Positive trend on the stock markets

The trend on the stock markets was mostly positive in 2021, thanks to better economic data and corporate results than in the previous year. Accelerated vaccination campaigns to contain the COVID-19 pandemic and declining cases in many countries also helped to raise investor confidence. This upward trend slowed in November, however, due to news of the rapid spread of the Omicron variant in several countries, which triggered concerns among investors of possible adverse effects on the economic situation.

The DAX closed 2021 at 15,884.86 points. This represented an increase of 15.8% compared to the end of 2020, when it was quoted at 13,718.78 points. The EURO STOXX 50 rose by 21.0% in 2021 and ended the year at 4,298.41 points.

Sharp rise in many automotive stocks

Over the course of 2021, automotive producers and tire manufacturers in particular benefited from a strong revival in demand in many markets coupled with short supply, causing their share prices to rise sharply. By contrast, many automotive suppliers suffered from supply bottlenecks – especially for semiconductors – and a rapid increase in purchase prices, as well as higher logistics and energy costs. This resulted in stagnating or declining share prices for the suppliers in question.

The STOXX Europe 600 Automobiles & Parts rose to 659.72 points in 2021, an increase of 25.1% compared to the end of 2020, mainly due to the strong performance and high index weighting of automotive manufacturers.

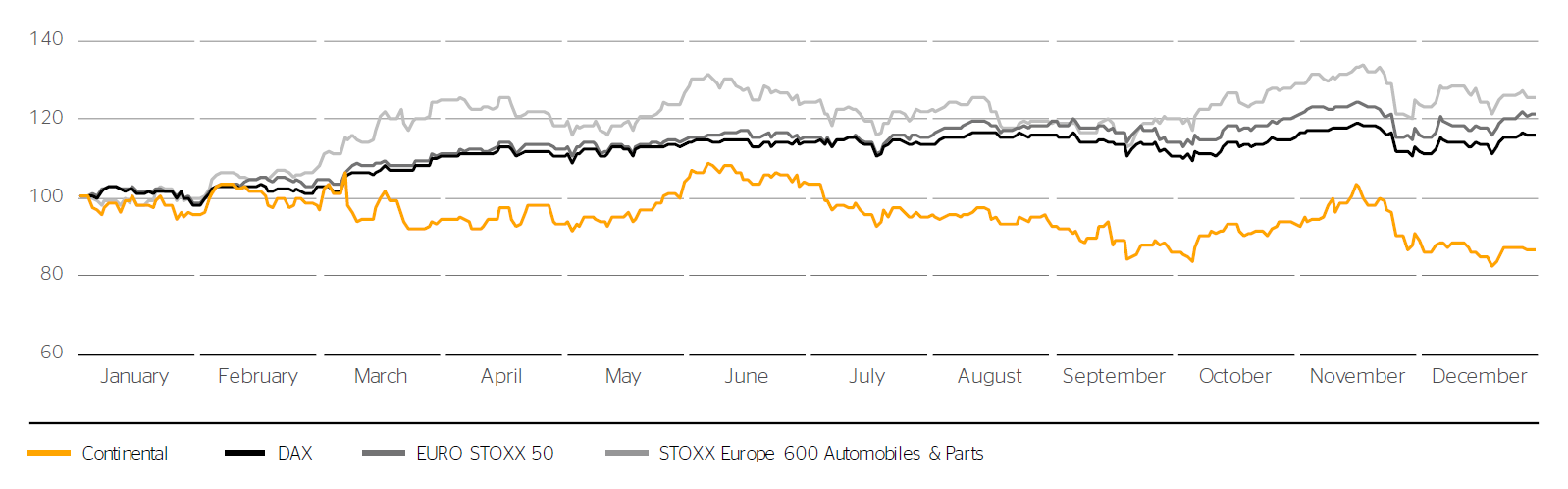

Price performance of Continental shares in 2021 versus selected stock indexes

(indexed to January 1, 2021; In order to improve comparability, figures relating to Continental shares prior to September 16, 2021, have been adjusted to account for the effect from the spin-off of Vitesco Technologies.

Data source: Bloomberg.)

Negative performance by Continental shares

Continental shares initially followed the trend in the European automotive sector at the start of the year. At the beginning of March 2021, the announcement regarding the new annual guidance disappointed the expectations of many investors, with the price of Continental shares falling significantly as a result. Over the rest of the year, Continental shares again largely tracked the STOXX Europe 600 Automobiles & Parts. However, the ongoing supply shortages and the impact of cost increases led to further setbacks with respect to investor sentiment and a drop in share prices in the second half of 2021.

At the end of 2021, they were listed at €93.11, having fallen 14.0% compared to the 2020 year-end price, adjusted for the spin-off of Vitesco Technologies, of €108.32.

In terms of its share-price performance, Continental was 33rd in the 2021 annual ranking of the new DAX, consisting of 40 constituents (PY: 13th out of 30 DAX constituents).

| Continental’s key bonds outstanding as at December 31, 2021 | ||||||

|---|---|---|---|---|---|---|

| WKN/ISIN | Coupon | Maturity | Volume in € millions | Issue price | Price as at Dec. 31, 2021 | Price as at Dec. 31, 2020 |

| A2YPE5/XS2051667181 | September 12, 2023 | 500.0 | 100.209% | 100.098% | ||

| A28XTQ/XS2178585423 | November 27, 2023 | 750.0 | 103.946% | 105.797% | ||

| A28YEC/XS2193657561 | September 25, 2024 | 625.0 | 102.625% | 103.589% | ||

| A2YPAE/XS2056430874 | June 27, 2025 | 600.0 | 100.627% | 100.852% | ||

| A28XTR/XS2178586157 | August 27, 2026 | 750.0 | 109.623% | 111.672% | ||

Prices of Continental bonds virtually unchanged

Interest rates for European corporate bonds showed only slight fluctuations up until September 2021 and remained at a very low level. In the final months of the year, rising inflation figures caused interest rates to increase slightly and share prices to fall slightly as a result.

The prices of outstanding Continental bonds at the end of December 2021 remained virtually unchanged compared with the end of 2020 – apart from the usual decline in fair value due to interest paid and a shorter remaining term.

Positive earnings per share

The economic recovery following the previous year, which was severely affected by the outbreak of the COVID-19 pandemic, led to a considerably improved operating result in the reporting year. Net income attributable to the shareholders of the parent achieved a positive value of €1.46 billion (PY: -€0.96 billion).

Earnings per share amounted to €7.28 in 2021 (PY: -€4.81).

Dividend proposal of €2.20 for fiscal 2021

The Executive Board and the Supervisory Board have resolved to propose to the Annual Shareholders’ Meeting, which will be held virtually on April 29, 2022, that a dividend of €2.20 be paid for the past fiscal year and that the retained earnings for fiscal 2021 be carried forward to new account.

In accordance with a resolution of the Annual Shareholders’ Meeting, no dividend was paid for fiscal 2020.

Free float unchanged at 54.0%

As in the previous year, free float as defined by Deutsche Börse AG amounted to 54.0% as at the end of 2021. The most recent change took place on September 17, 2013, when our major shareholder, the IHO Group, Herzogenaurach, Germany, announced the sale of 7.8 million Continental shares, reducing its shareholding in Continental AG from 49.9% to 46.0%.

As at the end of 2021, the market capitalization of Continental AG amounted to €18.6 billion (PY: €24.3 billion including Vitesco Technologies). Market capitalization on the basis of free float averaged €10.1 billion over the last 20 trading days of the reporting year (PY: €12.6 billion including Vitesco Technologies). Free-float market capitalization is the decisive factor for index calculation in the new regulatory framework of Deutsche Börse AG.

At the end of 2021, Continental AG ranked 36th in terms of free float market capitalization in the new DAX, which has consisted of 40 constituents since September 2021 (PY: 26th out of 30 DAX constituents).

Share of free float in the USA rises further

As at the end of the year, we once again determined the distribution of free float of Continental shares by way of shareholder identification (SID).

We were able to assign 105.4 million of the 108.0 million shares held in the form of shares or alternatively as American depositary receipts (ADRs) in the USA to more than 570 institutional investors, banks and asset managers across 40 countries. The identification ratio was 97.6% (PY: 90.7%).

According to the SID, the identified level of Continental shares held in Europe was slightly lower than the previous year at 49.0% of free float (PY: 52.5%).

The identified level of shares held by investors from the UK and Ireland remained unchanged compared to the previous year at 29.7%.

The identified free-float holdings of German investors fell to 6.3% in the year under review (PY: 9.3%).

French investors held 3.4% of Continental free-float shares at the end of 2021.

The free-float holdings of Scandinavian investors fell to 3.1% in 2021 (PY: 4.1%).

Investors in other European countries increased their share of free float to 6.5% in 2021 (PY: 6.0%).

Shareholdings of investors in North America increased significantly in 2021. In total, they held 45.7% (PY: 34.5%) of the free float in the form of shares or ADRs.

The identified shareholdings of investors in Asia, Australia and Africa were at 2.9% at the end of 2021 (PY: 3.6%).

| Continental share data | |

|---|---|

| Type of share | No-par-value share |

| German stock exchanges (regulated market) | Frankfurt (Prime Standard), Hamburg, Hanover, Stuttgart |

| German securities code number (WKN) | 543900 |

| ISIN | DE0005439004 |

| Reuters ticker symbol | CONG |

| Bloomberg ticker symbol | CON |

| Index memberships (selection) | DAX Prime All Share Prime Automobile NISAX |

| Outstanding shares as December 31, 2021 | 200,005,983 |

| Free float as at December 31, 2021 | |

| Continental’s American depositary receipt (ADR) data | |

|---|---|

| Ratio | 1 share : 10 ADRs |

| SEDOL number | 2219677 |

| ISIN | US2107712000 |

| Reuters ticker symbol | CTTAY.PK |

| Bloomberg ticker symbol | CTTAY |

| ADR Level | Level 1 |

| Trading | OTC |

| Sponsor | Deutsche Bank Trust Company Americas |

| ADRs issued as at December 31, 2021 | 35,274,610 (with 3,527,461 Continental shares deposited) |

Share capital unchanged

As at the end of fiscal 2021, the share capital of Continental AG still amounted to €512,015,316.48. It is divided into 200,005,983 no-par-value shares with a notional value of €2.56 per share.

In line with Article 20 of Continental AG’s Articles of Incorporation, each share grants one vote at the Shareholders’ Meeting. The current Articles of Incorporation are available on our website at www.continental.com under Company/Corporate Governance.

All shares, except treasury shares (December 31, 2021: three shares), have the same dividend and voting rights.

Continental share listings

Continental’s shares continue to be officially listed on the German stock exchanges in Frankfurt, Hamburg, Hanover and Stuttgart on the regulated market. They are also traded on other unofficial stock exchanges in Germany and in other countries around the world.

Continental ADR listings

In addition to being listed on European stock exchanges, Continental shares are traded in the USA as part of a sponsored ADR program on the over-the-counter (OTC) market. They are not admitted to the US stock market. Since the split of the outstanding ADRs at the end of October 2018, ten ADRs (rather than the previous five) are equivalent to one Continental share.

Continental Investor Relations online

For more information about Continental shares, bonds and credit ratings, please visit www.continental-ir.com.

| Key figures of the Continental share1 | ||

|---|---|---|

| € (unless otherwise specified) | 2021 | 2020 |

| Basic earnings per share | 7.28 | -4.81 |

| Diluted earnings per share | 7.28 | -4.81 |

| Dividend per share | 2.202 | - |

| Dividend payout ratio (%) | 30.22 | n. a. |

| Dividend yield3 (%) | 2.12 | 0.0 |

| Annual average price-earnings ratio (P/E ratio)4 | 14.2 | n. a. |

| Share price at year end | 93.11 | 108.32 |

| Annual average share price | 103.03 | 83.33 |

| Share price at year high | 118.53 | 113.01 |

| Share price at year low | 87.53 | 45.96 |

| Number of outstanding shares, average (in millions) | 200.0 | 200.0 |

| Number of outstanding shares as at December 31 (in millions) | 200.0 | 200.0 |

1 All market prices are quotations of the Continental share in the Xetra system of Deutsche Börse AG. In order to improve comparability, figures prior to September 16, 2021, have been adjusted to account for the effect from the spin-off of Vitesco Technologies. Data source: Bloomberg.

2 Subject to the approval of the Annual Shareholders’ Meeting on April 29, 2022.

3 Dividend per share at the annual average share price.

4 Net income per share attributable to the shareholders of the parent at the annual average share price.