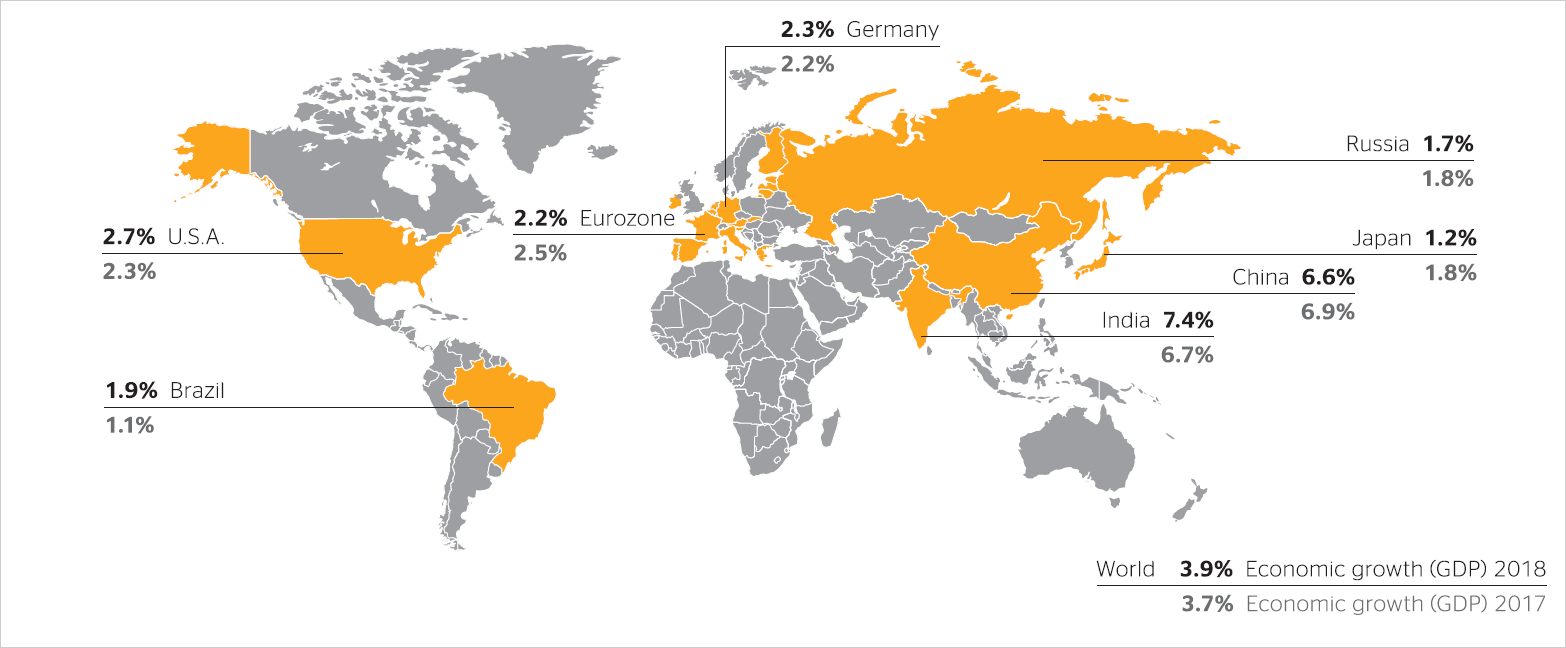

In its January 2018 World Economic Outlook Update, the International Monetary Fund (IMF) predicts that growth in Germany and the eurozone will continue in the current fiscal year, due in particular to consistently good domestic demand. By contrast, the appreciation of the euro is likely to dampen exports and foreign trade. For 2018, the IMF is now projecting that the gross domestic product (GDP) of Germany and the eurozone will grow by 2.3% and 2.2% respectively.

For the U.S.A., the IMF expects a significant increase in GDP growth to 2.7% this year. Here, the tax cuts enacted for companies are likely to result in greater investing activity and a revival in domestic demand. Above all, economic activity could be curbed in 2018 by further interest rate hikes by the U.S. Federal Reserve (Fed) and a higher trade deficit due to increasing imports.

The IMF expects moderate growth of 1.2% for Japan in 2018. The main reason for the lower growth compared to 2017 is an anticipated smaller increase in the trade surplus. Low interest rates, which are boosting private investment, and increasing consumer and public spending continue to have a positive effect.

According to the IMF, emerging and developing economies will record GDP growth of 4.9% in 2018. The increase in growth is mainly being driven by India, whose economy is likely to gain momentum again after the extensive reforms of recent years. The IMF expects growth of 7.4% for India in 2018. The economic recovery in Brazil is also expected to continue this year, with the IMF expecting GDP to increase by 1.9% in 2018. In contrast, it expects growth to decline slightly in China and Russia. The IMF forecasts GDP growth of 6.6% for China and 1.7% for Russia in 2018.

Based upon these estimates, the IMF expects global economic growth to increase by 0.2 percentage points year-on-year to 3.9% in 2018.

However, the IMF points out that the acceleration of growth is mostly based on short-term factors. The IMF sees risks including a rise in inflation, which would require many central banks to tighten their expansionary monetary policy. Against the backdrop of increased national and corporate debt and in view of the high valuations on many capital markets, this could have considerable negative consequences. The IMF also continues to see risks in tendencies to put up barriers to trade and in geopolitical tensions between individual countries. At the same time, it points to ongoing structural problems and growing income inequality in some economies and urges appropriate reforms.

In 2018, the IMF primarily sees opportunities – given the favorable financing conditions and positive economic prospects at present – in a greater-than-expected increase in businesses’ investing activities.