Various raw materials such as steel, aluminum, copper, precious metals and plastics are key input materials for a wide range of different electronic, electromechanical and mechanical components. We need these components, in turn, in order to manufacture our products and systems for the automotive industry. Consequently, developments in the prices of raw materials usually influence Continental’s production costs indirectly, in most cases, via changes in costs at our suppliers. Depending on the contractual arrangement, these cost changes are either passed on to us after a certain amount of time or redefined in upcoming contract negotiations.

In the reporting year, global economic growth resulted in increasing demand for raw materials. After the sharp rise in the prices of many raw materials in the fourth quarter of 2016, prices initially consolidated year-on-year before mostly increasing palpably again in the second half of 2017, especially among metals.

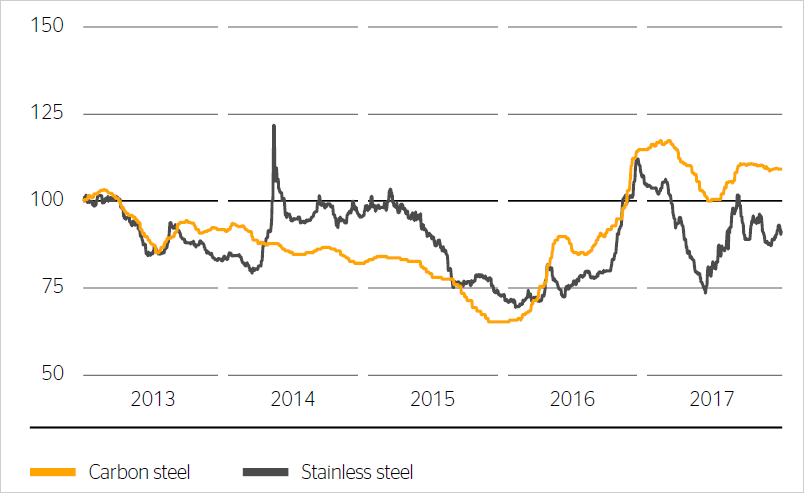

Carbon steel and stainless steel are input materials for many of the mechanical components such as stamped, turned, drawn and diecast parts integrated by Continental into its products. Average prices for carbon steel increased in Europe by around 30% compared to the previous year’s average. This was due firstly to the growing demand for steel and secondly to the development of global market prices for the primary products iron ore and coking coal. Although these abated again after the sharp rise at the beginning of the year and in the fourth quarter of the previous year, they stabilized at a much higher level than their respective averages in the previous year.

The base price for stainless steel in Europe was relatively stable in 2017 with an increase of around 2%. In contrast, the average alloy surcharges for the year rose by more than 30% year-on-year in 2017. Chrome in particular became over 40% more expensive as an annual average, while the average price increase for nickel was relatively limited at 6%. Overall, average prices for stainless steel in Europe increased by around 15% year-on-year in 2017.

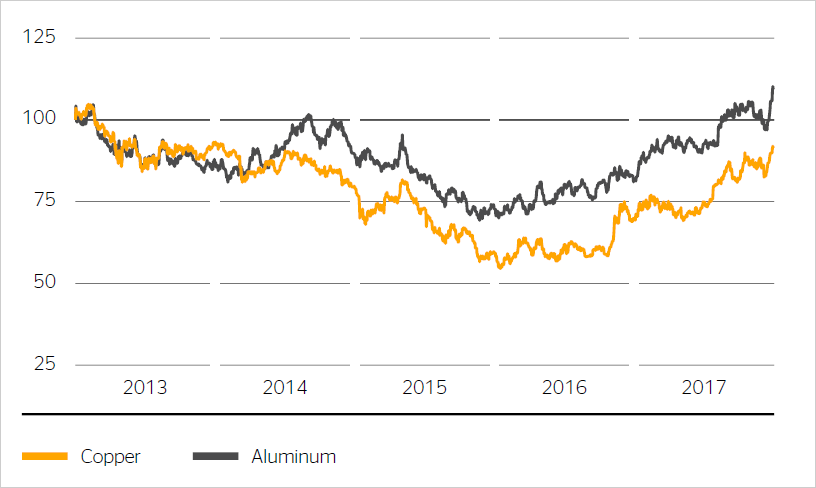

Aluminum is used by Continental primarily for die-cast parts and stamped and bent components, while copper is used in particular for electric motors and mechatronic components. The price of aluminum rose sharply in 2017, with the annual average increasing by 23% on a U.S. dollar basis and 20% on a euro basis year-on-year. The price of copper also rose palpably in the second half of 2017, with the annual average increasing by 27% on a U.S. dollar basis and 24% on a euro basis.

We and our suppliers use precious metals such as gold, silver, platinum and palladium to coat a wide range of components. Prices for gold, silver and platinum in 2017 remained at the average level of the previous year on a U.S. dollar basis, while they got slightly cheaper on a euro basis due to the appreciation of the euro over the course of the year. In contrast, the continued rise in demand for palladium, which is used primarily for catalytic converters, caused a rapid price increase. The average price per troy ounce for the year increased by 42% year-on year on a U.S. dollar basis, by 38% on a euro basis.

Both we and our suppliers require various plastic granulates, known as resins, as technical thermoplastics primarily for manufacturing housing components. The recovery in prices for plastic granulates begun in the second half of the previous year continued very dynamically in the year under review. This was due to growing demand and the increase in the price of oil throughout the year, coupled with scarce supply. Average prices increased by over 30% year-on-year both on a U.S. dollar basis and on a euro basis.

Continental uses various types of natural rubber and synthetic rubber for the production of tires and industrial rubber products in the Rubber Group. It also uses relatively large quantities of carbon black as a filler material and of steel cord and nylon cord as structural materials. Due to the large quantities and direct purchasing of raw materials, their price development, especially that of rubber, has a significant influence on the earnings of the Rubber Group, particularly the Tire division.

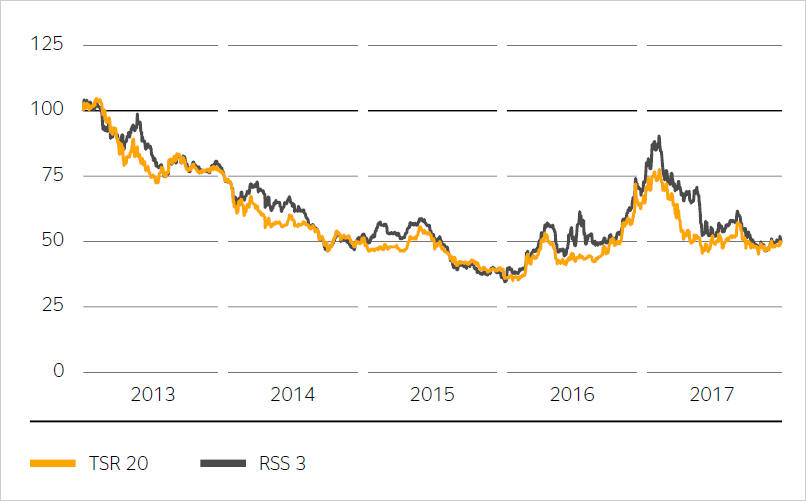

After prices for natural rubber at the end of January 2017 had more than doubled since the seven-year low at the start of the previous year due to the weather-related supply shortage, they dropped significantly again, starting in mid-February 2017. This trend persisted until the end of the first half of the year. In the second half of the year, natural rubber prices stabilized at the average level of the previous year due to the further increase in demand. Overall, the average price of the natural rubber TSR 20 for the year increased by 20% on a U.S. dollar basis and 18% on a euro basis. The average price of ribbed smoked sheets (RSS) for the year increased by 22% on a U.S. dollar basis and 20% on a euro basis.

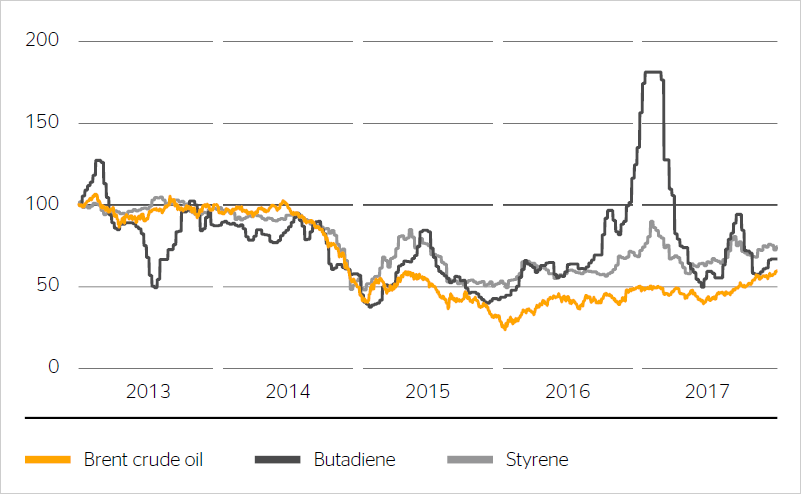

The average price of butadiene, the main input material for synthetic rubber, for the year increased by over 30% year-on-year both on a U.S. dollar basis and on a euro basis in 2017. The scarcity-related soaring price increase that began in the fourth quarter of the previous year peaked in February 2017. Subsequently, the increase in supply and falling prices for natural rubber and crude oil divided the price of butadiene by three by the end of the first half of the year. In the second half of the year, it then stabilized again above the average price level of the previous year.

Other input materials for synthetic rubber mostly developed similarly to butadiene in 2017, but with lower volatility. For example, the average price of styrene for the year increased by 18% on a U.S. dollar basis and 16% on a euro basis.

Overall, the described price increases for the various raw materials led to considerable costs for Continental in 2017, which were passed on to customers via price adjustments only in part and with a delay. The Rubber Group was particularly affected by this in the year under review.