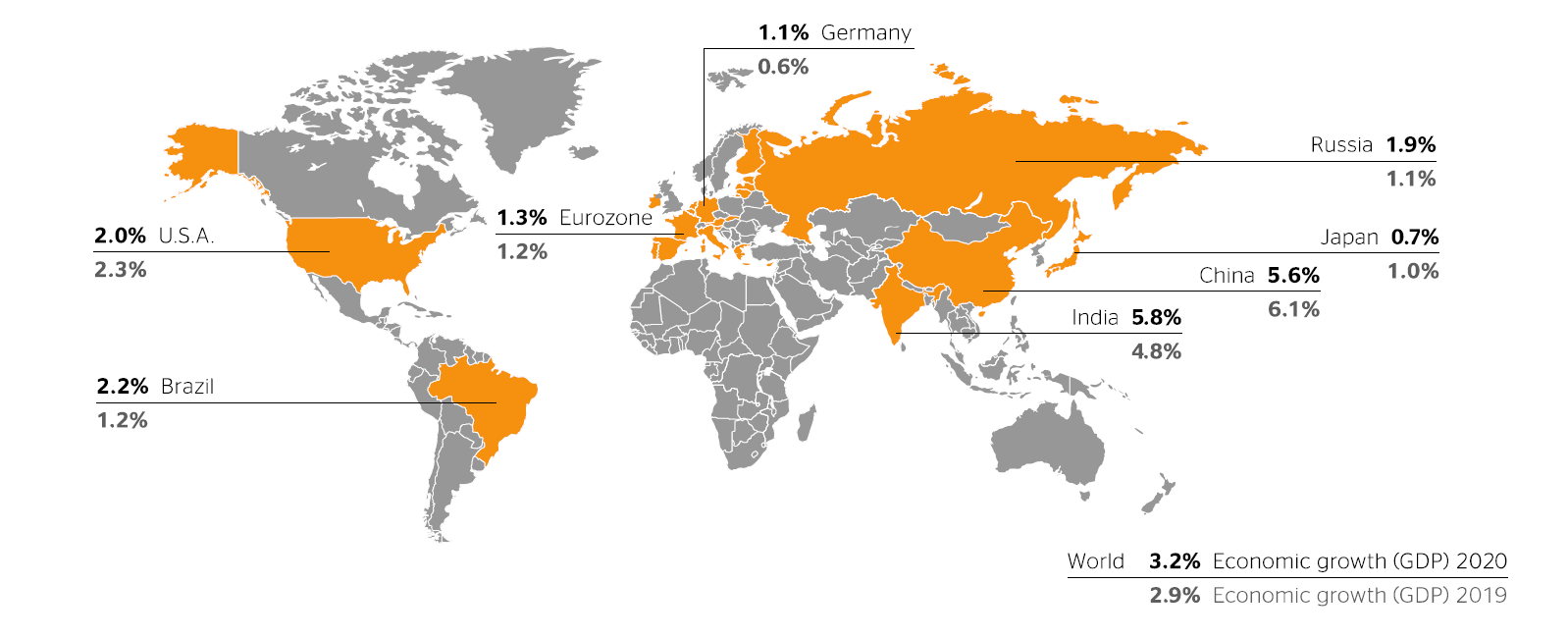

In February 2020, the International Monetary Fund (IMF) lowered its 2020 growth forecast for the global economy from its World Economic Outlook Update (WEO Update) in January by 0.1 percentage points to 3.2%. This is due to the expected economic damage from the current coronavirus outbreak.

According to the IMF, the higher year-on-year growth will be driven in particular by emerging and developing economies. Most notably, it forecasts an increase in gross domestic product (GDP) of 5.8% in India, 2.2% in Brazil and 1.9% in Russia, according to its WEO Update. But in many other emerging and developing economies, too, the IMF expects growth to increase slightly in 2020. Growth in the Chinese economy is likely to slow further, however, in particular due to the expected negative effects of the coronavirus. In February 2020, the IMF lowered its GDP forecast for China from 6.0% to 5.6% for the current year.

For the eurozone, the IMF anticipates that GDP will rise by 1.3% in 2020 according to its WEO Update. A key factor here is the German economy, for which the IMF estimates GDP growth of 1.1%.

For the U.S.A., the IMF predicts a decline in GDP growth to 2.0% for 2020 in its WEO Update. The IMF expects the effects of U.S. fiscal and monetary policy to subside and anticipates a more restrictive budget policy.

For Japan, the IMF believes that the expansive fiscal policy measures announced by the Japanese government at the start of December 2019 will have only a limited positive effect. For 2020, it forecasts moderate growth of 0.7% in its WEO Update.

Key opportunities for the global economy identified by the IMF in its WEO Update include in particular stronger-than-expected economic growth in major emerging markets and positive effects from the ongoing expansionary monetary policy in many countries. In addition, the partial agreement in the trade conflict between the U.S.A. and China could have a positive impact on business and consumer sentiment.

According to its WEO Update, the IMF sees key risks in growing geopolitical tensions, in particular between the U.S.A. and Iran, and in an escalation of various trade conflicts. Due to the high level of public and private debt, this could lead to an abrupt deterioration in general sentiment, companies’ propensity to invest and financial market conditions.

As of February 2020, the IMF anticipates that the economic damage caused by the spread of the coronavirus will be manageable. Its amendments in February assume that China’s economy will return to normal in the second quarter of 2020 and that a global pandemic can be avoided.