Continental is the mobility and material technology group for safe, smart and sustainable solutions.

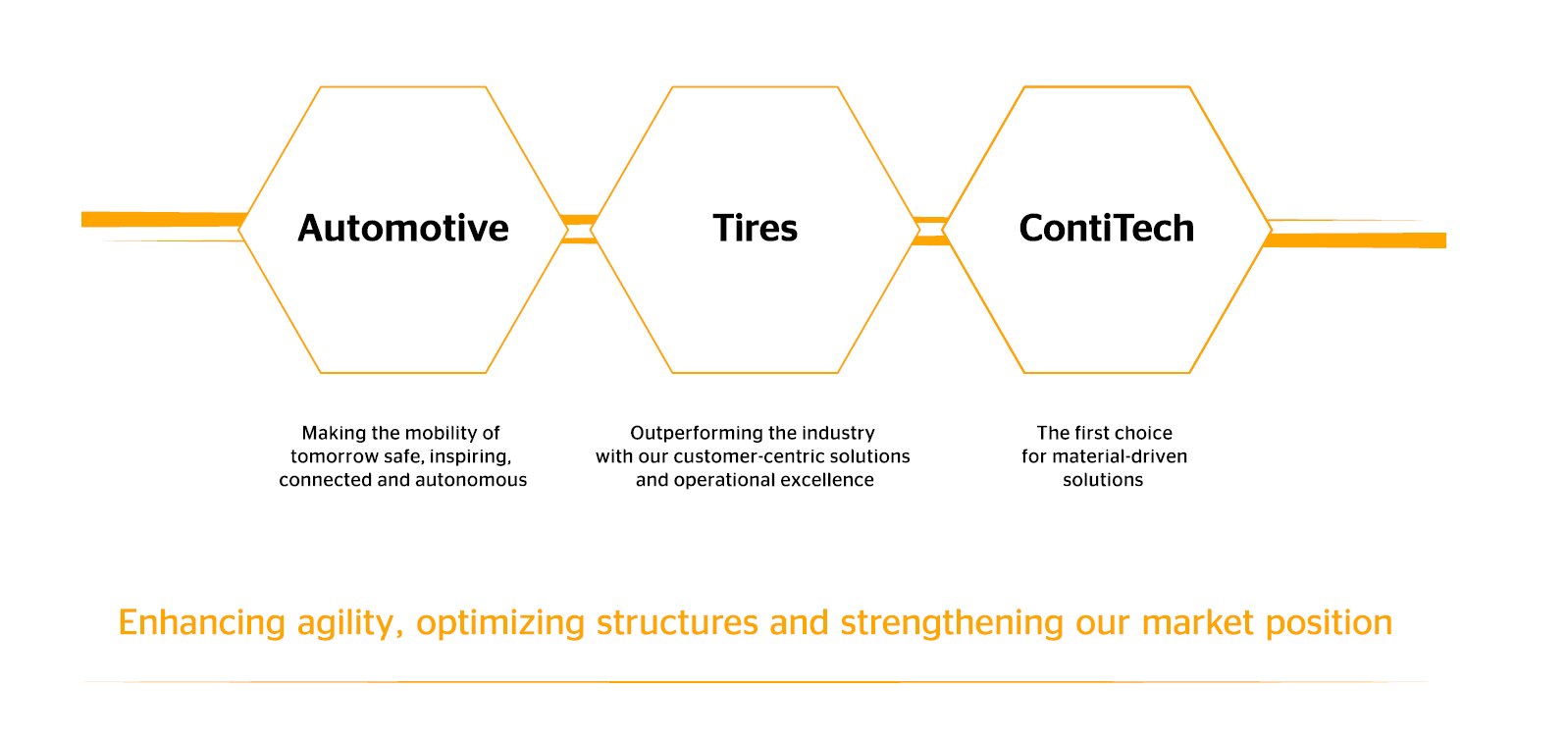

Continental’s corporate strategy is founded on three strategic pillars, which in turn define clear timelines for the future objectives of the group sectors – and of the Continental Group as a whole.

In 2024, Continental rigorously implemented this strategy for increasing value creation. At the same time, the Executive Board took decisive action in response to the constantly and quickly changing conditions faced by our group sectors. In the automotive market in particular, trends are becoming harder to predict. Examples of this include rapid shifts in our customers’ market shares, intense price competition and the need for greater agility as part of collaboration with technology companies.

As a result, and in line with its renewed strategic focus, Continental’s Executive Board decided – after conducting a detailed evaluation – to spin off the Automotive and Contract Manufacturing group sectors, subject to the approval of the Supervisory Board and the Annual Shareholders’ Meeting of Continental AG. For Automotive, a spin-off has the potential to create competitive opportunities, increase transparency and enhance agility, which will also benefit investors and partnerships. As a strong, independent entity, Automotive will be able to harness its full potential for creating value. The Tires and ContiTech group sectors will also benefit from a clearer focus on their respective business areas and their specific challenges.

The following elements were also important in fiscal 2024:

- The company continued to invest in particular in those areas with value creation upside and continuously expand its technology position in areas where it can expect to gain an edge over the competition.

- The Automotive, Tires and ContiTech group sectors rigorously implemented the measures initiated in 2023 to improve performance, each achieving successes.

These elements build upon the three strategic pillars introduced by Continental in 2020 in response to the transformation in the mobility industry and to pave the way for profitable growth.

- Strengthening operational performance

By strengthening its operational performance, Continental can ensure its future viability and competitiveness. The company is aligning its cost structure to global market conditions. - Differentiating the portfolio

Continental continues to pursue the targeted differentiation of its product portfolio with a focus on growth and value. - Turning change into opportunity

The focus of Continental’s organizational structure helps it to seize market opportunities and translate them into profit even more quickly. Transparent structures and a high level of autonomy make the company more flexible in an increasingly complex market environment.

Continental’s strategic goals are based on its vision:

CREATING VALUE FOR A BETTER TOMORROW.

OUR TECHNOLOGIES. YOUR SOLUTIONS. POWERED BY THE PASSION OF OUR PEOPLE.

“CREATING VALUE”: Continental aims to create value in everything it does. This can be financial value for its shareholders as well as value for its customers, its employees and the social environment in which it operates.

“A BETTER TOMORROW”: With its products and services, Continental contributes to making the world a little better. It develops and produces the mobility of tomorrow in a way that is more convenient and comfortable, safer and more sustainable. At the same time, “a better tomorrow” means acting now and not in the distant future.

“OUR TECHNOLOGIES. YOUR SOLUTIONS”: Continental is a technology company and believes that it will only be able to tackle the challenges of our time by rapidly developing the right technologies. Continental’s technology should help its customers make their products even better and more useful. Because Continental is customer-focused in everything it does.

“POWERED BY THE PASSION OF OUR PEOPLE”: Continental stands for a certain culture. A culture of mutual respect. A culture of togetherness. And a culture of passion.

Automotive: focus on value-creating business areas with high growth

In the Automotive group sector, Continental continues to focus on value-creating business areas with high growth. With its updated strategy, the group sector aims to systematically increase its profitability and competitiveness. The strategy is geared toward achieving a leading market position in all business areas, positioning these areas to achieve maximum efficiency, and becoming the preferred system integrator for software-defined vehicles.

The dynamic development of markets and customer requirements in the automotive industry calls for greater flexibility. The Automotive group sector’s strategy is based on the three cornerstones “lead – focus – perform” in order to effectively address the future market for software-defined and autonomous vehicles.

- Lead means striving for a leading market position through outstanding products and services.

- Focus is aimed at actively adapting the product portfolio to changing market conditions and customer requirements.

- Perform is focused on laying a solid foundation for commercial success with efficient structures and a strong financial base.

Automotive was organizationally realigned according to this strategy. Specifically, expertise in software and high-performance computers was consolidated in the Architecture and Network Solutions business area, while commercial vehicle expertise was concentrated in the Autonomous Mobility business area. Furthermore, the Automotive Aftermarket area was integrated into the Safety and Motion business area.

Continental is aiming for above-average growth in the Automotive group sector compared with the market environment. This is to be achieved by improving the group sector’s market share – in particular among Asian automotive manufacturers, which are growing at a disproportionate rate – increasing value creation per vehicle and adjusting prices. In addition, Continental has taken various measures to optimize operational costs and cash inflow. These include increasing efficiency in the manufacture of electronic components, reducing freight costs and optimizing inventory turnover.

Independently of this, Automotive is aiming to reduce costs significantly by €400 million per year from 2025 by simplifying administrative structures, reducing the complexity of interfaces and hierarchy levels, and speeding up decision-making processes. Automotive is also planning to further optimize its use of research and development resources. This will be achieved by consolidating its development locations worldwide, for example.

Tires: premium tires will continue to create opportunities for profitable growth

In the Tires group sector, Continental continues to focus on stable earnings from customer-focused solutions as well as operational excellence. Sustainable products and solutions, the transformation toward electric mobility and digital tire services will also create various opportunities for further profitable growth and exceptional value creation. The basis for the group sector’s commercial success is its operational efficiency. Capacity and modern production technologies are continually adapted to changing market requirements. This enables Tires to benefit from major economies of scale and scope, with around 80% of its global production capacity bundled in so-called megafactories.

Continental already offers its most sustainable passenger car tire on the market as a production tire and is growing in the area of data-based tire services. In total, it has around 500 original equipment approvals for supplying fully electric models from automotive manufacturers worldwide, including the ten highest-volume manufacturers of fully electric cars.

The Tires group sector sees strong growth potential in the Asia-Pacific region as well as North and South America. Based on its strategy of being in the market for the market, production capacity is being expanded accordingly in these regions – such as at the Chinese plant in Hefei in 2024. The recovery of the weak demand seen in the reporting year in the original equipment business and the segment for specialty tires, continuous increases in efficiency, the ongoing trend worldwide toward larger and higher-performing tires as well as high cost discipline will form the basis for sales and margin increases.

ContiTech: group sector strengthens strategic focus on industrial business

In its ContiTech group sector, Continental is focusing on reliable profitability thanks to material solutions made from rubber and plastics. At the same time, the group sector is strengthening its strategic focus on the industrial business and plans to increase the share of sales accounted for by the industrial business from 56% currently to 60% in the medium term. ContiTech’s ambition is to achieve an industrial share of sales of around 80%. This is to be achieved organically through greater penetration of existing and new markets, systematic expansion of the replacement market business and innovative product portfolio expansions, as well as inorganically through investments and divestments.

ContiTech’s industrial growth areas are primarily in energy, mining, agriculture and construction, as well as exterior and interior design. These industries place high demands on the materials and products used. The ContiTech group sector benefits here from its high level of materials expertise and technological production expertise. In combination with its broad product portfolio, which includes high-performance solutions for hoses, drive belts, conveyor belts and surfaces, ContiTech is well positioned for further profitable growth.

As already announced, the Original Equipment Solutions (OESL) business area – comprising the automotive business of ContiTech, with the exception of surface solutions for vehicle interiors – will also be made organizationally independent with a view to its subsequent sale.

Continental’s strategy forms the basis for its success as a company

This strategy forms the basis for strengthening Continental AG moving forward. All group sectors have introduced extensive measures and have a strong product portfolio that is fit for the future. On this basis, Continental’s group sectors (with the exception of Contract Manufacturing) aim to further increase their sales and earnings. Pending the Supervisory Board’s and the Annual Shareholders’ Meeting’s approval of the planned spin-off of Automotive and Contract Manufacturing, the new mid-term targets for Continental and the future Automotive company are expected to be presented at Capital Market Days in summer 2025.

Increase in value creation

We are confident that the strategic positioning of the Automotive, Tires and ContiTech group sectors will lead to long-term success. By successfully implementing short-term strategic measures to improve performance, and with a clear focus on medium and long-term targets, all group sectors have a balanced and resilient portfolio.

Consistently increasing our organizational agility, as well as having clear market positioning and efficient structures, will help to consolidate our position as the mobility and material technology group for safe, smart and sustainable solutions.

The decision to potentially spin off Automotive and Contract Manufacturing and to strengthen the independence of the Tires and ContiTech group sectors are important steps aimed at leveraging our full potential for creating value.