Forecast process

Continental reports its expectations regarding the development of the important production and sales markets already in January of the current fiscal year. This forms the basis of our forecast for the corporation’s key performance indicators, which we publish at the same time. These include sales and the adjusted EBIT margin for the corporation. In addition, we provide information on the assessment of important factors influencing EBIT. These include the expected negative or positive effect of the estimated development of raw materials prices for the current year, the expected development of special effects and the amount of amortization from purchase price allocation. We thus allow investors, analysts, and other interested parties to estimate the corporation’s EBIT. Furthermore, we publish an assessment of the development of interest income and expenses as well as the tax rate for the corporation, which in turn allows the corporation’s net income to be estimated. We also publish a forecast of the capital expenditures planned for the current year and the free cash flow before acquisitions. In February of the current fiscal year, we supplement this forecast for the corporation with a forecast of the sales and adjusted EBIT margins of the two core business areas: the Automotive Group and the Rubber Group. We then publish this forecast in March as part of our annual financial press conference and our annual report for the previous year. The forecast for the current year is reviewed continually. Possible changes to the forecast are described at the latest in the financial report for the respective quarter. At the start of the subsequent year, i.e. when the annual report for the previous year is prepared, a comparison is made with the forecast published in the annual report for the year before.

In 2015, Continental compiled a medium-term forecast in addition to the targets for the current year. This comprises the corporate strategy, the incoming orders in the Automotive Group and the medium-term targets of the Rubber Group. Accordingly, we want to generate sales of more than €50 billion and a return on capital employed (ROCE) of at least 20% in 2020. These medium-term targets were confirmed again after the review in 2017.

Comparison of the past fiscal year against forecast

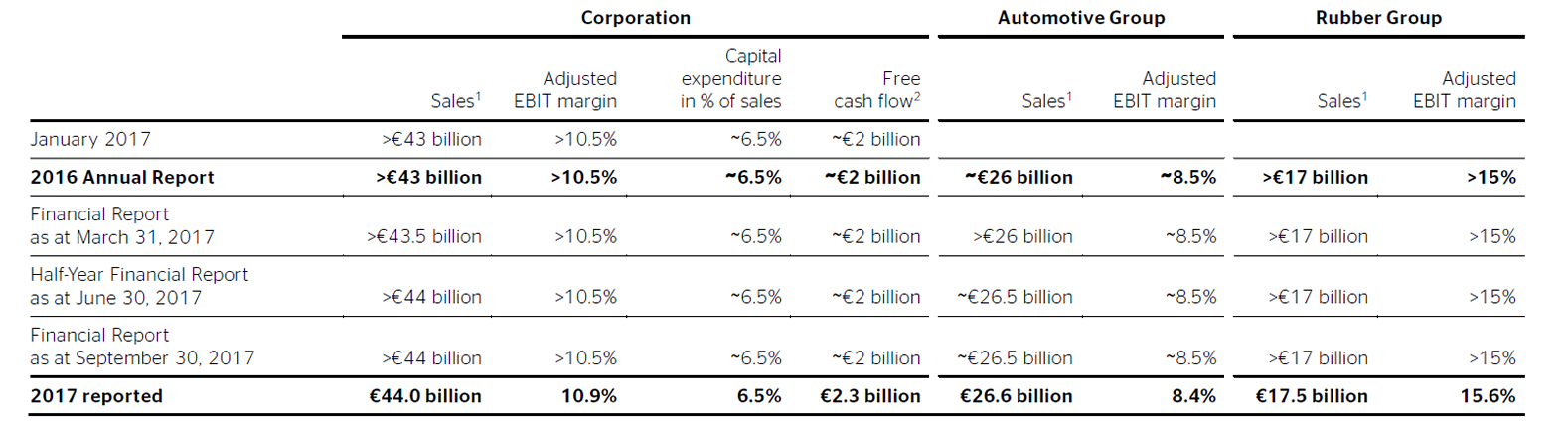

We achieved all and even significantly exceeded some aspects of the forecast compiled in February 2017.

On the basis of the good business development, the forecast for consolidated sales was raised in the first-quarter reporting in May 2017 and the reporting on the first half of the year in August 2017. With consolidated sales of €44.0 billion, the original forecast was exceeded by more than €1 billion.

The forecast for the corporation’s adjusted EBIT margin of more than 10.5% was maintained over the entire forecast period. It was 10.9% at the end of the reporting year and thus considerably higher than the forecast target value.

The sales forecast for the Automotive Group was likewise revised upward twice over the course of the reporting year, first in the first-quarter reporting in May 2017 and then again in the reporting on the first half of the year in August 2017. At €26.6 billion, the Automotive Group’s sales were considerably higher than the original forecast of around €26 billion. This was due to the better-than-expected volume development in all divisions of the Automotive Group.

The forecast for the Automotive Group’s adjusted EBIT margin was maintained over the entire forecast period. At 8.4%, it was in line with the forecast of approximately 8.5%.

Comparison of fiscal 2017 against forecast

1 Assuming exchange rates remain constant year-on-year. The negative exchange-rate effects for the corporation amounted to €435 million in 2017. Around two-thirds of this was attributable to the Automotive Group, around one-third to the Rubber Group.

2 Before acquisitions.

The sales forecast of more than €17 billion for the Rubber Group was maintained at all times during the reporting year. With sales of €17.5 billion, the original forecast was exceeded. This was due firstly to the earlier-than-expected first-time consolidation of the Hornschuch Group and secondly to the good volume development in the Tire and ContiTech divisions.

The forecast for the Rubber Group’s adjusted EBIT margin was maintained over the forecast period. At 15.6%, it was ultimately above the original forecast of more than 15%.

The negative financial result increased in the reporting year despite the good development of free cash flow. This was due to effects from currency translation, as well as effects from changes in the fair value of derivative instruments, and other valuation effects. Altogether, these had a negative impact of €98.6 million (PY: positive impact of €90.4 million) on the reported financial result in 2017. Adjusted for these effects, the negative financial result of €187.1 million was in line with the forecast we compiled at the start of the year of around €200 million assuming constant exchange rates. The tax rate of 28.7% was slightly below our forecast of less than 30%.

As in the previous year, the free cash flow before acquisitions was €2.3 billion despite the slightly increased capital expenditure ratio and the partial outflows for the provisions for warranty cases in the Automotive Group recognized in 2016.

Order situation

The Automotive Group continued to experience a positive trend in incoming orders in the past fiscal year. All three Automotive divisions considerably increased their goods on order compared to the previous year. Altogether, the Chassis & Safety, Powertrain and Interior divisions acquired orders for a total value of nearly €40 billion for the entire duration of the deliveries for the vehicles. These lifetime sales are based primarily on assumptions regarding production volumes of the respective vehicle or engine platforms, the agreed cost reductions, and the development of key raw materials prices. The volume of orders calculated in this way represents a reference point for the resultant sales achievable in the medium term that may, however, be subject to deviations if these factors change. Should the assumptions prove to be correct, the lifetime sales are a good indicator for the sales volumes that can be achieved in the Automotive Group in four to five years.

The replacement tire business accounts for a large portion of the Tire division’s sales, which is why it is not possible to calculate a reliable figure for order volumes. The same applies to the ContiTech division, which since January 2018 has comprised seven business units operating in various markets and industrial sectors, each in turn with their own relevant factors. Consolidating the order figures from the various ContiTech business units would thus be meaningful only to a limited extent.

Outlook for the Continental Corporation

For fiscal 2018, we anticipate an increase in global light-vehicle production (passenger cars, station wagons and light commercial vehicles) of more than 1% to 96.5 million units. We expect demand on our key replacement-passenger-tire markets – Europe and North America – to grow by a total of 12 million replacement tires or 2% in each case. Based on these market assumptions and provided that exchange rates remain constant, we anticipate an increase in consolidated sales to around €47 billion in 2018.

We have set ourselves the goal for the corporation of achieving a consolidated adjusted EBIT margin of around 10.5% for fiscal 2018. With regard to the development of the adjusted EBIT margin, the lower expectation in comparison to the previous year is attributable mainly to the expected additional expenses due to the rising fixed costs in the Tire division and additionally due to rising raw material costs in the Rubber Group. The increase in fixed costs in the Tire division has resulted primarily from the considerable expansion of capacity over recent years. In 2017, this already led to an increase in depreciation and amortization of around €60 million year-on-year. This year, the startup of the tire plants in Clinton, Mississippi, U.S.A., and in Rayong, Thailand, is expected to result in a further rise in depreciation and amortization, but also other fixed costs, before these two plants generate their first sales. We estimate these costs alone at around €120 million. For the Automotive Group, assuming constant exchange rates, we anticipate sales growth of 7% to approximately €28.5 billion with an adjusted EBIT margin of around 8.5%. For the Rubber Group, assuming constant exchange rates, we expect sales growth to approximately €18.5 billion with an adjusted EBIT margin of around 15%.

In 2018, we anticipate a negative effect of approximately €50 million from the rising prices of raw materials in the Rubber Group. This is based on the assumption of an average price of U.S. $1.84 per kilogram (2017: U.S. $1.67 per kilogram) for natural rubber (TSR 20) and U.S. $1.60 per kilogram (2017: U.S. $1.51 per kilogram) for butadiene, a base material for synthetic rubber. We also expect costs for carbon black and other chemicals to increase by at least 10% compared to the average prices in 2017. For the Rubber Group, every U.S. $10 increase in the average price of crude oil equates to a negative annual gross effect on EBIT of around U.S. $50 million. The average price of North Sea Brent was around U.S. $54 in 2017.

In 2018, we expect the negative financial result before effects from currency translation, effects from changes in the fair value of derivative instruments, and other valuation effects to be less than €180 million. The tax rate should again be less than 30% in 2018.

For 2018, we expect negative special effects to total €100 million. Amortization from purchase price allocations, resulting primarily from the acquisitions of Veyance Technologies (acquired in 2015), Elektrobit Automotive (acquired in 2015), and the Hornschuch Group (acquired in 2017), is expected to total approximately €180 million and to affect mainly the ContiTech and Interior divisions.

In fiscal 2018, the capital expenditure ratio before financial investments will increase to around 7% of sales. Approximately 60% of capital expenditure will be attributable to the Automotive Group and 40% to the Rubber Group.

The largest projects within the Chassis & Safety division in 2018 remain the global expansion of production capacity for the MK 100 and for the MK C1 brake generations in the Vehicle Dynamics business unit. In addition, major investments are planned for the global expansion of capacity for long- and short-range radar sensors as well as for 360-degree and multi-function cameras in the Advanced Driver Assistance Systems business unit. Initial investments will also be made in increasing the production of high-resolution 3D lidar sensors. The Powertrain division is planning investments in a new plant in China. Investments in the Hybrid Electric Vehicle business unit are also a priority of the investment program. Besides investments in capacity for electric motors, capital expenditure is planned to increase production of 48V belt-driven starter generators. The Interior division is investing in the construction of new plants in Eastern Europe and North America and the expansion of R&D capacity at certain European locations.

In the Tire division, investments in 2018 will focus on the expansion of passenger tire production in Southern and Eastern Europe, Asia, and North America. In the area of commercial-vehicle tires, the emphasis will be on the expansion of production capacity in Eastern Europe and North America. In the ContiTech division, investments will continue to concentrate on the relocation of a plant in the Mobile Fluid Systems business unit and the expansion of production in the Benecke-Hornschuch Surface Group business unit in China.

As at the end of 2017, Continental’s net indebtedness amounted to €2.0 billion. In the future, we intend to continue strengthening industrial business in particular, in line with our objective of reducing our dependency on the automotive original-equipment sector. The acquisition of further companies for this purpose has not been ruled out. Another focus will be the selective reinforcement of our technological expertise in future-oriented fields within the Automotive Group.

For 2018, we are planning on free cash flow of approximately €2 billion before acquisitions. One reason for this year-on-year decrease is an increase in the capital expenditure ratio. In addition, we expect the rest of the warranty provisions recognized in 2016 and the provision recognized in 2016 for potential antitrust fines to flow out in full in 2018.

The start to 2018 has confirmed our expectations for the full year.