Continental is the mobility and material technology group for safe, smart and sustainable solutions.

In 2023, Continental announced its updated strategy for increasing value creation at its Capital Market Day in December. This will allow Continental to develop into the mobility and material technology group for safe, smart and sustainable solutions and is based on three key elements:

- Continental has a clear strategy to achieve its mid-term targets.

- The company will invest in particular in those areas with value creation upside and continuously expand its technology position in areas where it can expect to gain an edge over the competition.

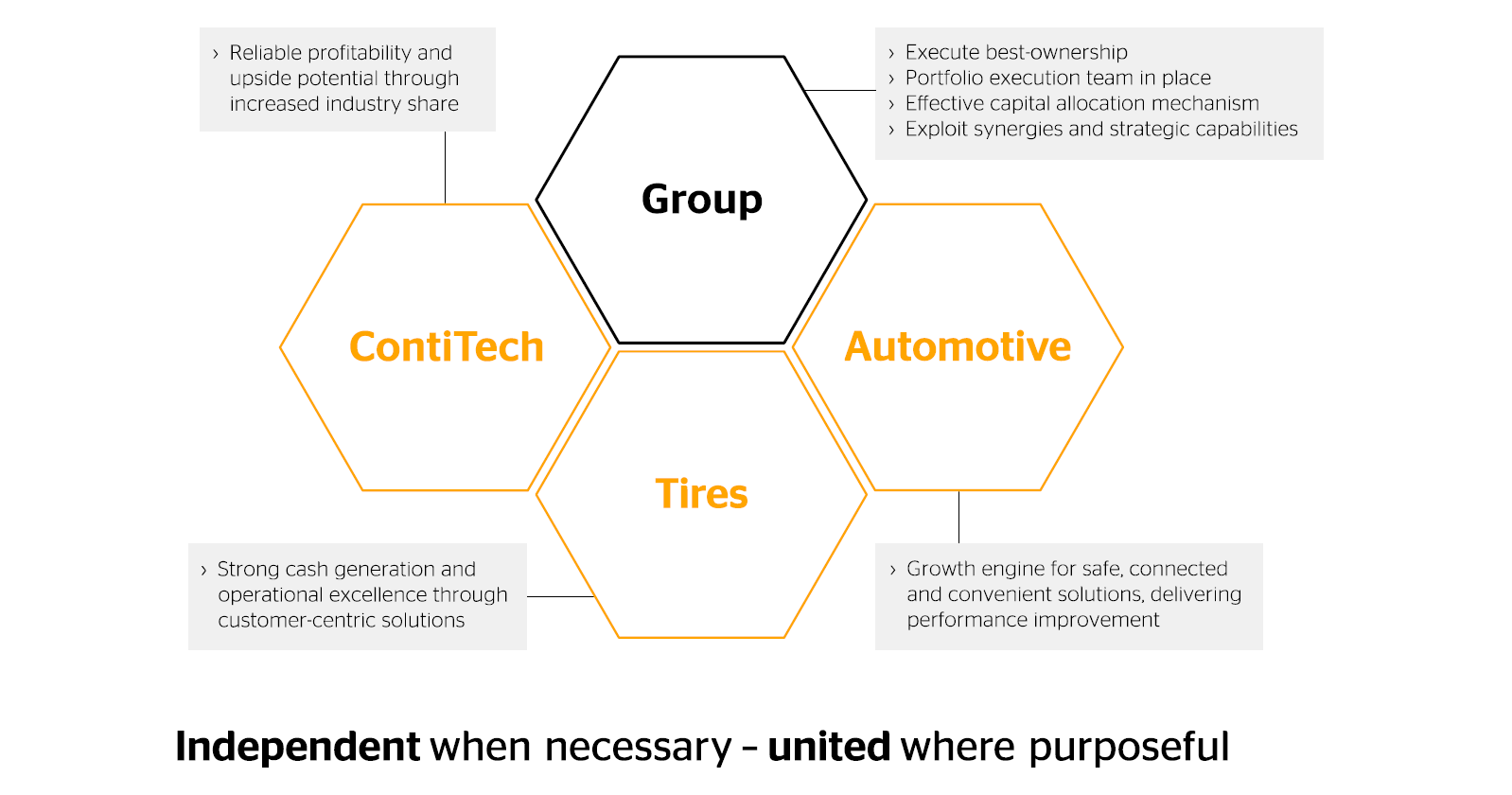

- The Automotive, Tires and ContiTech group sectors make up a balanced and resilient portfolio.

These elements build upon the three strategic pillars introduced by Continental in 2020 in response to the transformation in the mobility industry and to pave the way for profitable growth. Its overall organizational structure and management processes were realigned to turn the transformation in the mobility industry into an opportunity.

- Strengthening operational performance

By strengthening its operational performance, Continental can ensure its future viability and competitiveness. The company is aligning its cost structure to global market conditions. - Differentiating the portfolio

Continental continues to pursue the targeted differentiation of its product portfolio with a focus on growth and value. - Turning change into opportunity

Continental’s comprehensive organizational structure helps it to seize market opportunities and translate them into profit even more quickly. Transparent structures and a high level of autonomy make the company more flexible in an increasingly complex market environment.

Continental’s strategic goals are based on its vision:

CREATING VALUE FOR A BETTER TOMORROW.

OUR TECHNOLOGIES. YOUR SOLUTIONS. POWERED BY THE PASSION OF OUR PEOPLE.

“CREATING VALUE”: Continental aims to create value in everything it does. This can be financial value for its shareholders as well as value for its customers, its employees and the social environment in which it operates.

“A BETTER TOMORROW”: With its products and services, Continental contributes to making the world a little better. It develops and produces the mobility of tomorrow in a way that is more convenient and comfortable, safer and more sustainable. At the same time, “a better tomorrow” means acting now and not in the distant future.

“OUR TECHNOLOGIES. YOUR SOLUTIONS”: Continental is a technology company and believes that it will only be able to tackle the challenges of our time by rapidly developing the right technologies. Continental’s technology should help its customers make their products even better and more useful. Because Continental is customer-focused in everything it does.

“POWERED BY THE PASSION OF OUR PEOPLE”: Continental stands for a certain culture. A culture of mutual respect. A culture of togetherness. And a culture of passion.

Automotive: focus on value-creating business areas with high growth

In the Automotive group sector, Continental will step up its focus on value-creating business areas with high growth. With its updated strategy, the group sector aims to increase its long-term profitability and competitiveness. The strategy is geared toward achieving a leading market position in all business areas and becoming the preferred system integrator for software-defined vehicles.

The group sector decided on a number of measures in 2023, including making the User Experience business area organizationally independent, which will open up new strategic options for this business. With sales of €3.5 billion in 2023 and a total order volume of more than €7 billion (production launch after 2022), User Experience is among the market leaders in display solutions, head-up displays and digital instrument clusters.

The Automotive group sector is also reviewing further business activities that contributed around €1.4 billion to consolidated sales in fiscal 2023. A review is therefore being carried out with a view to improving performance or selling or discontinuing these business activities.

Continental is aiming for above-average growth of 3% to 5% in the Automotive group sector compared with the market environment. This is to be achieved by improving the group sector’s market share – in particular among Asian automotive manufacturers, which are growing at a disproportionate rate – increasing value creation per vehicle and adjusting prices. In addition, Continental has taken various measures to optimize operational costs and cash inflow. These include increasing efficiency in the manufacture of electronic components, reducing freight costs and optimizing inventory turnover.

Independently of this, Automotive is aiming to reduce costs significantly by €400 million per year from 2025. Administrative structures, interfaces, hierarchy levels and complexity will be reduced, for example, and decision-making structures and processes simplified. Automotive is also planning to further optimize its use of research and development resources. The group sector is therefore aiming to reduce net research and development expenses in the short term to around 11% of sales (2023: 11.8%). In the medium term, the share is expected to be less than 10%. This will be achieved by consolidating its approximately 80 development locations worldwide, for example.

Tires: premium tires will continue to create opportunities for profitable growth

In the Tires group sector, Continental will continue to rely on stable earnings and operational excellence. Sustainability, electric mobility and digital tire services will also create various opportunities for further profitable growth and exceptional value creation. Over the past five years, Tires has increased its sales by an average of 4.3% annually. The basis for the group sector’s commercial success is its operational efficiency. Capacity and modern production technologies are continually adapted to changing market requirements. This enables Tires to benefit from major economies of scale and scope, with more than 80% of its global production capacity bundled in so-called megafactories.

Continental already offers its most sustainable passenger car tire on the market as a production tire and is growing strongly in the area of data-based tire services. In total, it has more than 500 original equipment approvals for supplying fully electric models from automotive manufacturers worldwide, including the 10 highestvolume manufacturers of fully electric cars.

The Tires group sector sees strong growth potential in the Asia-Pacific region as well as North and South America. Based on its strategy of being in the market for the market, production capacity will therefore be expanded in these regions. The recovery of the current weak demand, particularly in the European tire-replacement business, continuous increases in efficiency, the ongoing trend worldwide toward larger and higher-performing tires as well as high cost discipline will form the basis for sales and margin increases.

ContiTech: group sector to strengthen strategic focus on industrial business

In its ContiTech group sector, Continental will focus on reliable profitability thanks to material solutions made from rubber and plastics. At the same time, the group sector will strengthen its strategic focus on the industrial business and plans to increase the share of sales accounted for by the industrial business from 52% currently to 60% in the medium term. ContiTech’s ambition is to achieve an industrial share of sales of around 80%. This is to be achieved organically through greater market development and an expanded product portfolio, as well as inorganically through investments and divestments.

ContiTech’s industrial growth areas are primarily in energy, agriculture and construction as well as interior design. These industrial fields place high demands on materials and products, for which the group sector is well positioned thanks to its high level of materials expertise, including for hoses, belts, conveyor belts and surfaces, as well as its diverse product portfolio.

As already announced, the Original Equipment Solutions (OESL) business area – comprising the automotive business of ContiTech, with the exception of surface materials – will also become organizationally independent. OESL is expected to become fully independent in 2025. All strategic options will be reviewed as part of this process.

Continental’s strategy forms the basis for its mid-term targets

The mid-term targets are as follows:

- Based on its updated strategy, Continental aims to achieve consolidated sales of around €44 billion to €48 billion in the short term (two to three years) and around €51 billion to €56 billion in the medium term. The target for its adjusted EBIT margin is more than 8% in the short term and around 8% to 11% in the medium term. The cash conversion ratio is expected to exceed 70% in the short and medium term.

- For the Automotive group sector, Continental expects sales of around €22 billion to €24 billion in the short term and around €26 billion to €29 billion in the medium term. The adjusted EBIT margin is expected to exceed 6% in the short term and to be around 6% to 8% in the medium term. Additionally, it aims to achieve a return on capital employed (ROCE) of more than 15% in the short term and more than 20% in the medium term.

- For the Tires group sector, Continental expects sales of around €15 billion to €16 billion in the short term and around €17 billion to €18 billion in the medium term. The adjusted EBIT margin is expected to exceed 13% in the short term and to be around 13% to 16% in the medium term. It aims to achieve an ROCE of more than 20% in the short term and more than 23% in the medium term.

- For the ContiTech group sector, Continental expects sales of around €7 billion to €8 billion in the short term and around €8 billion to €9 billion in the medium term. The adjusted EBIT margin is expected to exceed 9% in the short term and to be around 9% to 11% in the medium term, assuming that the share of the industrial business is around 60%. It aims to achieve an ROCE of more than 20% in the short term and more than 22% in the medium term.

Increase in value creation

We are confident that our strategic setup, with the three group sectors mentioned above, is our path to long-term success. The three group sectors make up a balanced and resilient portfolio. Our business activities continue to be independent when necessary and united where purposeful. Together with the group functions, Automotive, Tires and ContiTech make up the mobility and material technology group for safe, smart and sustainable solutions.