Raw materials such as steel, aluminum, copper, precious metals and plastics are key input materials for a wide range of different electronic, electromechanical and mechanical components. We and in particular our suppliers need these components to manufacture products and systems for the automotive industry. Consequently, developments in the prices of raw materials influence Continental’s production costs either directly or, in most cases, indirectly, via changes in costs at our suppliers.

Carbon steel and stainless steel are input materials for many of the mechanical components such as stamped, turned, drawn and diecast parts integrated by Continental into its products. Steel wire is used in particular in tire production as steel cord but also, for example, in conveyor belts or in rubber belts to increase tensile strength. Aluminum is used by Continental in particular for die-cast parts and stamped and bent components, while copper is used in particular in electric motors and mechatronic components. Precious metals such as gold, silver, platinum and palladium are used by Continental and by our suppliers to coat a wide range of components. Both Continental and our suppliers require various plastic granulates, known as resins, as technical thermoplastics primarily for manufacturing housing components.

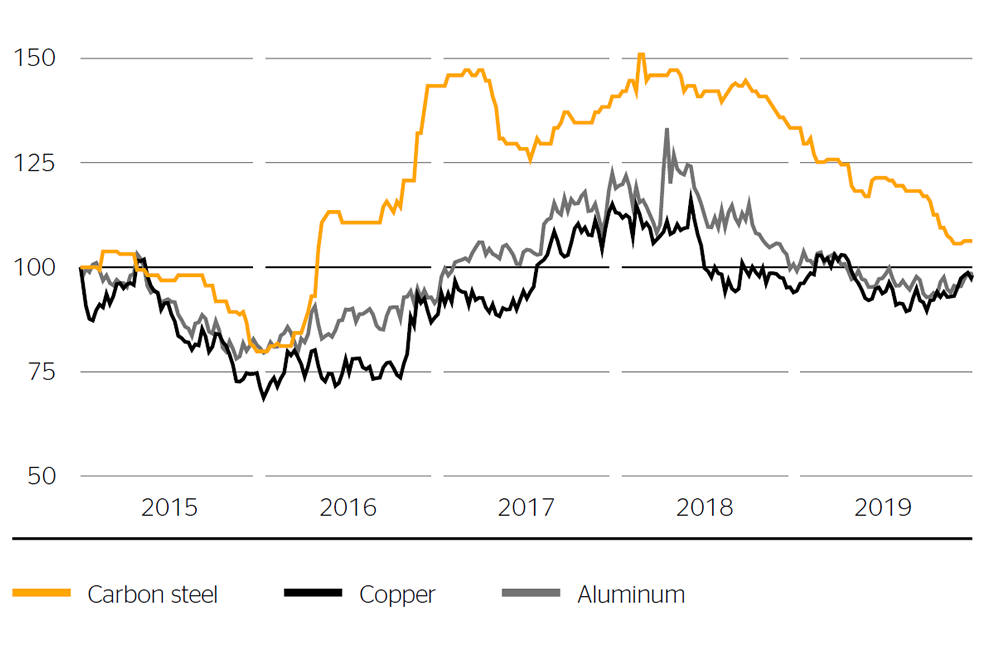

In the reporting year, the slowing economic momentum over the course of the year resulted in diminishing demand for raw materials and in a decline in prices for many raw materials. On a euro basis, prices for carbon steel fell in 2019 by more than 10% on average for the year. The annual average price for copper decreased by around 8% on a U.S. dollar basis in 2019, while the annual average price for aluminum fell by more than 10% on a U.S. dollar basis. By contrast, prices for precious metals rose in 2019, with the listings for gold and palladium increasing particularly sharply. On average for the year, on a U.S. dollar basis, the price of gold increased by 10% and the price of palladium by 50%.

Continental uses various types of natural rubber and synthetic rubber for the production of tires and industrial rubber products. It also uses relatively large quantities of carbon black as a filler material and of steel cord and nylon cord as structural materials. Due to the large quantities and direct purchasing of raw materials, their price development has a significant influence on the earnings of the Rubber Group, particularly the Tire division.

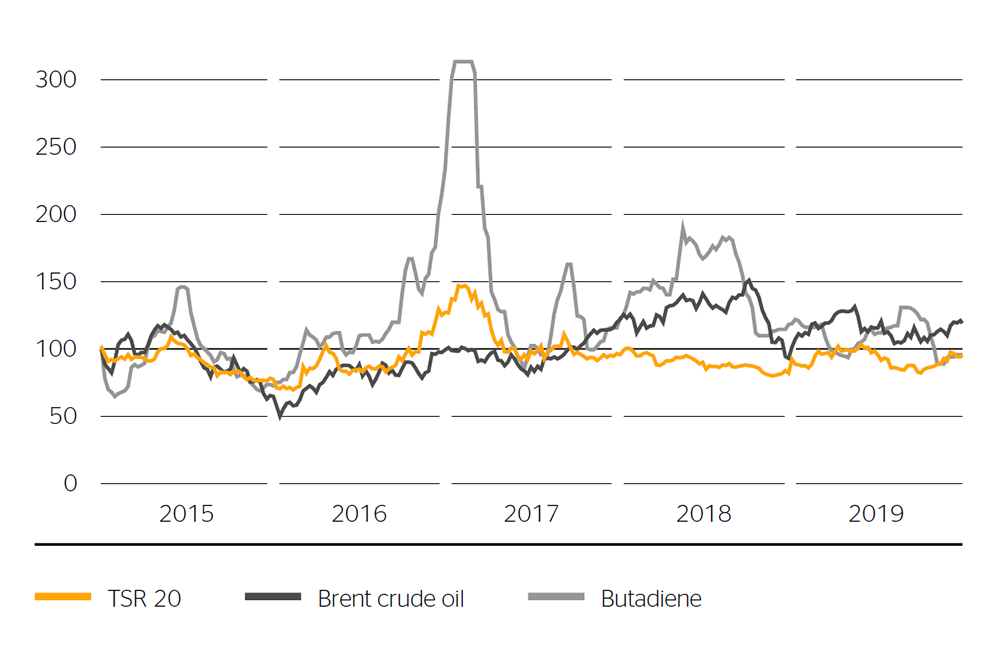

The price of crude oil – the most important basic building block for synthetic-rubber input materials such as butadiene and styrene as well as for carbon black and various other chemicals – rose sharply in the first half of 2019 following the rapid decline in the fourth quarter of 2018. From mid-May 2019, the listings fell once again, however. The average price of Brent crude oil for the year decreased by around 10% year-on-year on a U.S. dollar basis. As a result, the price of various input materials for synthetic rubber, such as butadiene and styrene, fell year-on-year in the year under review. By contrast, the prices for carbon black increased significantly due to limited production capacity.

Prices for natural rubber rose considerably in the first half of 2019. The primary reason for this was the recovering demand for tires in China. Declining demand for tires in Europe and North America over the course of the year led to prices for natural rubber falling even further over the course of the third quarter of 2019. In the fourth quarter, an outbreak of fungal disease affecting rubber trees had a negative impact on the rubber harvest in Southeast Asia. The scarce supply led to an increase in listings for natural rubber in November and December. The average price for the year for natural rubber TSR 20 was up 3% year-on-year on a U.S. dollar basis. The average price of ribbed smoked sheets (RSS) for the year rose by 6% on a U.S. dollar basis.

The weaker euro led to an increase in the average price of raw material imports to Europe by around five percentage points in the reporting year. The introduction of tariffs on steel imports by the U.S.A. weighed on the purchase of raw materials in 2019.

TSR 20, crude oil and butadiene

indexed to January 1, 2015

Sources: TSR 20: Rolling one-month contracts from the Singapore Exchange (U.S. $ cents per kg). Crude oil: Europe Brent Forties Oseberg Ekofisk price from Bloomberg (U.S. $ per barrel). Butadiene: South Korea export price (FOB) from PolymerUpdate.com (U.S. $ per metric ton).

Overall, the described price developments for raw materials led, in particular in the Rubber Group, to costs in 2019, which, due to the difficult market conditions in the customer sectors, were passed on to our customers only in individual markets and to a very limited extent. The decline in the price of metals reduced production costs for the reporting year only to a limited extent. Depending on the product, there is generally a gap of several months between purchasing raw materials, their delivery and their use in production. In addition, such changes in costs at our suppliers, depending on the contractual arrangement, are in most cases passed on to us after a certain amount of time or redefined in upcoming contract negotiations.