Corporate Governance Statement

Pursuant to Sections 289f and 315d of the German Commercial Code (HGB)

Responsible corporate governance is what governs the actions of the Executive Board and the Supervisory Board.

Good, responsible corporate governance geared toward sustainable, long-term value creation and in the interests of all stakeholder groups is what governs the actions of the Executive Board and Supervisory Board of Continental AG. The following corporate governance statement pursuant to Sections 289f and 315d of the German Commercial Code (Handelsgesetzbuch – HGB), to which reference is made in the management report, outlines corporate governance at Continental. The remuneration report for fiscal 2023 on the remuneration of the Executive Board and the Supervisory Board together with the auditor’s report and the valid remuneration system for the remuneration of the Executive Board are available on Continental’s website under Company/Corporate Governance/ Executive Board. The valid remuneration system for remuneration of the Supervisory Board is described in the remuneration report for fiscal 2023 and is available on Continental’s website under Company/Corporate Governance/Supervisory Board.

Declaration pursuant to Section 161 of the German Stock Corporation Act (Aktiengesetz – AktG) and deviations from the German Corporate Governance Code (Deutscher Corporate Governance Kodex – DCGK)

In December 2023, the Executive Board and the Supervisory Board issued the following annual declaration pursuant to Section 161 AktG:

“The Executive Board and the Supervisory Board of Continental AG declare in accordance with Section 161 German Stock Corporations Act (AktG) that the recommendations of the “Government Commission on the German Corporate Governance Code” in the version dated April 28, 2022 (published by the Federal Ministry of Justice in the official section of the electronic Federal Gazette (Bundesanzeiger) on June 27, 2022) have been complied with in the reporting year and will continue to be complied with, with the exception set out below.

Reference is made to the declaration of the Executive Board and the Supervisory Board of December 2022 as well as to previous declarations in accordance with Section 161 AktG and the deviations from the recommendations of the German Corporate Governance Code explained therein.

According to recommendation C.2 of the German Corporate Governance Code, the Supervisory Board shall set an age limit for members of the Supervisory Board. The Supervisory Board does not set an age limit because it does not consider such a general criterion to be appropriate for evaluating the qualifications of a Supervisory Board member.

Hanover, December 2023

Prof. Dr.-Ing. Wolfgang Reitzle

Chairman of the Supervisory Board

Nikolai Setzer

Chairman of the Executive Board”

The declaration of compliance is published on Continental’s website under Company/Corporate Governance. Earlier declarations pursuant to Section 161 AktG can also be found there. Out-of-date corporate governance statements can also be found there for a period of at least five years from the date they were issued.

Key corporate governance practices

The following documents are key foundations of our sustainable and responsible corporate governance:

- Continental AG’s corporate guidelines. The vision, mission and values, desired behavior and self-image of the Continental Group; available on Continental’s website under Company/Corporate Governance/Vision & Mission.

- Sustainability ambition; available on Continental’s website under Sustainability/Framework/Sustainability Ambition.

- Compliance with the binding Code of Conduct for all Continental employees. For more information, see Continental’s website under Sustainability/Strategy and Sustainable Corporate Governance/ Organization and Management.

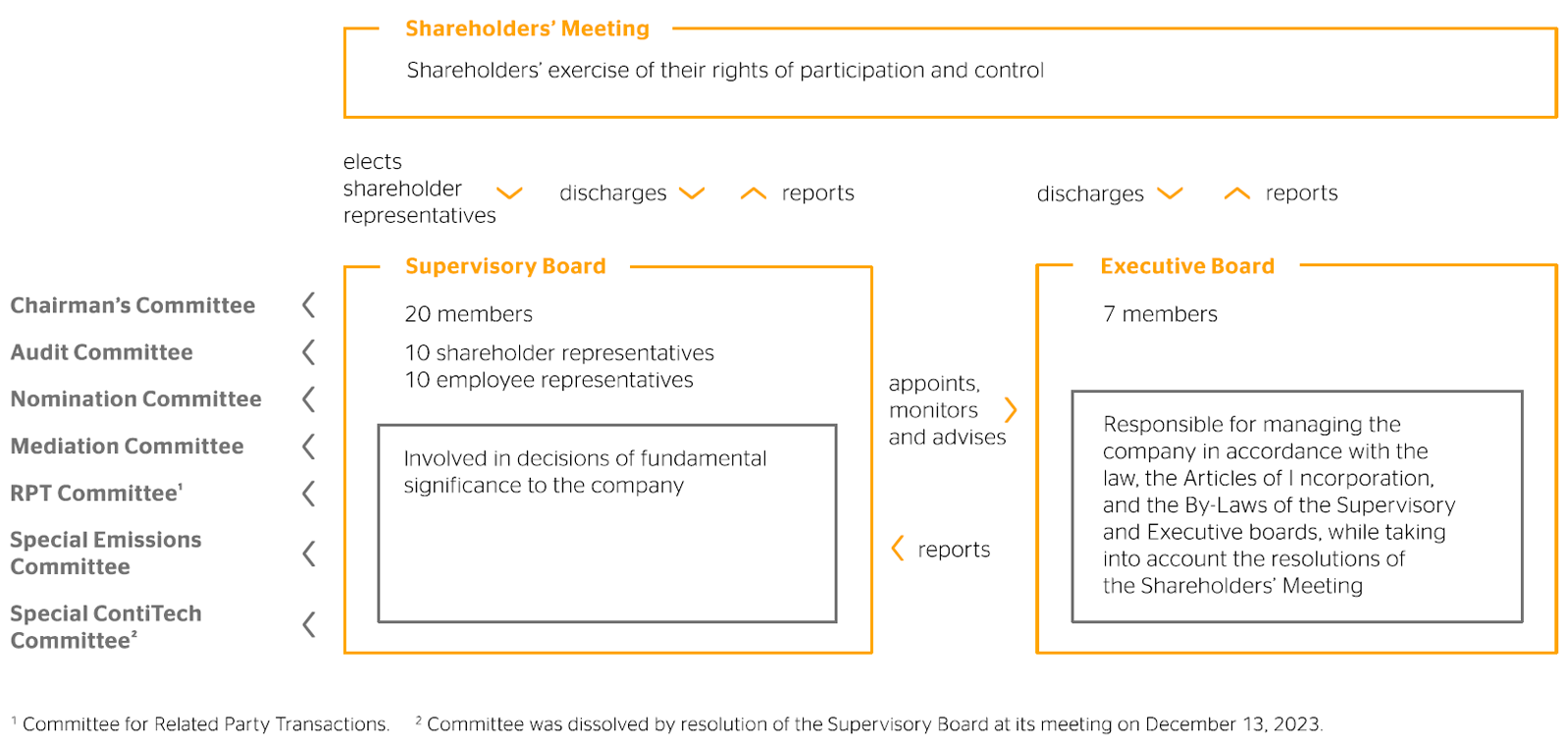

Corporate bodies

In line with the law and the Articles of Incorporation, the company’s corporate bodies are the Executive Board, the Supervisory Board and the Shareholders’ Meeting. As a German stock corporation, Continental AG has a dual management system characterized by a strict personnel division between the Executive Board as the management body and the Supervisory Board as the monitoring body. The cooperation between the Executive Board, Supervisory Board and Shareholders’ Meeting is depicted on the next page.

The Executive Board and its practices

The Executive Board has sole responsibility for managing the company in the interests of the company, free from instructions from third parties in accordance with the law, the Articles of Incorporation and the Executive Board’s By-Laws, while taking into account the resolutions of the Shareholders’ Meeting. All members of the Executive Board share responsibility for the management of the company jointly. Regardless of this principle of joint responsibility, each Executive Board member is individually responsible for the areas entrusted to them. The chairman of the Executive Board is responsible for the company’s overall management and business policy. He ensures management coordination and uniformity on the Executive Board and represents the company to the public. The Executive Board jointly develops the company’s strategy, agrees it with the Supervisory Board and ensures its implementation.

The Executive Board had seven members as at December 31, 2023, and as at the date of this statement. Information on areas of responsibility and resumes of the Executive Board members are available on Continental’s website under Company/Corporate Governance/Executive Board. The Executive Board was expanded from five to seven members effective May 1, 2023. The Executive Board function for Integrity and Law was newly created and filled. In addition, the management of the Automotive group sector was transferred from the chairman of the Executive Board to a new member of the Executive Board. The first time a person is appointed to the Executive Board, his or her term as a rule is three years only. As a rule, a member of the Executive Board is not appointed beyond the statutory retirement age. Only under exceptional circumstances will a member of the Executive Board be reappointed earlier than one year prior to the end of their term of appointment with simultaneous annulment of their current appointment. More information on the members of the Executive Board can be found on page 223 and on Continental’s website under Company/Corporate Governance/Executive Board.

The Executive Board has By-Laws that regulate in particular the allocation of duties among the Executive Board members, key matters pertaining to the company and its subsidiaries that require a decision to be made by the Executive Board, the duties of the Executive Board chairman, and the process in which the Executive Board passes resolutions. The Executive Board By-Laws are available on Continental’s website under Company/Corporate Governance/Executive Board. The Supervisory Board By-Laws on the basis of the Articles of Incorporation require the consent of the Supervisory Board for significant actions taken by management.

The Executive Board has established separate boards for the Automotive, Tires and ContiTech group sectors. This measure supports the decentralization of responsibility that the global organization of the company seeks to achieve, and relieves the burden on the Executive Board. In addition to establishing these boards, the Executive Board has delegated to them decision-making powers for certain matters that affect only the relevant group sectors.

The boards for the three group sectors each comprise the Executive Board member responsible for the group sector in question as their chairman, the heads of the relevant business areas within the group sector, as well as further members from among the central functions of the relevant group sectors.

The Supervisory Board and its practices

The Supervisory Board appoints the members of the Executive Board and collaborates with the Executive Board to develop a long-term succession plan. The Supervisory Board discusses this at least once a year without the Executive Board. In order to become acquainted with potential successors, the Supervisory Board, in consultation with the Executive Board, offers them the opportunity to deliver presentations to the Supervisory Board.

The Supervisory Board supervises and advises the Executive Board in managing the company. This includes, in particular, issues relating to the company’s strategy, planning, business development, risk situation, risk management, compliance and sustainability. The Supervisory Board is directly involved in decisions of material importance to the company. As specified by law, the Articles of Incorporation or the Supervisory Board By-Laws, certain corporate management matters require the approval of the Supervisory Board. The chairman of the Supervisory Board coordinates its work and represents it vis-à-vis third parties. Within reasonable limits, he is prepared to talk to investors about issues specific to the Supervisory Board. He maintains regular contact between meetings with the Executive Board, and in particular with its chairman, to discuss issues relating in particular to the company’s strategy, business development, risk situation, risk management and compliance.

Composition of the Supervisory Board

The Supervisory Board comprises 20 members in accordance with the German Co-determination Act (Mitbestimmungsgesetz – MitbestG) and the company’s Articles of Incorporation. Half the members of the Supervisory Board are elected individually by the shareholders in the Shareholders’ Meeting (shareholder representatives), while the other half are elected by the employees of Continental AG and its German subsidiaries (employee representatives). Both the shareholder representatives and the employee representatives have an equal duty to act in the interests of the company. The Supervisory Board’s chairman is a shareholder representative. In accordance with the provisions of the Co-determination Act, he has the casting vote in the event of a tie.

The current Supervisory Board was constituted on April 26, 2019. The term of office of the Supervisory Board members lasts until the end of the 2024 Annual Shareholders’ Meeting. The chairman of the Supervisory Board is Prof. Dr.-Ing. Wolfgang Reitzle who, in accordance with the German Corporate Governance Code, is independent of the company and its Executive Board. The Supervisory Board does not include any members who previously belonged to the Executive Board of Continental AG, who exercise an executive function or advisory role at a major competitor of Continental, or who have a personal relationship with such a competitor.

In the year under review, the Supervisory Board resolved at its meeting on September 27 that shareholder representatives would in the future follow the staggered board concept. Moreover, shareholder representatives will be nominated for terms of office of four years each. Under this staggered board concept, the terms of office of the shareholder representatives do not run in parallel but are staggered between two groups of five shareholder representatives, each for a term of office of four years. Five shareholder representatives will thus be up for election every two years. This increased flexibility in the Supervisory Board’s composition makes it easier for the Supervisory Board to respond to the changing demands on its tasks and areas of expertise. To establish the rhythm of the staggered election cycles, five shareholder representatives will stand for election at the 2024 Annual Shareholders’ Meeting for a one-time term of office of two years.

The company has set up an informational program that provides newly elected members of the Supervisory Board with a comprehensive overview of the company’s products and technologies as well as finances, controlling and corporate governance at Continental.

The Supervisory Board has drawn up its own By-Laws that supplement the law and the Articles of Incorporation with more detailed provisions, including provisions on Supervisory Board meetings, the duty of confidentiality, the handling of conflicts of interest and the Executive Board’s reporting obligations, and a list of transactions and measures that require the approval of the Supervisory Board. The Supervisory Board By-Laws are available on Continental’s website under Company/Corporate Governance/Supervisory Board. The Supervisory Board also consults on a regular basis in the absence of the Executive Board. Before each regular meeting of the Supervisory Board, the representatives of the shareholders and of the employees each meet separately with members of the Executive Board to discuss the upcoming meeting.

The Supervisory Board regularly reviews how effectively it and its committees have fulfilled their responsibilities. It recently carried out such a review in 2021 with the help of an external consultant. This confirmed the Supervisory Board’s efficient and professional approach to its work in the past years. The Supervisory Board has adopted the recommendations from the 2021 self-assessment.

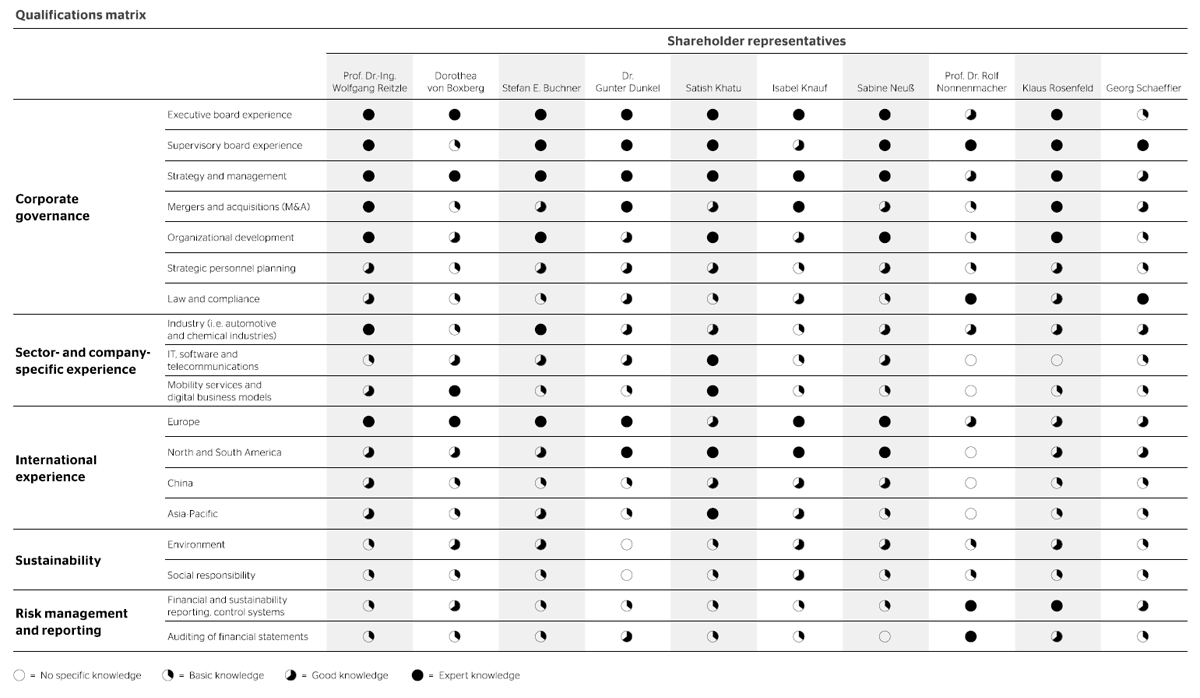

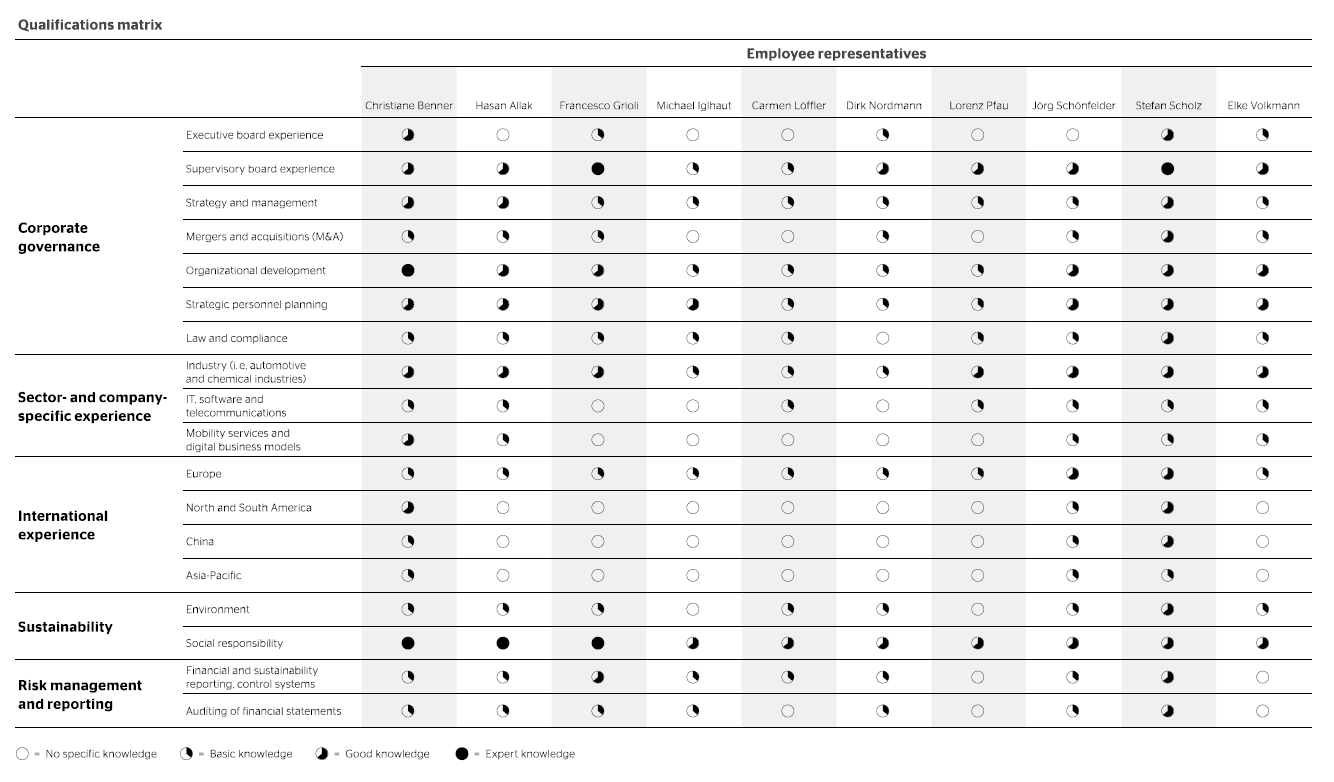

Profile of skills and expertise for the Supervisory Board

In accordance with recommendation C.1 of the German Corporate Governance Code, the Supervisory Board has prepared a profile of skills and expertise and specified targets for its composition. The Supervisory Board updated the current profile of skills and expertise in the reporting year and adopted it by circular resolution in February 2024.

The Supervisory Board as a whole should possess the skills and expertise noted below. It is not expected that all Supervisory Board members possess all of the skills and expertise noted below. Instead, each area of expertise must be covered by at least one Supervisory Board member. The profile of skills and expertise assumes that all Supervisory Board members possess the knowledge and skills required for the proper performance of their duties and the characteristics necessary for successful Supervisory Board work in an internationally active, capital market-oriented company. In particular, these include integrity, commitment, capacity for discussion and teamwork, sufficient availability and discretion.

The Supervisory Board members should collectively cover all skills, expertise and experience deemed to be significant in view of Continental’s business activities. These include in particular:

- Skills, expertise and experience related to corporate governance, particularly in the areas of:

- Executive board experience

- Supervisory board experience

- Strategy and management

- Mergers and acquisitions (M&A)

- Organizational development

- Strategic personnel planning

- Law and compliance

- Sector- and company-specific experience, particularly in the areas of:

- Industry (i.e. automotive and chemical industries)

- IT, software and telecommunications

- Mobility services and digital business models

- International experience, particularly in the regions of:

- Europe

- North and South America

- China

- Asia-Pacific

- Skills, expertise and experience related to sustainability, particularly in the areas of:

- Environment

- Social responsibility

- Skills, expertise and experience related to risk management and reporting, particularly in the areas of:

- Financial and sustainability reporting, control systems

- Auditing of financial statements

The Supervisory Board has also specified the following targets for its composition:

- Professional skills and expertise: The personal and professional qualifications defined in the profile of skills and expertise should be covered as broadly as possible by the candidates proposed for election. The progress achieved to date in implementing the profile of skills and expertise can be viewed in the qualifications matrix.

- Independence: The Supervisory Board should have an appropriate number of members on the shareholder side whom it deems to be independent in accordance with the German Corporate Governance Code. Taking into account the ownership structure, a Supervisory Board member is therefore considered independent if they are independent of the company and its Executive Board, and also independent of a controlling shareholder. The Supervisory Board has specified the following targets for this purpose:

- More than half of the shareholder representatives should be independent of Continental AG and its Executive Board.

The independence of shareholder representatives was assessed in accordance with the German Corporate Governance Code by shareholder representatives on the Supervisory Board. As part of the assessment of independence from the Executive Board and the company, it was taken into account that four shareholder representatives will have been members of the Supervisory Board for more than 12 years in 2023. In the assessment of the independence of these four shareholder representatives, given the former and ongoing administration of the members in question, the shareholder representatives overall see no grounds to accept changing the existing assessment of independence. The shareholder representatives currently on the Supervisory Board are therefore all, without exception, independent of Continental AG and its Executive Board. - At least five shareholder representatives should be independent of the controlling shareholder, the IHO Group, headquartered in Herzogenaurach, Germany.

It was taken into consideration in the assessment of independence from any controlling shareholder that two Supervisory Board members are linked to the controlling shareholder, the IHO Group, Herzogenaurach, Germany. As determined in the assessment by the shareholder representatives on the Supervisory Board, the Supervisory Board still has an appropriate number of members on the shareholder side who are independent in accordance with the German Corporate Governance Code. These include: - Prof. Dr.-Ing. Wolfgang Reitzle

- Dorothea von Boxberg

- Stefan E. Buchner

- Dr. Gunter Dunkel

- Satish Khatu

- Isabel Corinna Knauf

- Sabine Neuß

- Prof. Dr. Rolf Nonnenmacher

- Term of office: In its nominations for election to the Supervisory Board, the Supervisory Board as a rule does not nominate candidates who at the time of election have already been a member of the Supervisory Board for 12 years.

In its nominations of candidates for election to the Supervisory Board, the Supervisory Board takes into account the requirements of the profile of skills and expertise for the board as a whole as well as the aforementioned targets.

| Targets for composition | Independence from the company and Executive Board in accordance with the DCGK | ||||

|---|---|---|---|---|

| Was the Supervisory Board member a member of the Executive Board of Continental AG in the two years prior to their appointment? | Does the Supervisory Board member currently maintain or have they maintained a material business relationship with the company or a company dependent on it (e.g. as a customer, supplier, lender or consultant), either directly or as a co-owner/shareholder or in a responsible function of a company outside the company, in the year up to their appointment? | Is the Supervisory Board member a close family member of a member of the Executive Board? | Has the Supervisory Board member been a member of the Supervisory Board for more than 12 years? | |

| Prof. Dr.-Ing. Wolfgang Reitzle | ||||

| Dorothea von Boxberg | ||||

| Stefan E. Buchner | ||||

| Dr. Gunter Dunkel | ||||

| Satish Khatu | ||||

| Isabel Corinna Knauf | ||||

| Sabine Neuß | ||||

| Prof. Dr. Rolf Nonnenmacher | ||||

| Klaus Rosenfeld | ||||

| Georg F. W. Schaeffler | ||||

| = Yes = No | ||||

Committees of the Supervisory Board

The Supervisory Board currently has five committees with decision-making powers: the Chairman’s Committee, the Audit Committee, the Nomination Committee, the committee formed in accordance with Section 27 (3) MitbestG (the Mediation Committee) and the committee for the approval of company transactions with related persons (Committee for Related Party Transactions, RPT Committee) (Section 107 (3) Sentence 4; Section 111b (1) AktG).

Key responsibilities of the Chairman’s Committee are preparing the appointment of Executive Board members and concluding, terminating and amending their employment contracts and other agreements with them. However, the plenum of the Supervisory Board alone is responsible for stipulating the total remuneration of the Executive Board members. Another key responsibility of the Chairman’s Committee is deciding on the approval of certain transactions and measures by the company as specified in the Supervisory Board By-Laws. The Supervisory Board has conferred some of these participation rights on the Chairman’s Committee, each member of which may however, in individual cases, demand that a matter again be submitted to the plenary session for decision. The members of the Chairman’s Committee are Prof. Dr.-Ing. Wolfgang Reitzle (chairman); his vice chairperson, Christiane Benner; Georg F. W. Schaeffler; and Jörg Schönfelder.

The Audit Committee primarily deals with the audit of the accounts, the monitoring of the accounting process and the effectiveness of the internal control system, the risk management system and the internal audit system, the audit of the financial statements (including sustainability reporting and examination thereof) and compliance. In particular, the committee deals with the preliminary examination of Continental AG’s annual financial statements and the consolidated financial statements, and makes its recommendation to the plenary session of the Supervisory Board, which then passes resolutions pursuant to Section 171 AktG. Furthermore, the committee discusses the company’s draft interim financial reports. It is also responsible for ensuring the necessary independence of the auditor and deals with additional services performed by the auditor.

The committee engages the auditor, determines the focus of the report as necessary, negotiates the fee and regularly reviews the quality of the audit. The chairman of the Audit Committee regularly consults with the auditor on the progress of the audit and reports on this to the committee. The committee also regularly consults with the auditor without the Executive Board. It also gives its recommendation for the Supervisory Board’s proposal to the Annual Shareholders’ Meeting for the election of the auditor. The Audit Committee is also responsible for the preliminary audit of non-financial reporting and for the engagement of an auditor for its review, if any. The chairman of the Audit Committee is Prof. Dr. Rolf Nonnenmacher, who is independent in accordance with the German Corporate Governance Code. As an auditor with many years of professional experience in management positions, he has indepth knowledge and experience in auditing. Another committee member, Klaus Rosenfeld, is also a financial expert, and as chief financial officer in a number of companies has in-depth knowledge and experience in accounting and internal control and risk management systems. The other members are Francesco Grioli, Michael Iglhaut, Dirk Nordmann and Georg F. W. Schaeffler. Neither a former Executive Board member nor the chairman of the Supervisory Board may act as chairman of the Audit Committee.

The Nomination Committee is responsible for nominating suitable candidates for the Supervisory Board to propose to the Annual Shareholders’ Meeting for election. In addition, the committee must propose targets for the Supervisory Board’s composition and profile of skills and expertise and review both regularly. The Nomination Committee consists entirely of shareholder representatives, specifically the two members of the Chairman’s Committee, Prof. Dr.-Ing. Wolfgang Reitzle (chairman) and Georg F. W. Schaeffler; the chairman of the Audit Committee, Prof. Dr. Rolf Nonnenmacher; and Isabel Corinna Knauf.

In accordance with Section 31 (3) Sentence 1 MitbestG, the Mediation Committee becomes active only if the first round of voting on a proposal to appoint a member of the Executive Board or to remove a member by consent does not achieve the legally required twothirds majority. This committee must then attempt mediation before a new vote is taken. The members of the Chairman’s Committee are also the members of the Mediation Committee.

The Committee for Related Party Transactions (RPT Committee) deals with transactions between Continental AG and a related person, where these transactions require the prior consent of Continental AG’s Supervisory Board in accordance with Sections 111a and 111b AktG. Transactions in this case require the prior consent of the Supervisory Board. In addition to the chairman of the Supervisory Board, Prof. Dr.-Ing. Wolfgang Reitzle, and the chairman of the Audit Committee, Prof. Dr. Rolf Nonnenmacher, the Committee for Related Party Transactions includes two further members elected by the Supervisory Board from among the employee representatives where necessary.

The Special Emissions Committee supports the Supervisory Board’s investigations into the manipulation of emission limits by certain automotive manufacturers. This committee is available to external law firms as a point of contact, source of information and recipient of reports, regularly reports to the plenary session on the investigations and prepares any resolutions required for the plenary session or committees. The members of the Special Emissions Committee are Prof. Dr.-Ing. Wolfgang Reitzle, Prof. Dr. Rolf Nonnenmacher and Dirk Nordmann. The Special ContiTech Committee assumed the same function with regard to the investigation into irregularities in the production of air conditioning lines and industrial hoses in two business areas of the ContiTech group sector. This special committee was dissolved following the conclusion of its investigations by resolution of the Supervisory Board at its meeting on December 13, 2023. The members of the Special ContiTech Committee up until its dissolution were Prof. Dr.-Ing. Wolfgang Reitzle, Prof. Dr. Rolf Nonnenmacher and Dirk Nordmann.

The Sustainability Working Group established by the Supervisory Board deals with sustainability issues relevant to Continental. The working group includes two shareholder representatives, Dorothea von Boxberg and Stefan E. Buchner, and two employee representatives, Hasan Allak and Stefan Scholz.

More information on the members of the Supervisory Board and its committees can be found on pages 224 and 225. Current resumes, which are updated annually, are available on Continental’s website under Company/Corporate Governance/Supervisory Board. They also contain information on how long each member has held their position on the Supervisory Board.

Shareholders and the Shareholders’ Meeting

The company’s shareholders exercise their rights of participation and control at the Annual Shareholders’ Meeting. The Annual Shareholders’ Meeting, which must be held in the first eight months of every fiscal year, decides on all issues assigned to it by law, such as the appropriation of profits, the election of shareholder representatives to the Supervisory Board, the discharging of Supervisory Board and Executive Board members, the appointment of auditors and the approval of the remuneration system and remuneration report. Each Continental AG share entitles the holder to one vote. There are no shares conferring multiple or preferential voting rights and no limitations on voting rights.

All shareholders who register in a timely manner and prove their entitlement to participate in the Shareholders’ Meeting and to exercise their voting rights are entitled to participate in the Shareholders’ Meeting. To facilitate the exercise of their rights and to prepare them for the Shareholders’ Meeting, the shareholders are fully informed about the past fiscal year and the points on the upcoming agenda before the Shareholders’ Meeting by means of the annual report and the invitation to the meeting. All documents and information on the Annual Shareholders’ Meeting, including the annual report, are published on Continental’s website in German and English. Moreover, the Annual Shareholders’ Meeting can also be watched in full in an audio-visual stream on the company’s website. When holding the Annual Shareholders’ Meeting, the chairperson presiding over the meeting is guided by the fact that an ordinary annual shareholders’ meeting should be concluded after four to six hours. To make it easier for shareholders to exercise their rights, the company offers all shareholders who cannot or do not want to exercise their voting rights during the Annual Shareholders’ Meeting themselves the opportunity to vote at the Annual Shareholders’ Meeting via a proxy who is bound by instructions or through absentee voting. The required voting instructions can also be issued to the proxy via an Internet service (InvestorPortal) before the end of the general debate on the day of the Shareholders’ Meeting. In addition, the service provider that assists the company with conducting the Shareholders’ Meeting is instructed not to forward the individual voting instructions to Continental until the day before the Shareholders’ Meeting.

Accounting and auditing of financial statements

The Continental Group’s accounting is prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the European Union (EU). The annual financial statements of Continental AG are prepared in accordance with the accounting regulations of the German Commercial Code. The Annual Shareholders’ Meeting on April 27, 2023, elected PricewaterhouseCoopers GmbH Wirtschaftsprüfungsgesellschaft, Hanover branch (PwC) to audit the consolidated financial statements for fiscal 2023 as well as the interim financial reports of the company. Dr. Arne Jacobi is the responsible auditor at PwC.

Internal control system and risk management

Diligent corporate management and good corporate governance also require that the company deal with risks responsibly. Continental has a corporate-wide internal control and risk management system that is used to analyze and manage the company’s risk situation. We report on this in detail in the report on risks and opportunities starting on page 93, which forms part of the management report for the consolidated financial statements.

Transparent and prompt reporting

As part of our investor relations and corporate communications, we regularly report to shareholders, analysts, shareholders’ associations, the media and interested members of the public in equal measure on significant developments in the company and its situation. All shareholders have instant access to all the information that is also available to financial analysts and similar parties. The website of Continental AG provides the latest information, including the company’s financial reports, presentations held at analyst and investor conferences, press releases and ad-hoc disclosures. The dates of key periodic publications (annual report, quarterly statements and half-year report) and events as well as of the Annual Shareholders’ Meeting and the annual press conference are announced well in advance in a financial calendar on the website of Continental AG. For the scheduled dates for 2024, see the Investors/Events/Financial Calendar section.

Reporting pursuant to Section 289f (2) Nos. 4 to 6 HGB

Pursuant to Section 96 (2) AktG, the Supervisory Board of Continental AG as a listed stock corporation subject to the German Codetermination Act consists of at least 30% women and at least 30% men. This minimum quota must, as a general rule, be fulfilled by the Supervisory Board as a whole. Due to an objection by the employee representatives against the overall fulfillment in accordance with Section 96 (2) Sentence 3 AktG before the election of the Supervisory Board in spring 2019, the minimum quota for the Supervisory Board of Continental AG must be fulfilled separately by the shareholder representatives and the employee representatives. Women made up 30% of both the shareholder and employee representatives on the Supervisory Board of Continental AG as at December 31, 2023.

For Continental AG, as a listed stock corporation subject to the German Co-determination Act, the ratio requirement as set out in Section 76 (3a) AktG applies, according to which any Executive Board composed of more than three persons should have at least one woman and one man as members of the Executive Board. This requirement was met in the fiscal year under review. The Supervisory Board continues to follow the general debate around the representation of women on executive and supervisory boards and will take any future regulations into account.

In accordance with Section 76 (4) AktG, the Executive Board of Continental AG is required to set targets for the ratio of women in the first two management levels below the Executive Board and a deadline for achieving these targets. In December 2021, the Executive Board set new target quotas for women in the first two management levels below the Executive Board at Continental AG for the period up until December 31, 2026: 37% for the first management level and 33% for the second management level. As at December 31, 2023, the ratio of women was 30% in the first management level and 30% in the second management level.

As a global company, Continental continues to attach high priority to the goal of steadily increasing the proportion of women in management positions throughout the Continental Group, above and beyond the legal requirements in Germany.

Diversity concept

Continental counts on the diversity of its employees. The current focus of its commitment to promote diversity is on internationality and a balanced gender ratio.

The Supervisory Board also pays attention to the diversity of the composition of the Executive Board. The Executive Board does the same when appointing people to management positions. As a basic principle, the Executive Board aims to achieve a balanced ratio of domestic to international managers everywhere. The proportion of local and international managers varies according to region. In 2023, a total of around 49% of the Continental Group’s managers came from countries other than Germany (PY: around 49%). Continental is also working on increasing the proportion of women in management positions. In 2023, we were able to increase this number to around 20% across the Continental Group (PY: 19%). The proportion is to be increased to 25% by 2025.

In drawing up the Executive Board’s succession plan, the Supervisory Board together with the Executive Board makes use of the measures and programs to promote internationality and women in management positions, thus making it possible to identify and develop potential international candidates and female managers for positions on the Executive Board. The aim in the medium term is to use these measures to increase the diversity of the Executive Board even further.

The Supervisory Board also pays attention to the diversity of its own composition. For the Supervisory Board, diversity refers to age, gender, background and professional experience, among other things. The Supervisory Board is convinced that it will achieve diversity in its composition in particular by fulfilling the profile of skills and expertise and meeting the targets for its composition.