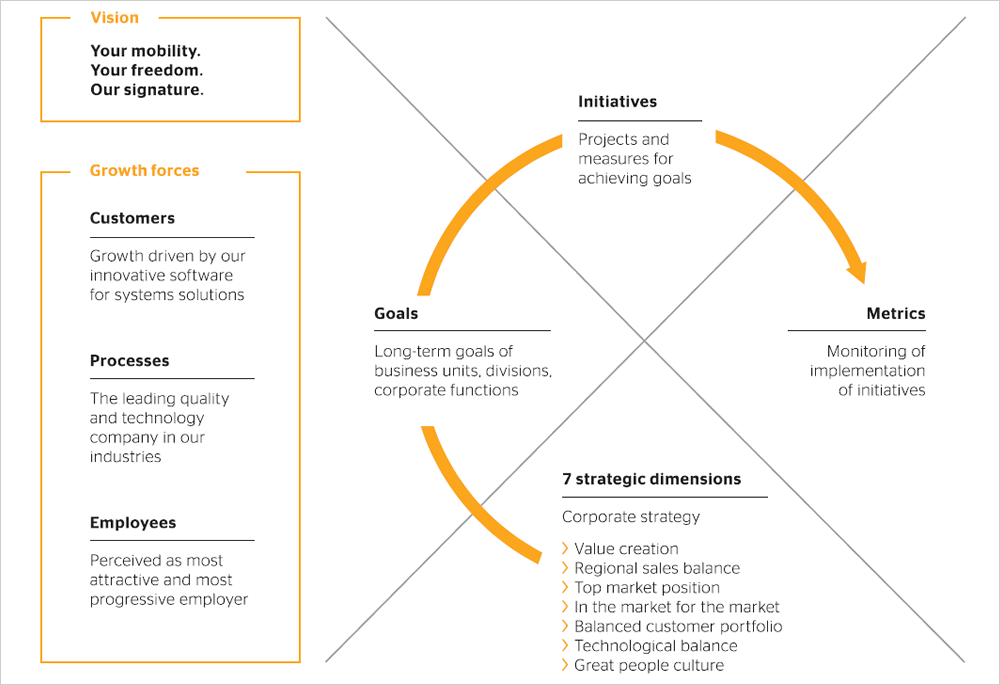

Our strategy comprises seven dimensions that complement each other.

We are continually improving our management and work processes. For example, in the reporting year, we began establishing the planning and management system Hoshin Kanri (Japanese for policy management) for the entire company. This is about aligning the activities and efforts of all employees worldwide with our shared vision and our mutual goals.

In this way, we are organizing the interconnection and the interplay of our various target levels: the strategic goals of the organization as a whole with their associated initiatives and dimensions and the goals of individual organizational units. Our vision gives us the long-term orientation for this planning process. In the short term, we are accelerating our development with the aid of three crucial growth forces in relation to customers, processes and employees.

The Hoshin Kanri planning system means that all managers and employees in the entire company – companies and business units as well as divisions and corporate functions – are involved in a systematic, interconnected strategy process. We are thus aligning the activities for achieving the goals of individual units with our vision and the seven strategic dimensions. At the same time, we are identifying potential contradictions of our vision and our seven strategic dimensions as well as commonalities and opportunities. We are deriving measures from this so as to align the content of our work more closely with our strategic dimensions.

Seven strategic dimensions for enhancing the value of the corporation on a sustainable basis

Our seven strategic dimensions complement one another. They are geared toward sustainably creating value for all stakeholders and ensuring the future viability of the company.

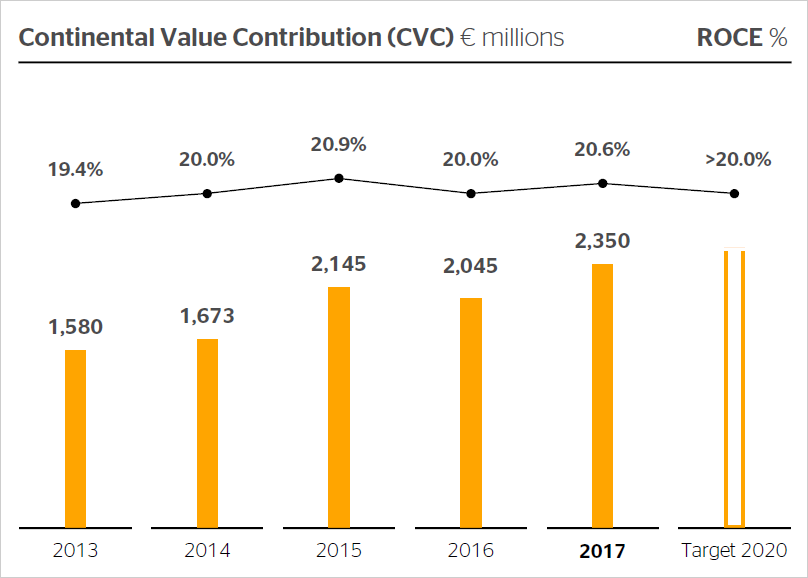

1. Value creation – enhancing the value of the corporation on a long-term basis

For us, enhancing the value of the corporation on a long-term basis means sustainable success while taking into consideration the cost of capital. Our target is at least 20% ROCE. We reached this target again in 2017. After 20.0% in 2016, we achieved 20.6% in the reporting year.

2. Regional sales balance – globally balanced distribution of sales

We want to achieve a globally balanced distribution of regional sales, which will allow us to become less dependent on individual regional sales markets and on market and economic fluctuations. To accomplish this, we are taking advantage of the opportunities available to us on the growing markets in Asia and North America, while bolstering our strong market position in Europe. We aim to gradually increase the share of our consolidated sales in the Asian markets to 30%. In China we want to grow at an above-average rate in the next few years. The total share of our sales in the North and South American markets should be maintained at 25% or more.

In 2017, we achieved a 22% share of sales in Asia. The share of our sales in the North and South American markets was 28% in total.

3. Top market position – among the three leading suppliers in all relevant markets

We want to be among the world’s three leading suppliers in terms of customer focus, quality, and market share in the long term. This will enable us to plan our future based on a leading position and thereby play a major role in advancing technological development in individual sectors.

In terms of sales in their respective markets, the Automotive Group’s divisions and the ContiTech division are among the leading providers with the majority of products. In the tire business, we are number four in the world over all, while we are also in top positions in individual segments and markets in this area.

Continental Value Contribution (CVC) in € millions / ROCE in %

4. In the market for the market – high degree of localization

Our global business model is based on a high degree of localization, with numerous product applications developed and produced locally. This is the best way to meet the respective market conditions and the requirements of our customers. The aim is for at least eight out of ten application developments to be carried out locally, and for the percentage of local production to be just as high. Our development and production teams worldwide enable us to offer solutions and products for high-quality cars and affordable vehicles, as well as customized industrial applications. At the same time, we are purchasing locally – insofar as this is possible and cost-effective – as well as marketing locally.

We have production locations in 38 of 61 countries in which we are represented. We again expanded our production in various divisions in 2017, for example by increasing tire production capacity in Portugal and beginning the expansion of tire production as well as opening a new plant for coated fabrics in China. The construction of a tire plant began in Thailand. We opened a research and development center in Silicon Valley in the U.S.A.

We are still working on being able to count one of the Asian manufacturers among our five largest automotive customers as well. We aim to achieve this with a high degree of localization. In the meantime, two Asian manufacturers are now among our ten largest customers.

5. Balanced customer portfolio – balance between automotive and other industries

Our dependency on the automotive economy is to be reduced by way of a balanced customer portfolio. To this end, we want to increase business in industries outside of the automotive original-equipment sector while at the same time achieving further growth with carmakers. In the medium to long term, we want to lift the share of sales with end users and industrial customers outside of the automotive original-equipment sector toward a figure of 40%.

This will be based mainly on our Tire and ContiTech divisions. Our activities in the field of software-based services for the end-user market will also make an increasing impact. Examples include advanced traffic management, intelligent payment systems, maintenance management and new technologies that go beyond the vehicle.

Despite our efforts, the share of sales with end users and industrial customers remained broadly stable at 28%. The reasons for this in the reporting year included the above-average growth in our Automotive divisions, which was seven percentage points higher than global vehicle production.

6. Technological balance – combination of established and pioneering technologies

Our product portfolio should consist of a mix of profitable as well as viable established and pioneering technologies. We set and follow new trends and standards in high-growth markets and market segments. On our established core markets, we ensure that our position as one of the leading automotive suppliers and industrial partners keeps on developing. This allows us to be represented and competitive in all phases of the respective product life cycles.

Alongside technologies for optimizing the combustion engine, we are developing new technologies that allow all-electric driving for limited periods or continuously.

We are expanding our portfolio with software-based and mobility services that complement existing products and benefit our customers.

In order to strengthen the innovation and agility so essential in times of digital transformation, we set up a special program for cooperating with startups last year. The potential of employees and external startups is thus to be utilized worldwide. It is a special and comprehensive program with a separate company that links the startup world to Continental – co-pace GmbH. The startup program comprises three elements: In the “incubator,” our employees are given the opportunity to develop new business concepts in a startup environment. In the “cooperation program,” external startups are brought together with Continental to develop and trial applications on a prototype basis. The third element is “corporate venture capital,” where investments are made in selected startups.

7. Great people culture – a culture of inspiration

We aim to foster an inspiring management culture, in which our employees can enjoy demonstrating their full commitment and achieving top performance. We promote a culture of trust and personal responsibility in all divisions and functions, one in which we openly deal with and tolerate our mistakes and turn them into lessons learned. Our working conditions are intended to make it easy for our employees to focus on what is important and to strike the right work-life balance. We keep in regular contact with our employees, for example through our worldwide surveys. These give our employees the chance to tell us about how satisfied they are in general, the quality of management in the company and their attitude toward Continental. Participation is voluntary and anonymous. In previous years, we invited all employees around the world to take part every two to three years. Since 2017, the survey has been carried out annually with a representative sample of the workforce. This enables us to identify potential improvements faster and implement changes more quickly.

In the reporting year, we asked around a quarter of employees for their opinion on 50 questions. 74% of these employees took part in the survey. The results included the following: employee loyalty to the company is very positive; 84% of respondents are proud to work at Continental; 86% support our corporate values: Trust, For One Another, Freedom To Act and Passion To Win. At the same time, 63% stated that these values are practiced on an everyday basis – a decline of six percentage points compared to the 2015 survey. However, it should be noted that in our survey a neutral answer is classified as a negative opinion. Leadership was evaluated positively. 84% of the employees surveyed agreed that their superiors treated them with respect. Two-thirds of the respondents feel encouraged to give their best and to question traditional working methods.