Forecast process

Each year, Continental forecasts the values of key performance indicators for the Continental Group for the new fiscal year. These include sales and the adjusted EBIT margin for the Continental Group and for the Automotive Technologies, Rubber Technologies and Contract Manufacturing group sectors, and – from 2022 onward – for the Automotive, Tires, ContiTech and Contract Manufacturing group sectors.

In addition, we provide information on the assessment of important factors influencing EBIT. These include the expected negative or positive effect of the estimated development of raw material prices and other cost factors for the current year, the expected development of special effects and the amount of amortization from purchase price allocations. We thus allow the Continental Group’s expected EBIT to be estimated.

Furthermore, we give an assessment of the development of interest income and expenses as well as the tax rate for the Continental Group, which in turn allows the Continental Group’s expected net income to be estimated. We also publish a forecast of the capital expenditures planned for the current year and the free cash flow before acquisitions, divestments and certain exceptional effects, if any, such as the effects of the spin-off of Vitesco Technologies in 2021. Our forecast is based on our expectations regarding the most important production and sales markets in the new fiscal year.

We publish our forecast as part of our annual financial press conference and the publication of our annual report. It is continually reviewed over the course of the fiscal year. Possible changes to the forecast are described at the latest in the report for the respective quarter.

Comparison of the past fiscal year against forecast

Following the COVID-19 pandemic-related decline in the previous year, our forecast for fiscal 2021, which we published in March 2021, was based on the expectation of a noticeable recovery in the production of passenger cars and light commercial vehicles, both in our core markets and globally. To a lesser extent, this also applied to the replacement-tire markets and the industrial business. As mentioned in the report on expected developments in the 2020 annual report, we expected the global production of passenger cars and light commercial vehicles to increase by around 9% to 12% year-on-year in 2021.

Our outlook took into account expected impact of the ongoing COVID-19 pandemic on production volumes in 2021. The shortage of semiconductors due to our suppliers working at full capacity limited growth in the first quarter of 2021 in particular. At the same time, increased costs were anticipated in the supply chains. In the second half of the year, we expected the delivery situation to return to normal. The planned spin-off and subsequent listing of Vitesco Technologies during the second half of 2021 was not taken into account in the disclosures.

Based on all of the above assumptions as well as on the exchange rates at the beginning of the fiscal year, we expected the following key financial figures for fiscal 2021:

- We expected our Automotive business areas at that time – Autonomous Mobility and Safety, Vehicle Networking and Information, and Powertrain – to achieve sales of around €24.0 billion to €25.0 billion. We expected the adjusted EBIT margin to be in the range of around 1% to 2%. This included increased supply chain costs as well as additional research and development expenses in the Autonomous Mobility and Safety business area.

- We expected our Rubber business areas – Tires and ContiTech – to achieve sales of around €16.5 billion to €17.5 billion and an adjusted EBIT margin of around 11.5% to 12.5%. This included the expected negative impact of higher raw material costs.

- We expected the Continental Group to achieve total sales in the range of around €40.5 billion to €42.5 billion and an adjusted EBIT margin of around 5% to 6%. For 2021, taking into account expenses relating to the Transformation 2019–2029 structural program, among other factors, we expected negative special effects to total around €600 million. As in the previous year, amortization from purchase price allocations were again expected to total just under €200 million and affect mainly the ContiTech and Vehicle Networking and Information business areas. In 2021, we expected the negative financial result to be in the region of €220 million before effects from currency translation and before effects from changes in the fair value of derivative instruments, and other valuation effects. The tax rate was expected to be around 27% in 2021. The capital expenditure ratio was expected to be around 7% of sales in fiscal 2021. Finally, in 2021, we were planning on free cash flow of approximately €0.9 billion to €1.3 billion, before acquisitions and before the effects of transforming the Powertrain business area into an independent legal entity.

In the quarterly statement for the first quarter of 2021, we adjusted our outlook for 2021 mainly due to the anticipated spin-off of Vitesco Technologies:

- For the Continental Group’s continuing operations, we expected sales of €32.5 billion to €34.5 billion and an adjusted EBIT margin of 6% to 7% for 2021. We still anticipated negative special effects of around €300 million for continuing operations. These effects related to the Transformation 2019–2029 structural program, among other factors. Taking into account the effects of the anticipated spin-off of Vitesco Technologies, we expected free cash flow before acquisitions, divestments and carve-out effects of around €1.1 billion to €1.5 billion from continuing operations. The increase was due in particular to the postponement of cash utilizations from restructuring provisions. For fiscal 2021, we continued to expect a capital expenditure ratio before financial investments of around 7% of sales for continuing operations.

- For the continuing operations of Automotive Technologies, we expected sales of around €16 billion to €17 billion for 2021. An adjusted EBIT margin in the range of around 1% to 2% was anticipated. This still included the higher supply chain costs as well as the additional expenses for research and development announced on March 9, 2021, in the Autonomous Mobility and Safety business area.

- For the Rubber Technologies group sector, we still expected sales of around €16.5 billion to €17.5 billion and an adjusted EBIT margin of about 11.5% to 12.5% for the year as a whole. This included the impact expected from higher raw material costs.

In the half-year financial report, we updated our market forecasts. In particular, we lowered our expectations for the global production of passenger cars and light commercial vehicles to around 8% to 10% year-on-year in 2021.

- Based on new assumptions as well as current exchange rates, for continuing operations in fiscal 2021, we expected consolidated sales of around €33.5 billion to €34.5 billion, an adjusted EBIT margin of around 6.5% to 7.0% and negative special effects amounting to around €300 million. These effects related to the Transformation 2019–2029 structural program, among other factors.

- For Automotive Technologies, we expected sales of around €16.0 billion to €16.5 billion and an adjusted EBIT margin of around 0.5% to 1.0%.

- For Rubber Technologies, we raised our sales forecast to €17.2 billion to €17.8 billion and the forecast adjusted EBIT margin to around 12.5% to 13.0%.

- For the new Contract Manufacturing group sector created by the spin-off of Vitesco Technologies, we forecast sales of around €250 million and an adjusted EBIT margin of around 2% to 3% as of the date of the spin-off.

- We also updated our expectation for amortization from purchase price allocations to below €200 million.

- We lowered our estimate of the negative financial result before effects from currency translation, effects from changes in the fair value of derivative instruments, and other valuation effects to around €180 million.

- We continued to forecast a capital expenditure ratio of around 7% of sales.

- Taking into account the anticipated effects of the spin-off of Vitesco Technologies, we forecast free cash flow before acquisitions, divestments and carve-out effects of around €1.1 billion to €1.5 billion.

On October 22, 2021, we adjusted our outlook for fiscal 2021 due to several factors. Given the ongoing shortages of semiconductor components as well as uncertainties in the supply chain and customer demand, we lowered our expectation for the global production of passenger cars and light commercial vehicles to between -1% and +1% year-on-year in 2021. Negative effects from cost inflation for key inputs including electronics and electromechanical components for Automotive Technologies, raw materials for Rubber Technologies as well as energy and logistics also became more material.

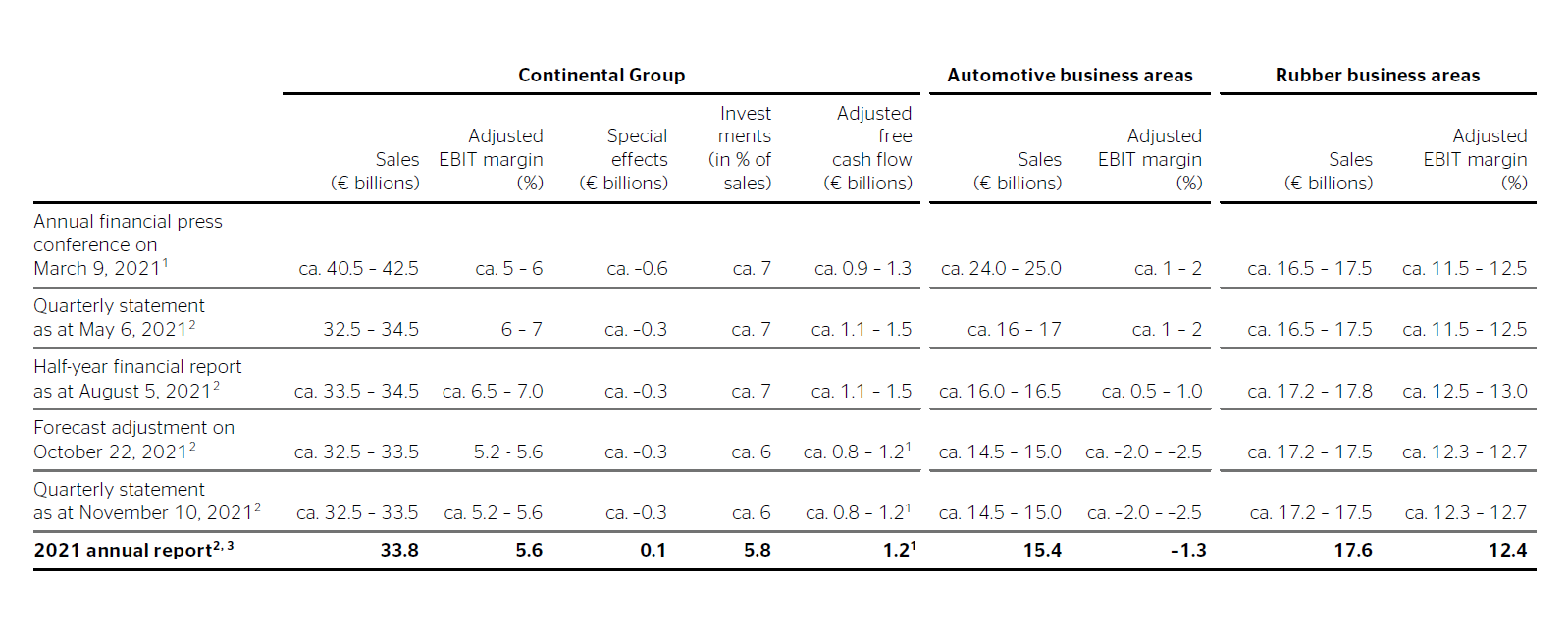

Comparison of key forecast elements for fiscal 2021

All figures take into account the exceptions and definitions specified in each case in the comparison against forecast.

1 Continuing and discontinued operations.

2 Only continuing operations.

3 The negative effect of exchange rates on sales amounted to €247 million for the Continental Group in 2021. Around one-third of this was attributable to Automotive Technologies and around two-thirds to Rubber Technologies.

- As a result of this and assuming that exchange rates in the fourth quarter of 2021 would remain stable, we expected consolidated sales of approximately €32.5 billion to €33.5 billion and an adjusted EBIT margin of 5.2% to 5.6% in fiscal 2021.

- For Automotive Technologies, we lowered expected sales to around €14.5 billion to €15.0 billion and the forecast adjusted EBIT margin to around -2% to -2.5%.

- In addition, we updated our forecast for sales in the Rubber Technologies group sector to around €17.2 billion to 17.5 billion and the adjusted EBIT margin to around 12.3% to 12.7%.

- For the Contract Manufacturing group sector, we forecast sales of around €800 million to €900 million and an adjusted EBIT margin of around 9% for 2021 as a whole.

- At the same time, we lowered our forecast for capital expenditure before financial investments to around 6% of sales.

- We anticipated that free cash flow before acquisitions, divestments and carve-out effects for continuing and discontinued operations would be in the range of around €800 million to €1.2 billion.

In the quarterly statement for the third quarter of 2021, we confirmed our outlook from October 22, 2021, and lowered our tax rate forecast to 23.0%.

The worsening semiconductor shortages over the course of the year and the rising costs for the procurement of materials, energy and logistics again required repeated adjustments to our forecast for fiscal 2021, in particular for the Automotive Technologies group sector.

With operating performance in the fourth quarter exceeding our expectations at the beginning of the quarter, the group sectors ultimately met or exceeded the adjusted targets from October 2021:

- Automotive Technologies generated sales of €15.4 billion and an adjusted EBIT margin of -1.3% in 2021.

- Rubber Technologies generated sales of €17.6 billion and an adjusted EBIT margin of 12.4% in the year under review.

- Contract Manufacturing generated sales of €0.9 billion and an adjusted EBIT margin of 11.7% in 2021.

The Continental Group generated sales of €33.8 billion in fiscal 2021. The upper value of the sales range from October 2021 was therefore exceeded by €0.3 billion. The adjusted EBIT margin of 5.6% was likewise at the upper end of the estimated range from October 2021.

The other parts of our October forecast for the Continental Group were also achieved or exceeded for 2021 as a whole:

- Total consolidated income from special effects amounted to €122.6 million in 2021.

- Amortization from purchase price allocations was lower than expected in 2021, at €159.0 million.

- The negative financial result before effects from currency translation, effects from changes in the fair value of derivative instruments, and other valuation effects amounted to €77.7 million in the reporting year, which was below our estimation in the 2021 half-year financial report of around €180 million.

- Income tax expense for fiscal 2021 amounted to tax expense of €359.5 million. The tax rate of 21.0% was below our forecast of 23.0% in the quarterly statement for the third quarter of 2021.

- The capital expenditure ratio before financial investments of 5.8% was on a par with our calculation from October 2021 of around 6%.

- At €1.2 billion, free cash flow before acquisitions, divestments and carve-out effects for continuing and discontinued operations in 2021 was at the upper end of the forecast range in October 2021 of around €800 million to €1.2 billion.

Order situation

The order situation in our Automotive group sector continues to be impacted by a high level of uncertainty due to the ongoing COVID-19 pandemic worldwide and semiconductor shortages. In total, orders amounting to around €19 billion were acquired in fiscal 2021. This figure includes expected sales over the entire duration of the delivery, known as lifetime sales. These are based primarily on assumptions regarding production volumes of the respective vehicle or engine platforms, the expected and agreed cost adjustments, and the development of key raw material prices.

The replacement-tire business accounts for a large portion of the Tires group sector’s sales, which is why it is not possible to calculate a reliable figure for order volumes.

The same applies to the ContiTech group sector, which has six business areas operating in various markets and industrial sectors, each in turn with their own relevant factors. Consolidating the order figures from the various business areas of the ContiTech group sector would thus be meaningful only to a limited extent.

Outlook for fiscal 2022

As mentioned on page 96 of the report on expected developments, we anticipate a noticeable recovery in the global production of passenger cars and light commercial vehicles in 2022, particularly in our core markets of Europe and North America. Our expectations do not include any effects of the potential impact of the current geopolitical crisis.

Our expectations take into account the current anticipated impact of ongoing supply shortages, particularly for semiconductors, on production volumes in 2022. The shortage of semiconductors due to our suppliers working at full capacity will limit growth in the first half of 2022 in particular. In the second half of the year, we expect the delivery situation to improve slightly.

Significantly higher costs for the procurement of materials, energy and logistics as well as the increase in wages and salaries are likely to weigh heavily on our earnings position in fiscal 2022.

Based on the above assumptions as well as on the exchange rates at the beginning of the fiscal year, we anticipate the following key financial figures for fiscal 2022:

- We expect our Automotive group sector to achieve sales of around €18 billion to €19 billion. We expect the adjusted EBIT margin to be in the range of around 0% to 1.5%. This includes higher procurement and logistics costs of around €1 billion as well as additional expenses for research and development in the Autonomous Mobility business area.

- We expect our Tires group sector to achieve sales of around €13.3 billion to €13.8 billion and an adjusted EBIT margin of around 13.5% to 14.5%. This includes the expected negative impact from higher procurement and logistics costs of around €1 billion.

- We expect our ContiTech group sector to achieve sales of around €6.0 billion to €6.3 billion and an adjusted EBIT margin of around 7.0% to 8.0%. This includes the expected negative impact from higher procurement and logistics costs of around €300 million.

- In the Contract Manufacturing group sector, we anticipate sales of around €600 million to €700 million and an adjusted EBIT margin of around 0% to 1.0%.

- We expect the Continental Group to achieve total sales in the range of around €38 billion to €40 billion and an adjusted EBIT margin of around 5.5% to 6.5% in 2022.

- As in the previous year, amortization from purchase price allocations is again expected to total approximately €150 million and affect mainly the Automotive and ContiTech group sectors.

- In addition, we expect negative special effects of around €150 million.

- In 2022, we expect the negative financial result to be below €200 million before effects from currency translation, effects from changes in the fair value of derivative instruments, and other valuation effects. The tax rate is expected to be around 27%.

- The capital expenditure ratio is expected to be below 7% of sales in fiscal 2022. In 2022, we are planning on adjusted free cash flow (before acquisitions and divestments) of approximately €0.7 billion to €1.2 billion.

On March 7, 2022, due to ongoing developments – particularly the war in Ukraine – the Executive Board of Continental AG amended its outlook for fiscal 2022 in the management report dated February 22, 2022, as follows: In the event the geopolitical situation, in particular in Eastern Europe, remains tense or even worsens, it could result in lasting consequences for production, supply chains and demand. Depending on the severity of the disruption, this may result in lower sales and earnings in all group sectors as well as for the Continental Group compared to the prior year.