2017 (max.) | 2016 | 2017 | |

| Payment in 2017 | Payment in 2018 | ||||||

| Fixed remuneration | 1,350 | 1,450 | 1,450 | 1,450 | 1,350 | 1,450 | — |

| Additional benefits | 102 | 13 | 13 | 13 | 102 | 13 | — |

| Total | 1,452 | 1,463 | 1,463 | 1,463 | 1,452 | 1,463 | — |

| Performance bonus (immediate payment) | 1,110 | 1,500 | 0 | 2,250 | 1,245 | — | 2,098 |

| Multiannual variable remuneration | 1,940 | 2,550 | 0 | 5,600 | 2,230 | 2,702 | 1,684 |

| Performance bonus (deferral) [3 years] | 740 | 1,000 | 0 | 2,500 | 2,230 | 1,264 | — |

| Long-term incentive [4 years] until 2013 | — | — | — | — | — | 1,438 | — |

| Long-term incentive [4 years] from 2014 | 1,200 | 1,550 | 0 | 3,100 | — | — | 1,684 |

| Total | 4,502 | 5,513 | 1,463 | 9,313 | 4,927 | 4,165 | 3,782 |

| Service costs | 900 | 1,123 | 1,123 | 1,123 | 900 | 1,123 | — |

| Total remuneration | 5,402 | 6,636 | 2,586 | 10,436 | 5,827 | 5,288 | 3,782 |

| J. A. Avila (Board member for Powertrain; Board member since January 1, 2010) | |||||||

|---|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | ||||||

| € thousands | 2016 | 2017 | 2017 (min.) | 2017 (max.) | 2016 | 2017 | |

| Payment in 2017 | Payment in 2018 | ||||||

| Fixed remuneration | 800 | 800 | 800 | 800 | 800 | 800 | — |

| Additional benefits | 49 | 19 | 19 | 19 | 49 | 19 | — |

| Total | 849 | 819 | 819 | 819 | 849 | 819 | — |

| Performance bonus (immediate payment) | 660 | 700 | 0 | 1,050 | 641 | — | 1,050 |

| Multiannual variable remuneration | 990 | 1,250 | 0 | 2,734 | 990 | 1,643 | 772 |

| Performance bonus (deferral) [3 years] | 440 | 467 | 0 | 1,168 | 990 | 990 | — |

| Long-term incentive [4 years] until 2013 | — | — | — | — | — | 653 | — |

| Long-term incentive [4 years] from 2014 | 550 | 783 | 0 | 1,566 | — | — | 772 |

| Total | 2,499 | 2,769 | 819 | 4,603 | 2,480 | 2,462 | 1,822 |

| Service costs | 365 | 607 | 607 | 607 | 365 | 607 | — |

| Total remuneration | 2,864 | 3,376 | 1,426 | 5,210 | 2,845 | 3,069 | 1,822 |

| Dr. R. Cramer (Board member for Continental China; Board member from Aug. 12, 2009 to Aug. 11, 2017) | |||||||

|---|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | ||||||

| € thousands | 2016 | 2017 | 2017 (min.) | 2017 (max.) | 2016 | 2017 | |

| Payment in 2017 | Payment in 2018 | ||||||

| Fixed remuneration | 800 | 493 | 493 | 493 | 800 | 493 | — |

| Additional benefits | 475 | 254 | 254 | 254 | 475 | 254 | — |

| Total | 1,275 | 747 | 747 | 747 | 1,275 | 747 | — |

| Performance bonus (immediate payment) | 660 | 428 | 0 | 642 | 740 | — | 599 |

| Multiannual variable remuneration | 990 | 405 | 0 | 952 | 844 | 1,252 | 697 |

| Performance bonus (deferral) [3 years] | 440 | 285 | 0 | 713 | 844 | 599 | — |

| Long-term incentive [4 years] until 2013 | — | — | — | — | — | 653 | — |

| Long-term incentive [4 years] from 2014 | 550 | 120 | 0 | 239 | — | — | 697 |

| Total | 2,925 | 1,580 | 747 | 2,341 | 2,859 | 1,999 | 1,296 |

| Service costs | 611 | 787 | 787 | 787 | 611 | 787 | — |

| Total remuneration | 3,536 | 2,367 | 1,534 | 3,128 | 3,470 | 2,786 | 1,296 |

| H.-J. Duensing (Board member for ContiTech; Board member since May 1, 2015) | |||||||

|---|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | ||||||

| € thousands | 2016 | 2017 | 2017 (min.) | 2017 (max.) | 2016 | 2017 | |

| Payment in 2017 | Payment in 2018 | ||||||

| Fixed remuneration | 800 | 800 | 800 | 800 | 800 | 800 | — |

| Additional benefits | 54 | 21 | 21 | 21 | 54 | 21 | — |

| Total | 854 | 821 | 821 | 821 | 854 | 821 | — |

| Performance bonus (immediate payment) | 660 | 700 | 0 | 1,050 | 965 | — | 828 |

| Multiannual variable remuneration | 990 | 1,250 | 0 | 2,734 | 140 | 105 | 141 |

| Performance bonus (deferral) [3 years] | 440 | 467 | 0 | 1,168 | — | — | — |

| Long-term incentive [4 years] until 2013 | — | — | — | — | 140 | 105 | — |

| Long-term incentive [4 years] from 2014 | 550 | 783 | 0 | 1,566 | — | — | 141 |

| Total | 2,504 | 2,771 | 821 | 4,605 | 1,959 | 926 | 969 |

| Service costs | 516 | 645 | 645 | 645 | 516 | 645 | — |

| Total remuneration | 3,020 | 3,416 | 1,466 | 5,250 | 2,475 | 1,571 | 969 |

| F. Jourdan (Board member for Chassis & Safety; Board member since September 25, 2013) | |||||||

|---|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | ||||||

| € thousands | 2016 | 2017 | 2017 (min.) | 2017 (max.) | 2016 | 2017 | |

| Payment in 2017 | Payment in 2018 | ||||||

| Fixed remuneration | 800 | 800 | 800 | 800 | 800 | 800 | — |

| Additional benefits | 60 | 28 | 28 | 28 | 60 | 28 | — |

| Total | 860 | 828 | 828 | 828 | 860 | 828 | — |

| Performance bonus (immediate payment) | 660 | 700 | 0 | 1,050 | 303 | — | 1,050 |

| Multiannual variable remuneration | 990 | 1,250 | 0 | 2,734 | 175 | 219 | 772 |

| Performance bonus (deferral) [3 years] | 440 | 467 | 0 | 1,168 | — | 88 | — |

| Long-term incentive [4 years] until 2013 | — | — | — | — | 175 | 131 | — |

| Long-term incentive [4 years] from 2014 | 550 | 783 | 0 | 1,566 | — | — | 772 |

| Total | 2,510 | 2,778 | 828 | 4,612 | 1,338 | 1,047 | 1,822 |

| Service costs | 305 | 663 | 663 | 663 | 305 | 663 | — |

| Total remuneration | 2,815 | 3,441 | 1,491 | 5,275 | 1,643 | 1,710 | 1,822 |

| H. Matschi (Board member for Interior; Board member since August 12, 2009) | |||||||

|---|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | ||||||

| € thousands | 2016 | 2017 | 2017 (min.) | 2017 (max.) | 2016 | 2017 | |

| Payment in 2017 | Payment in 2018 | ||||||

| Fixed remuneration | 800 | 800 | 800 | 800 | 800 | 800 | — |

| Additional benefits | 47 | 8 | 8 | 8 | 47 | 8 | — |

| Total | 847 | 808 | 808 | 808 | 847 | 808 | — |

| Performance bonus (immediate payment) | 660 | 700 | 0 | 1,050 | 282 | — | 905 |

| Multiannual variable remuneration | 990 | 1,250 | 0 | 2,734 | 844 | 1,643 | 772 |

| Performance bonus (deferral) [3 years] | 440 | 467 | 0 | 1,168 | 844 | 990 | — |

| Long-term incentive [4 years] until 2013 | — | — | — | — | — | 653 | — |

| Long-term incentive [4 years] from 2014 | 550 | 783 | 0 | 1,566 | — | — | 772 |

| Total | 2,497 | 2,758 | 808 | 4,592 | 1,973 | 2,451 | 1,677 |

| Service costs | 277 | 731 | 731 | 731 | 277 | 731 | — |

| Total remuneration | 2,774 | 3,489 | 1,539 | 5,323 | 2,250 | 3,182 | 1,677 |

| Dr. A. Reinhart (Board member for Human Relations; Board member since October 1, 2014) | |||||||

|---|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | ||||||

| € thousands | 2016 | 2017 | 2017 (min.) | 2017 (max.) | 2016 | 2017 | |

| Payment in 2017 | Payment in 2018 | ||||||

| Fixed remuneration | 800 | 800 | 800 | 800 | 800 | 800 | — |

| Additional benefits | 37 | 6 | 6 | 6 | 37 | 6 | — |

| Total | 837 | 806 | 806 | 806 | 837 | 806 | — |

| Performance bonus (immediate payment) | 660 | 700 | 0 | 1,050 | 740 | — | 979 |

| Multiannual variable remuneration | 990 | 1,250 | 0 | 2,734 | — | — | — |

| Performance bonus (deferral) [3 years] | 440 | 467 | 0 | 1,168 | — | — | — |

| Long-term incentive [4 years] until 2013 | — | — | — | — | — | — | — |

| Long-term incentive [4 years] from 2014 | 550 | 783 | 0 | 1,566 | — | — | — |

| Total | 2,487 | 2,756 | 806 | 4,590 | 1,577 | 806 | 979 |

| Service costs | 473 | 861 | 861 | 861 | 473 | 861 | — |

| Total remuneration | 2,960 | 3,617 | 1,667 | 5,451 | 2,050 | 1,667 | 979 |

| W. Schäfer (Board member for Finance; Board member since January 1, 2010) | |||||||

|---|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | ||||||

| € thousands | 2016 | 2017 | 2017 (min.) | 2017 (max.) | 2016 | 2017 | |

| Payment in 2017 | Payment in 2018 | ||||||

| Fixed remuneration | 1,100 | 1,100 | 1,100 | 1,100 | 1,100 | 1,100 | — |

| Additional benefits | 44 | 9 | 9 | 9 | 44 | 9 | — |

| Total | 1,144 | 1,109 | 1,109 | 1,109 | 1,144 | 1,109 | — |

| Performance bonus (immediate payment) | 660 | 700 | 0 | 1,050 | 740 | — | 979 |

| Multiannual variable remuneration | 1,090 | 1,360 | 0 | 2,954 | 1,715 | 1,756 | 912 |

| Performance bonus (deferral) [3 years] | 440 | 467 | 0 | 1,168 | 1,715 | 972 | — |

| Long-term incentive [4 years] until 2013 | — | — | — | — | — | 784 | — |

| Long-term incentive [4 years] from 2014 | 650 | 893 | 0 | 1,786 | — | — | 912 |

| Total | 2,894 | 3,169 | 1,109 | 5,113 | 3,599 | 2,865 | 1,891 |

| Service costs | 526 | 783 | 783 | 783 | 526 | 783 | — |

| Total remuneration | 3,420 | 3,952 | 1,892 | 5,896 | 4,125 | 3,648 | 1,891 |

| N. Setzer (Board member for Tires; Board member since August 12, 2009) | |||||||

|---|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | ||||||

| € thousands | 2016 | 2017 | 2017 (min.) | 2017 (max.) | 2016 | 2017 | |

| Payment in 2017 | Payment in 2018 | ||||||

| Fixed remuneration | 800 | 800 | 800 | 800 | 800 | 800 | — |

| Additional benefits | 81 | 18 | 18 | 18 | 81 | 18 | — |

| Total | 881 | 818 | 818 | 818 | 881 | 818 | — |

| Performance bonus (immediate payment) | 660 | 700 | 0 | 1,050 | 885 | — | 632 |

| Multiannual variable remuneration | 990 | 1,250 | 0 | 2,734 | 1,585 | 1,522 | 772 |

| Performance bonus (deferral) [3 years] | 440 | 467 | 0 | 1,168 | 1,585 | 869 | — |

| Long-term incentive [4 years] until 2013 | — | — | — | — | — | 653 | — |

| Long-term incentive [4 years] from 2014 | 550 | 783 | 0 | 1,566 | — | — | 772 |

| Total | 2,531 | 2,768 | 818 | 4,602 | 3,351 | 2,340 | 1,404 |

| Service costs | 735 | 966 | 966 | 966 | 735 | 966 | — |

| Total remuneration | 3,266 | 3,734 | 1,784 | 5,568 | 4,086 | 3,306 | 1,404 |

| H.-G. Wente (Board member for ContiTech; Board member from May 3, 2007 to April 30, 2015) | |||||||

|---|---|---|---|---|---|---|---|

| Remuneration granted | Inflows | ||||||

| € thousands | 2016 | 2017 | 2017 (min.) | 2017 (max.) | 2016 | 2017 | |

| Payment in 2017 | Payment in 2018 | ||||||

| Fixed remuneration | — | — | — | — | — | — | — |

| Additional benefits | — | — | — | — | — | — | — |

| Total | — | — | — | — | — | — | — |

| Performance bonus (immediate payment) | — | — | — | — | — | — | — |

| Multiannual variable remuneration | — | — | — | — | 1,438 | 1,125 | 256 |

| Performance bonus (deferral) [3 years] | — | — | — | — | 1,438 | 822 | — |

| Long-term incentive [4 years] until 2013 | — | — | — | — | — | 303 | — |

| Long-term incentive [4 years] from 2014 | — | — | — | — | — | — | 256 |

| Total | — | — | — | — | 1,438 | 1,125 | 256 |

| Service costs | — | — | — | — | — | — | — |

| Total remuneration | — | — | — | — | 1,438 | 1,125 | 256 |

Heinz-Gerhard Wente, who retired on April 30, 2015, was paid commitments of €303 thousand from the 2013 long-term incentive plan in 2017.

The disclosures on benefits granted and inflows are broken down into fixed and variable remuneration components and supplemented by disclosures on the service costs. The fixed remuneration components include the non-performance-related fixed remuneration and additional benefits. The variable performance-related remuneration components consist of the immediate payment from the performance bonus as a short-term remuneration component and the two long-term components: the deferral of the performance bonus and the LTI.

The immediate payment, the deferral (taking into account the reference tables as recommended in Section 4.2.5, para. 3 of the German Corporate Governance Code), and the LTI are each recognized as remuneration granted at the value of the commitment at the time it is granted (equivalent to 100% target achievement). The remuneration elements are supplemented by disclosures on individually attainable maximum and minimum remuneration.

The inflow recognized in the year under review comprises the fixed remuneration components actually received plus the amounts of the immediate payment to be received in the following year that had been determined at the time the remuneration report was prepared. Disclosures on the two long-term components – the deferral and the 2013/17 LTI tranche – relate to actual payments in the year under review. Inflows from multiannual variable remuneration that was scheduled to end in the period under review, but would not be paid until the following year, apply to the LTI tranche for 2014/17 in the reporting year. In line with the recommendations of Section 4.2.5 para. 3 of the German Corporate Governance Code, service costs in the disclosures on inflows correspond to the amounts granted, although they do not represent actual inflows in a stricter sense.

In fiscal 2017, the members of the Executive Board neither received nor were promised payments by a third party with respect to their activities on the Executive Board.

| Remuneration of the Executive Board in 2017 | |||||

|---|---|---|---|---|---|

| Remuneration components | |||||

| € thousands | Fixed1 | Variable, short-term | Variable, long-term 2 | Total | Share-based payment 3 |

| 1,463 | 2,098 | 4,387 | 7,948 | 4,979 | |

| J. A. Avila | 819 | 1,050 | 2,136 | 4,005 | 2,433 |

| Dr. R. Cramer (until August 11, 2017) | 747 | 599 | 1,172 | 2,518 | 735 |

| H.-J. Duensing | 821 | 828 | 1,440 | 3,089 | 1,951 |

| F. Jourdan | 828 | 1,050 | 1,614 | 3,492 | 2,441 |

| H. Matschi | 808 | 905 | 2,039 | 3,752 | 2,392 |

| Dr. A. Reinhart | 806 | 979 | 1,436 | 3,221 | 2,158 |

| W. Schäfer | 1,109 | 979 | 2,330 | 4,418 | 2,707 |

| N. Setzer | 818 | 632 | 1,857 | 3,307 | 2,262 |

| Total | 8,219 | 9,120 | 18,411 | 35,750 | 22,058 |

1 In addition to cash components, the fixed remuneration includes non-cash elements, such as benefits relating to international assignments and in particular any related taxes paid, company cars and insurance.

2 Long-term component of the variable remuneration that is converted into virtual shares of Continental AG to ensure a focus on sustainable development of the company, the granting of the 2017 long-term incentive plan, and the payment of the 2013 long-term incentive plan.

3 Long-term component of the variable remuneration that is converted into virtual shares of Continental AG to ensure a focus on sustainable development of the company, the granting of the 2017 long-term incentive plan, as well as the changes in the value of the virtual shares granted in previous years and in the value of the 2014 to 2017 long-term incentive plans.

| Remuneration of the Executive Board in 2016 | |||||

|---|---|---|---|---|---|

| Remuneration components | |||||

| € thousands | Fixed1 | Variable, short-term | Variable, long-term 2 | Total | Share-based payment 3 |

| 1,452 | 1,245 | 2,030 | 4,727 | 550 | |

| J. A. Avila | 849 | 641 | 977 | 2,467 | 288 |

| Dr. R. Cramer | 1,275 | 740 | 1,044 | 3,059 | 367 |

| H.-J. Duensing | 854 | 965 | 1,192 | 3,011 | 953 |

| F. Jourdan | 860 | 303 | 752 | 1,915 | 294 |

| H. Matschi | 847 | 282 | 738 | 1,867 | -13 |

| Dr. A. Reinhart | 837 | 740 | 1,044 | 2,621 | 795 |

| W. Schäfer | 1,144 | 740 | 1,144 | 3,028 | 200 |

| N. Setzer | 881 | 885 | 1,140 | 2,906 | 298 |

| Total | 8,999 | 6,541 | 10,061 | 25,601 | 3,732 |

1 In addition to cash components, the fixed remuneration includes non-cash elements, such as benefits relating to international assignments and in particular any related taxes paid, company cars and insurance.

2 Long-term component of the variable remuneration that is converted into virtual shares of Continental AG to ensure a focus on sustainable development of the company and benefits granted under the 2016 long-term incentive plan.

3 Long-term component of the variable remuneration that is converted into virtual shares of Continental AG to ensure a focus on sustainable development of the company, the granting of the 2016 long-term incentive plan, as well as the changes in the value of the virtual shares granted in previous years and in the value of the 2014 to 2016 long-term incentive plans.

The amounts of variable remuneration converted into virtual shares of Continental AG for members of the Executive Board changed as follows:

| units | Number of shares as at Dec. 31, 2015 | Payment | Commitments | Number of shares as at Dec. 31, 2016 | Payment | Commitments | Number of shares as at Dec. 31, 2017 |

| 21,813 | -11,169 | 5,836 | 16,480 | -6,123 | 4,252 | 14,609 | |

| J. A. Avila | 10,204 | -4,801 | 3,471 | 8,874 | -4,794 | 2,188 | 6,268 |

| Dr. R. Cramer (until August 11, 2017) | 9,818 | -4,226 | 3,471 | 9,063 | -2,904 | 2,528 | 8,687 |

| H.-J. Duensing (since May 1, 2015) | — | — | 465 | 465 | — | 3,293 | 3,758 |

| F. Jourdan | 3,328 | — | 3,471 | 6,799 | -427 | 1,036 | 7,408 |

| H. Matschi | 11,820 | -4,231 | 3,471 | 11,060 | -4,794 | 963 | 7,229 |

| Dr. A. Reinhart | 677 | — | 3,471 | 4,148 | — | 2,528 | 6,676 |

| W. Schäfer | 15,990 | -8,592 | 3,471 | 10,869 | -4,710 | 2,528 | 8,687 |

| N. Setzer | 14,788 | -7,937 | 3,316 | 10,167 | -4,208 | 3,023 | 8,982 |

| E. Strathmann (until April 25, 2014) | 11,971 | -7,732 | — | 4,239 | -4,239 | — | — |

| H.-G. Wente (until April 30, 2015) | 12,858 | -6,875 | 228 | 6,211 | -3,981 | — | 2,230 |

| Total | 113,267 | -55,563 | 30,671 | 88,375 | -36,180 | 22,339 | 74,534 |

| € thousands | Fair value as at Dec. 31, 2015 | Fair value of distribution | Change in fair value | Fair value of commitments | Fair value as at Dec. 31, 2016 | Fair value of distribution | Change in fair value | Fair value of commitments | Fair value as at Dec. 31, 2017 |

| 5,032 | -2,230 | -751 | 1,100 | 3,151 | -1,264 | 545 | 976 | 3,408 | |

| J. A. Avila | 2,356 | -958 | -354 | 655 | 1,699 | -990 | 245 | 502 | 1,456 |

| Dr. R. Cramer (until August 11, 2017) | 2,262 | -844 | -342 | 655 | 1,731 | -599 | 314 | 581 | 2,027 |

| H.-J. Duensing (since May 1, 2015) | — | — | — | 88 | 88 | — | 21 | 756 | 865 |

| F. Jourdan | 760 | — | -123 | 655 | 1,292 | -88 | 292 | 237 | 1,733 |

| H. Matschi | 2,723 | -845 | -416 | 655 | 2,117 | -990 | 344 | 221 | 1,692 |

| Dr. A. Reinhart | 155 | — | -25 | 655 | 785 | — | 186 | 581 | 1,552 |

| W. Schäfer | 3,690 | -1,715 | -548 | 655 | 2,082 | -972 | 338 | 581 | 2,029 |

| N. Setzer | 3,412 | -1,585 | -507 | 625 | 1,945 | -869 | 322 | 694 | 2,092 |

| E. Strathmann (until April 25, 2014) | 2,767 | -1,544 | -403 | — | 820 | -875 | 55 | — | — |

| H.-G. Wente (until April 30, 2015) | 2,966 | -1,373 | -440 | 43 | 1,196 | -822 | 152 | — | 526 |

| Total | 26,123 | -11,094 | -3,909 | 5,786 | 16,906 | -7,469 | 2,814 | 5,129 | 17,380 |

Heinz-Gerhard Wente, who retired on April 30, 2015, was paid commitments of €0.8 million (equivalent to 3,981 units) in 2017. As at December 31, 2017, there were commitments with a fair value of €0.5 million (equivalent to 2,230 units). Elke Strathmann, whose appointment as member of the Executive Board and employment contract ended as at April 25, 2014, was paid €0.9 million (equivalent to 4,239 units). There were no more commitments as at December 31, 2017.

Owing to the individual arrangements specific to the company, there are certain features of the virtual shares as compared to standard options that must be taken into account in their measurement.

A Monte Carlo simulation is used in the measurement of stock options. This means that log-normal distributed processes are simulated for the price of Continental shares. The measurement model also takes into account the average value accumulation of share prices in the respective reference period, the dividends paid, and the floor and cap for the distribution amount.

The following parameters for the performance bonus were used as at the measurement date of December 31, 2017:

- Constant zero rates as at the measurement date of December 31, 2017:

2014 tranche: -0.82% as at the due date and as at the expected payment date;

2015 tranche: -0.72% as at the due date and as at the expected payment date;

2016 tranche: -0.61% as at the due date and as at the expected payment date. - Interest rate based on the yield curve for government bonds.

- Dividend payments as the arithmetic mean based on publicly available estimates for 2018 and 2019; the paid dividend of Continental AG amounted to €4.25 per share in 2017, and Continental AG distributed a dividend of €3.75 per share in 2016.

- Historic volatilities on the basis of daily XETRA closing rates for Continental shares based on the respective remaining term for virtual shares. The volatility for the 2014 tranche is 13.39%, for the 2015 tranche 17.57%, and for the 2016 tranche 24.21%.

Share-based payment – long-term incentive (LTI plans starting with 2015)

The LTI plans starting with 2015 developed as follows:

| € thousands | Fair value as at Dec. 31, 2015 | Commitment LTI Plan 2016 | Change in fair value | Fair value as at Dec. 31, 2016 | Commitment LTI Plan 2017 | Change in fair value | Fair value as at Dec. 31, 2017 1 |

| Dr. E. Degenhart | 3,098 | 1,200 | -720 | 3,578 | 1,550 | 1,339 | 6,467 |

| J. A. Avila | 1,420 | 550 | -330 | 1,640 | 783 | 630 | 3,053 |

| Dr. R. Cramer (until August 11, 2017)2 | 1,420 | 550 | -330 | 1,640 | 120 | -184 | 1,576 |

| H.-J. Duensing (since May 1, 2015) | 826 | 550 | -238 | 1,138 | 783 | 482 | 2,403 |

| F. Jourdan | 1,420 | 550 | -330 | 1,640 | 783 | 630 | 3,053 |

| H. Matschi | 1,420 | 550 | -330 | 1,640 | 783 | 630 | 3,053 |

| Dr. A. Reinhart | 695 | 550 | -219 | 1,026 | 783 | 449 | 2,258 |

| W. Schäfer | 1,678 | 650 | -390 | 1,938 | 893 | 737 | 3,568 |

| N. Setzer | 1,420 | 550 | -330 | 1,640 | 783 | 630 | 3,053 |

| H.-G. Wente (until April 30, 2015) | 299 | — | -48 | 251 | — | 74 | 325 |

| Total | 13,696 | 5,700 | -3,265 | 16,131 | 7,261 | 5,417 | 28,809 |

1 As at the end of the reporting period, the 2017 tranche was vested at 25%, the 2016 tranche at 50%, the 2015 tranche at 75%. The 2014 tranche was vested at 100%.

2 With the departure of Dr. R. Cramer from the company as at August 11, 2017, a portion of the commitments of the 2014, 2015 and 2016 LTI plans expired. The commitment in 2014 of €550 thousand decreased to €497 thousand, resulting in a fair value of €717 thousand as at December 31, 2017, down by €77 thousand. The commitment in 2015 of €550 thousand decreased to €359 thousand, resulting in a fair value of €490 thousand as at December 31, 2017, down by €260 thousand. The commitment in 2016 of €550 thousand decreased to €222 thousand, resulting in a fair value of €222 thousand as at December 31, 2017, down by €327 thousand. As part of the 2017 LTI plan, a partial commitment of €120 thousand remains for Dr. R. Cramer, with a fair value of €147 thousand as at the measurement date.

A Monte Carlo simulation is used in the measurement of the TSR target criterion. This means that log-normal distributed processes are simulated for the price of Continental shares. The Monte Carlo simulation takes into account the average value accumulation of share prices in the respective reference period, the TSR dividends paid, and the restriction for the distribution amount.

The following parameters for the TSR were used as at the measurement date of December 31, 2017:

- Constant zero rates as at the measurement date of December 31, 2017:

2014 LTI plan: -0.86% as at the due date and -0.79% as at the expected payment date;

2015 LTI plan: -0.74% as at the due date and -0.69% as at the expected payment date;

2016 LTI plan: -0.65% as at the due date and -0.57% as at the expected payment date;

2017 LTI plan: -0.51% as at the due date; and -0.41% as at the expected payment date. - Interest rate based on the yield curve for government bonds.

- Dividend payments as the arithmetic mean based on publicly available estimates for the years 2018 to 2020; the paid dividend of Continental AG amounted to €4.25 per share in 2017.

- Historic volatilities on the basis of daily XETRA closing rates for Continental shares based on the respective remaining term for virtual shares. The volatility for the 2014 LTI plan is 9.69%, for the 2015 LTI plan 16.30%, for the 2016 LTI plan 23.40% and for the 2017 LTI plan 25.91%.

Expenses for retirement benefits

The defined benefit obligations for all pension commitments for the active members of the Executive Board in 2017 are presented below:

| Defined benefit obligations | ||

| € thousands | Dec. 31, 2017 | Dec. 31, 2016 |

| Dr. E. Degenhart | 11,718 | 10,535 |

| J. A. Avila | 8,076 | 7,145 |

| Dr. R. Cramer (until August 11, 2017) | 4,024 | 3,661 |

| H.-J. Duensing | 1,778 | 1,094 |

| F. Jourdan | 2,990 | 2,297 |

| H. Matschi | 5,495 | 4,913 |

| Dr. A. Reinhart | 2,884 | 2,041 |

| W. Schäfer | 9,634 | 8,925 |

| N. Setzer | 4,836 | 4,165 |

| Total | 51,435 | 44,776 |

We refer to Note 37 of the Notes to the Consolidated Financial Statements for details of pension obligations for former members of the Executive Board.

Remuneration of the Supervisory Board

Article 16 of the Articles of Incorporation regulates the remuneration paid to members of the Supervisory Board. It likewise has a fixed and – as the Supervisory Board is directly involved in decisions of fundamental and long-term importance to the corporation – a variable component. By way of connection with earnings per share (as reported in the consolidated financial statements for the respective fiscal year), the variable component is aligned with the sustainable development of the company. The chairman and vice chairman of the Supervisory Board and the chairs and members of committees qualify for higher remuneration.

In addition to their remuneration, the members of the Supervisory Board are also paid attendance fees and their expenses are reimbursed. The D&O insurance policy also covers members of the Supervisory Board. As recommended by the German Corporate Governance Code, their deductible also complies with the requirements of Section 93 (2) Sentence 3 AktG that apply directly to the Executive Board only.

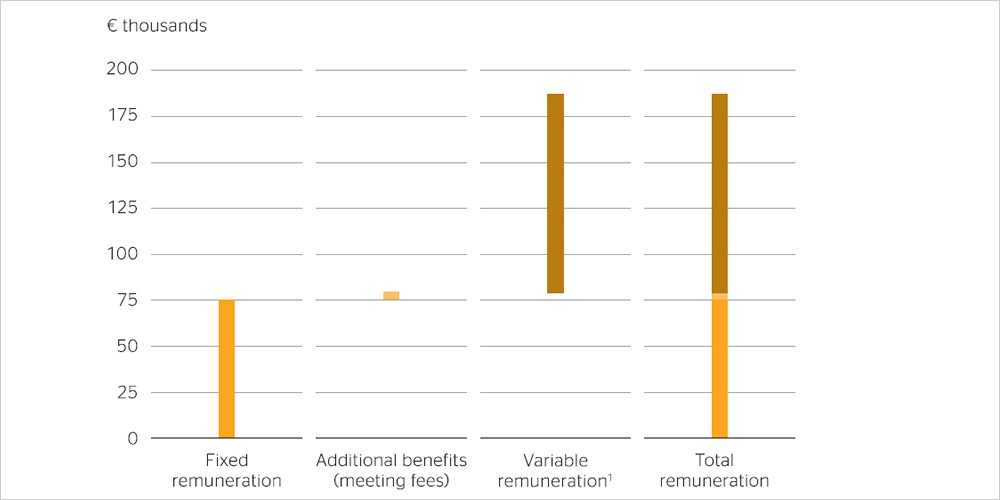

The chart illustrates the composition of the Supervisory Board member remuneration, not including the higher remuneration for the chairman, the vice chairman and committee members.

In the reporting year, there were no consultant agreements or other service or work agreements between the company and members of the Supervisory Board or related parties.

The remuneration of individual Supervisory Board members in 2017 as provided for under these arrangements is shown in the following table.

| Remuneration of the Supervisory Board | ||||

|---|---|---|---|---|

| Remuneration components | ||||

| 2017 | 2016 | |||

| € thousands | Fixed1 | Variable | Fixed1 | Variable |

| Prof. Dr.-Ing. Wolfgang Reitzle | 237 | 329 | 232 | 301 |

| Hartmut Meine2 | 123 | 164 | 119 | 151 |

| Dr. Gunter Dunkel | 82 | 110 | 81 | 101 |

| Hans Fischl (until Dec. 31, 2016)2 | — | — | 81 | 101 |

| Prof. Dr. Peter Gutzmer | 82 | 110 | 79 | 101 |

| Peter Hausmann2 | 121 | 164 | 121 | 151 |

| Michael Iglhaut2 | 123 | 164 | 92 | 113 |

| Prof. Dr. Klaus Mangold | 82 | 110 | 80 | 101 |

| Sabine Neuß | 82 | 110 | 81 | 101 |

| Prof. Dr. Rolf Nonnenmacher | 197 | 275 | 198 | 251 |

| Dirk Nordmann2 | 123 | 164 | 122 | 151 |

| Klaus Rosenfeld | 123 | 164 | 121 | 151 |

| Georg F. W. Schaeffler | 126 | 164 | 124 | 151 |

| Maria-Elisabeth Schaeffler-Thumann | 80 | 110 | 79 | 101 |

| Jörg Schönfelder2 | 123 | 164 | 120 | 151 |

| Stefan Scholz2 | 82 | 110 | 81 | 101 |

| Gudrun Valten (since Jan. 1, 2017)2 | 82 | 110 | — | — |

| Kirsten Vörkel2 | 82 | 110 | 81 | 101 |

| Elke Volkmann2 | 82 | 110 | 78 | 101 |

| Erwin Wörle2 | 82 | 110 | 111 | 136 |

| Prof. KR Ing. Siegfried Wolf | 80 | 110 | 80 | 101 |

| Total | 2,194 | 2,962 | 2,161 | 2,717 |

1 Including meeting-attendance fees.

2 In accordance with the guidelines issued by the German Federation of Trade Unions, these employee representatives have declared that their board remuneration is transferred to the Hans Böckler Foundation and in one case to other institutions as well.